Is Now The Time To Put Love Group Global (ASX:LVE) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Love Group Global (ASX:LVE), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Love Group Global

Love Group Global's Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. Commendations have to be given in seeing that Love Group Global grew its EPS from AU$0.005 to AU$0.015, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that Love Group Global is growing revenues, and EBIT margins improved by 6.5 percentage points to 11%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

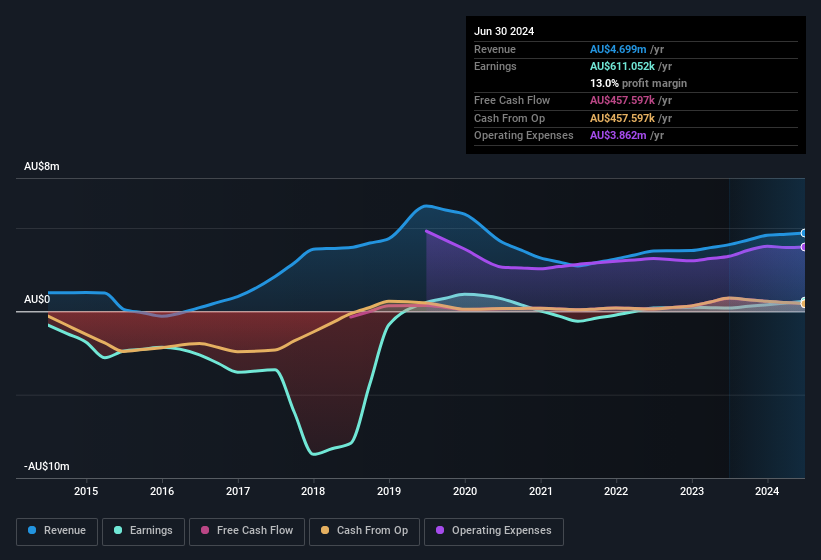

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Love Group Global isn't a huge company, given its market capitalisation of AU$4.9m. That makes it extra important to check on its balance sheet strength.

Are Love Group Global Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling Love Group Global shares, in the last year. So it's definitely nice that Founder Michael Ye bought AU$70k worth of shares at an average price of around AU$0.13. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Love Group Global.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Love Group Global will reveal that insiders own a significant piece of the pie. In fact, they own 54% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Although, with Love Group Global being valued at AU$4.9m, this is a small company we're talking about. That means insiders only have AU$2.6m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because on our analysis the CEO, Michael Ye, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Love Group Global with market caps under AU$325m is about AU$461k.

Love Group Global offered total compensation worth AU$409k to its CEO in the year to June 2024. That seems pretty reasonable, especially given it's below the median for similar sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Love Group Global Deserve A Spot On Your Watchlist?

Love Group Global's earnings per share growth have been climbing higher at an appreciable rate. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Love Group Global deserves timely attention. What about risks? Every company has them, and we've spotted 3 warning signs for Love Group Global (of which 2 don't sit too well with us!) you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Love Group Global, you'll probably love this curated collection of companies in AU that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:LVE

Love Group Global

Provides social and dating products and services in Asia, Europe, Singapore, and Bangkok.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives