Michael Ye Bought 8.2% More Shares In Love Group Global

Whilst it may not be a huge deal, we thought it was good to see that the Love Group Global Ltd (ASX:LVE) Founder, Michael Ye, recently bought AU$106k worth of stock, for AU$0.10 per share. Although the purchase is not a big one, increasing their shareholding by only 8.2%, it can be interpreted as a good sign.

Check out our latest analysis for Love Group Global

Love Group Global Insider Transactions Over The Last Year

In fact, the recent purchase by Michael Ye was the biggest purchase of Love Group Global shares made by an insider individual in the last twelve months, according to our records. Although we like to see insider buying, we note that this large purchase was at significantly below the recent price of AU$0.14. Because it occurred at a lower valuation, it doesn't tell us much about whether insiders might find today's price attractive.

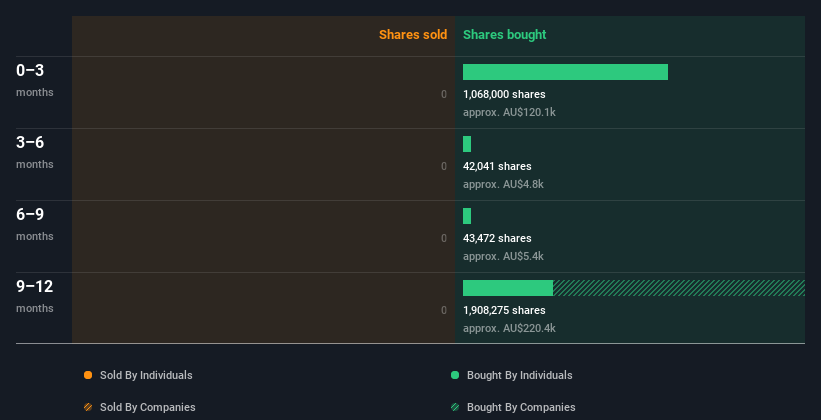

Michael Ye bought 1.63m shares over the last 12 months at an average price of AU$0.11. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Love Group Global is not the only stock insiders are buying. So take a peek at this free list of under-the-radar companies with insider buying.

Does Love Group Global Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Love Group Global insiders own about AU$3.0m worth of shares (which is 54% of the company). Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Do The Love Group Global Insider Transactions Indicate?

The recent insider purchase is heartening. We also take confidence from the longer term picture of insider transactions. Along with the high insider ownership, this analysis suggests that insiders are quite bullish about Love Group Global. One for the watchlist, at least! So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. Case in point: We've spotted 3 warning signs for Love Group Global you should be aware of, and 2 of these make us uncomfortable.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:LVE

Love Group Global

Provides social and dating products and services in Asia, Europe, Singapore, and Bangkok.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026