REA Group (ASX:REA) Valuation: Exploring the Impact of New Video Feature on Digital Growth Strategy

Reviewed by Simply Wall St

REA Group (ASX:REA) has rolled out a video discovery feature in the realestate.com.au iOS app. The company is expanding its digital platform with short-form vertical video content to attract and engage property seekers at an earlier stage.

See our latest analysis for REA Group.

While REA Group’s new video feature signals fresh momentum for its digital strategy, the company’s share price tells a different story. The stock has slid 7.6% in the past month and is down 23.6% over the past quarter. Despite strong three- and five-year total shareholder returns of 71.2% and 49.6% respectively, recent short-term price returns reflect fading momentum as the broader market digests mixed signals about future growth and valuation.

If you’re watching digital innovation shape the real estate sector, it could be the perfect moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares trading well below analyst price targets despite steady underlying growth, the question for investors remains: is REA Group undervalued at current levels, or is the market already factoring in its future potential?

Most Popular Narrative: 20.7% Undervalued

REA Group's last close of A$199.70 sits considerably below the narrative’s assessed fair value, reflecting optimism for superior growth and margins. That gap, paired with recent market dips, sets the scene for a closer look at what’s driving this bullish stance.

The acceleration of digital transformation in property search and transactions, as illustrated by record traffic to realestate.com.au and the successful rollout of personalized, AI-driven listing experiences (such as NextGen listings), is likely to increase user engagement and premium product adoption. This can drive both higher ARPU and sustainable revenue growth.

Curious how digital innovation and ambitious profit targets combine to power this much higher valuation? Key numbers such as climbing margins and bold earnings growth lie just beneath the surface. Get the inside story behind the aggressive forecast and discover what really moves the needle for REA’s fair value.

Result: Fair Value of $251.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strengthening competition and heightened regulatory scrutiny could challenge REA Group’s growth potential and limit the optimistic case for long-term expansion.

Find out about the key risks to this REA Group narrative.

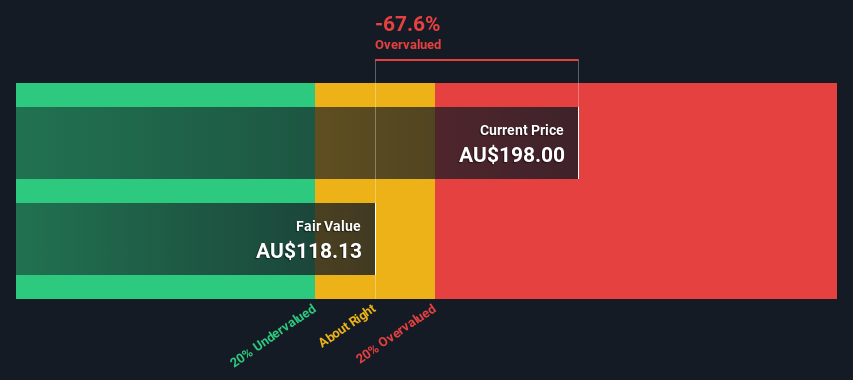

Another View: Discounted Cash Flow Suggests a Different Story

While analyst projections point to REA Group being undervalued, our DCF model paints a less optimistic picture. According to this method, REA shares are trading above their estimated fair value. Is the market pricing in too much future growth, or is the DCF model missing something about the digital leader's upside potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out REA Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own REA Group Narrative

If the current outlook does not match your own expectations or you prefer to explore the fundamentals firsthand, it's never been easier to build a story from the ground up in just minutes. Do it your way

A great starting point for your REA Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t wait to unlock your next opportunity. The market moves fast and these unique ideas could give your portfolio the edge you’re seeking.

- Start building passive income by tapping into these 16 dividend stocks with yields > 3% offering yields above 3% for steady growth.

- Take charge of tomorrow’s potential by scanning these 25 AI penny stocks, which are leading advances in artificial intelligence innovation.

- Uncover value that others may miss with these 901 undervalued stocks based on cash flows, noted for their strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:REA

REA Group

Engages in online property advertising business in Australia, Asia, and North America It provides property and property-related services on websites and mobile applications.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives