Does ACCC Pricing Probe Change the Bull Case for REA Group (ASX:REA)?

Reviewed by Simply Wall St

REA Group Investment Narrative Recap

Owning REA Group stock means believing in its leadership as Australia’s top real estate listings platform, steady revenue growth from digital transformation, and expansion in financial services. The ACCC investigation into pricing practices introduces immediate regulatory uncertainty. While this is relevant short term, the most important catalyst, a growing adoption of new digital products, appears unchanged for now, but the largest risk is heightened regulatory scrutiny and market trust.

A recent CEO appointment in India is the most relevant announcement to consider alongside this news. With Praveen Sharma’s leadership expected to accelerate innovation in a fast-growing market, investors will be watching to see whether REA’s international expansion counters or compounds the risk stemming from regulatory pressures at home.

But while product rollout remains an important growth engine, the risk of ongoing regulatory scrutiny is something investors should not lose sight of, especially if…

Read the full narrative on REA Group (it's free!)

REA Group's outlook anticipates A$2.2 billion in revenue and A$800.0 million in earnings by 2028. This is based on a 6.6% annual revenue growth rate and a A$183.3 million increase in earnings from A$616.7 million currently.

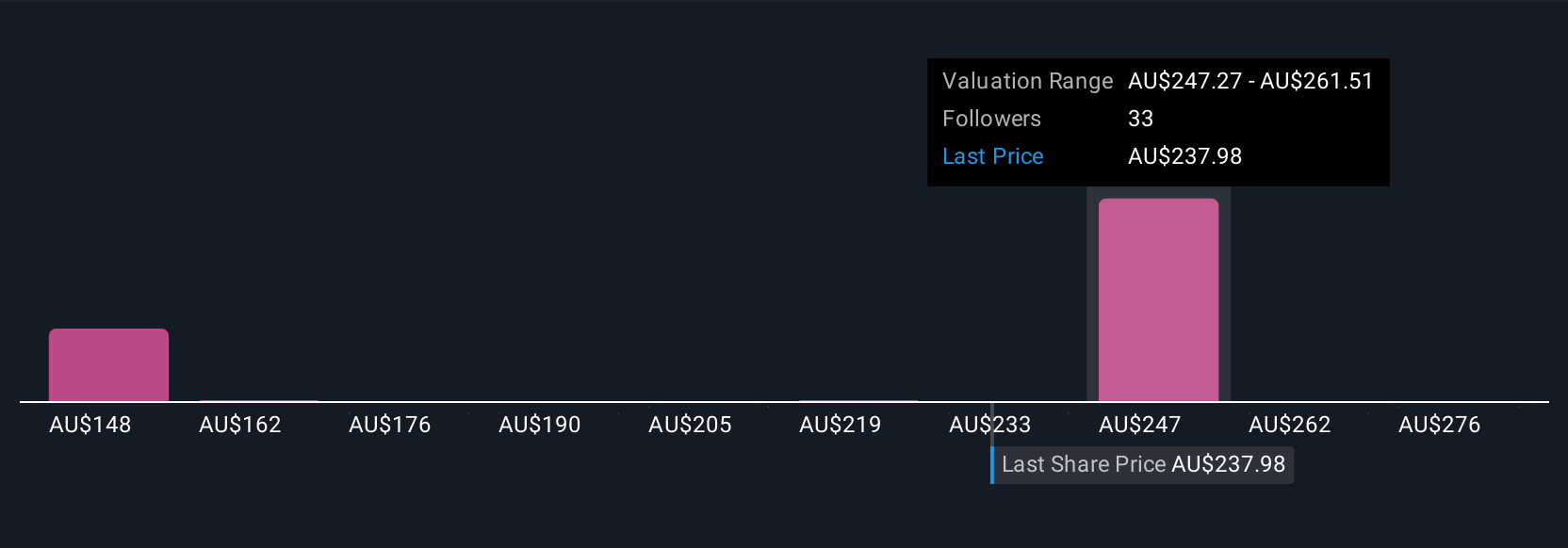

Uncover how REA Group's forecasts yield a A$250.41 fair value, a 7% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community submitted eight fair value opinions for REA Group, sparking a wide range from A$144.91 to A$290 per share. Even as product innovation drives optimism, regulatory risk could influence future perceptions so explore the different viewpoints shaping the discussion today.

Build Your Own REA Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your REA Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free REA Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate REA Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:REA

REA Group

Engages in online property advertising business in Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives