Sports Entertainment Group Limited's (ASX:SEG) Shares May Have Run Too Fast Too Soon

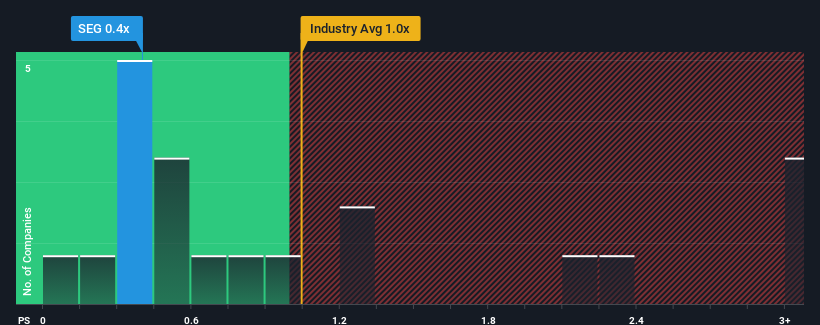

It's not a stretch to say that Sports Entertainment Group Limited's (ASX:SEG) price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" for companies in the Media industry in Australia, where the median P/S ratio is around 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Sports Entertainment Group

How Has Sports Entertainment Group Performed Recently?

With revenue growth that's superior to most other companies of late, Sports Entertainment Group has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Sports Entertainment Group will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Sports Entertainment Group?

The only time you'd be comfortable seeing a P/S like Sports Entertainment Group's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 36%. The latest three year period has also seen an excellent 67% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should bring plunging returns, with revenue decreasing 6.3% as estimated by the one analyst watching the company. With the rest of the industry predicted to shrink by 0.4%, it's a sub-optimal result.

With this information, it's perhaps strange that Sports Entertainment Group is trading at a fairly similar P/S in comparison. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Sports Entertainment Group currently trades on a higher P/S than expected based on revenue decline, even more so since its revenue forecast is even worse than the struggling industry. It's not unusual in cases where revenue growth is poor, that the share price declines, sending the moderate P/S lower relative to the industry. We're also cautious about the company's ability to resist even greater pain to its business from the broader industry turmoil. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Sports Entertainment Group is showing 3 warning signs in our investment analysis, and 1 of those is a bit concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SEG

Sports Entertainment Group

Engages in sports media content and entertainment business in Australia and New Zealand.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives