Undiscovered Gems With Strong Fundamentals In Australia October 2025

Reviewed by Simply Wall St

As Australia's headline inflation rate climbs to 3.2%, surpassing the Reserve Bank's target, market sentiment has turned cautious, particularly impacting expectations for interest rate cuts. Amidst this backdrop, investors are increasingly seeking stocks with strong fundamentals that can weather economic uncertainties and offer potential growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| ASF Group | NA | -44.54% | 20.06% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Carlton Investments (ASX:CIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Carlton Investments Limited is a publicly owned asset management holding company with a market capitalization of A$923.30 million.

Operations: The primary revenue stream for Carlton Investments comes from the acquisition and long-term holding of shares and units, generating A$41.60 million.

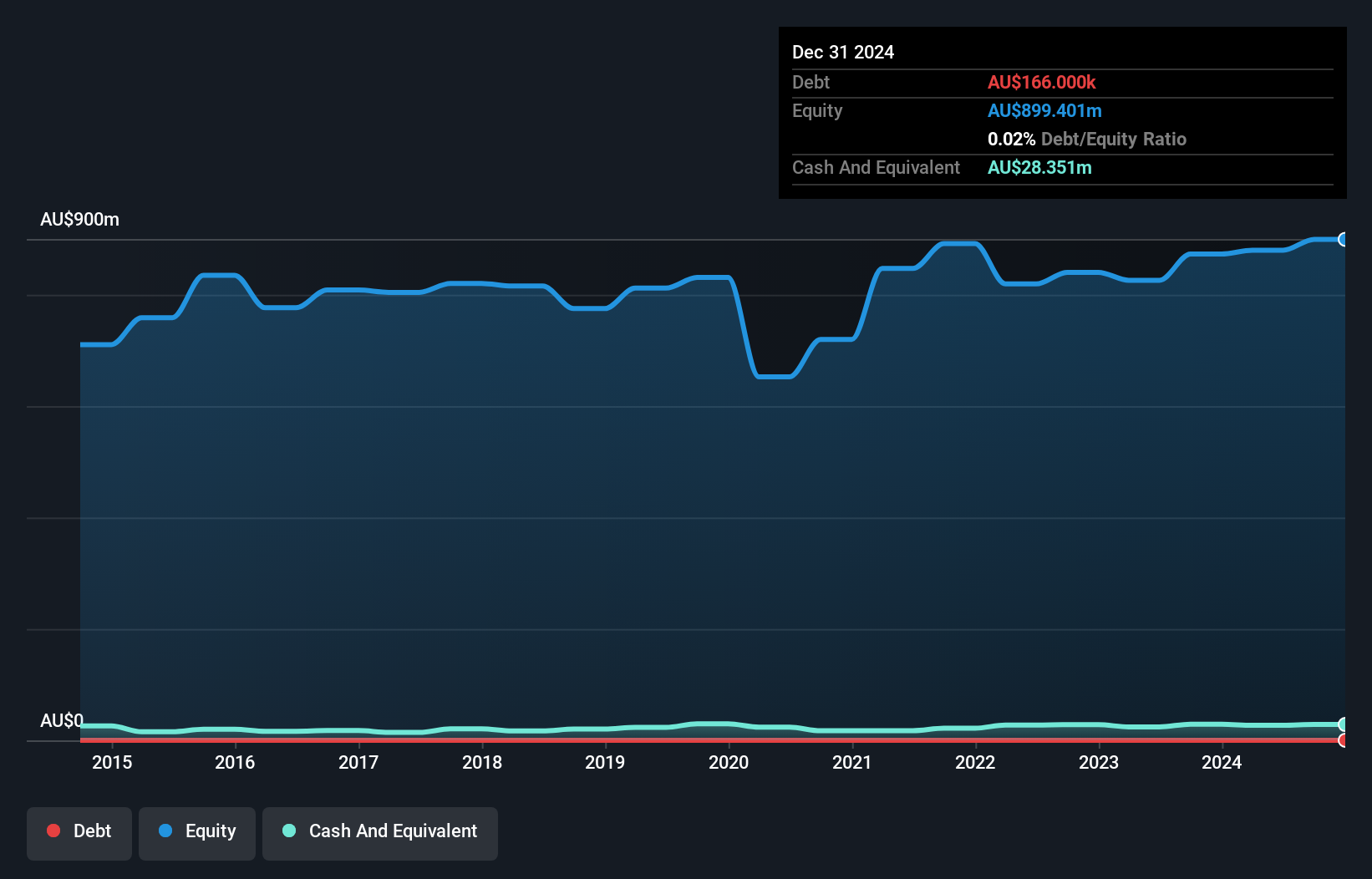

Carlton Investments, a smaller player in the Australian market, showcases a solid financial footing with its debt to equity ratio trimmed from 0.03% to 0.02% over five years and more cash than total debt. Despite earnings growing at an average of 8.7% annually over five years, recent growth of just 0.09% lagged behind the industry’s pace of 19.3%. The company declared fully franked dividends totaling A$0.75 per share for the first half of 2025, reflecting stable profitability with net income slightly up at A$38.81 million compared to last year’s A$38.77 million, indicating consistent performance amidst industry challenges.

- Get an in-depth perspective on Carlton Investments' performance by reading our health report here.

Understand Carlton Investments' track record by examining our Past report.

IVE Group (ASX:IGL)

Simply Wall St Value Rating: ★★★★★☆

Overview: IVE Group Limited, along with its subsidiaries, operates in the marketing sector in Australia and has a market capitalization of A$425.72 million.

Operations: IVE Group generates revenue primarily from its advertising segment, which accounts for A$959.25 million.

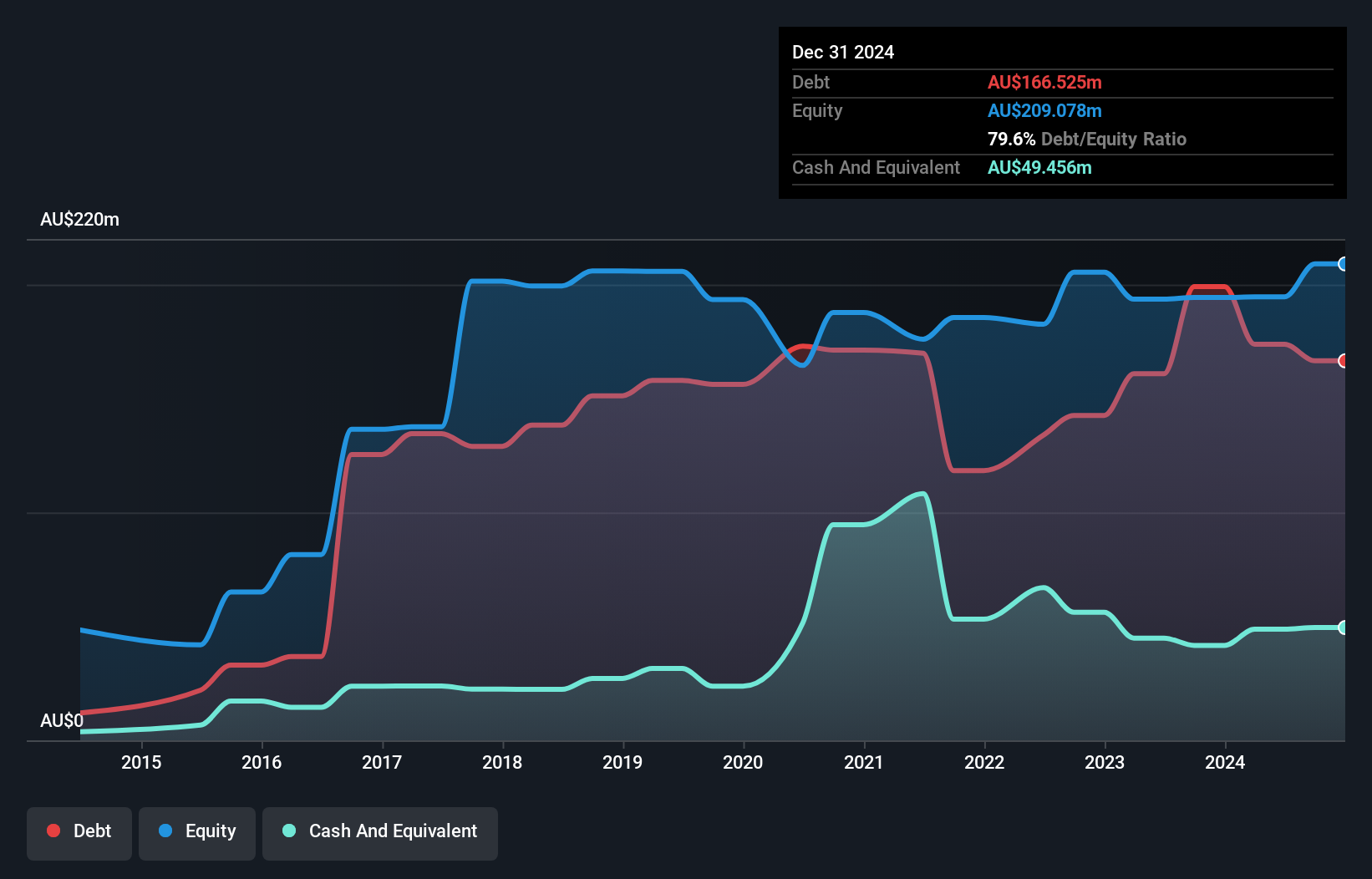

IVE Group, a notable player in the Australian market, showcases strong financials with net income rising to A$46.71 million from A$27.61 million last year, and basic earnings per share increasing to A$0.302 from A$0.18. Despite a high net debt to equity ratio of 51.7%, interest payments are well-covered at 5.1 times by EBIT, reflecting solid financial management amidst industry challenges like declining print media consumption and high fixed costs for new facilities. The company recently repurchased 706,893 shares for A$1.6 million and seeks strategic acquisitions in areas like merchandise and creative content to bolster growth prospects further.

Metals X (ASX:MLX)

Simply Wall St Value Rating: ★★★★★★

Overview: Metals X Limited is an Australian company focused on the production of tin, with a market capitalization of A$740.14 million.

Operations: Metals X derives its revenue primarily from its 50% stake in the Renison Tin Operation, contributing A$271.38 million.

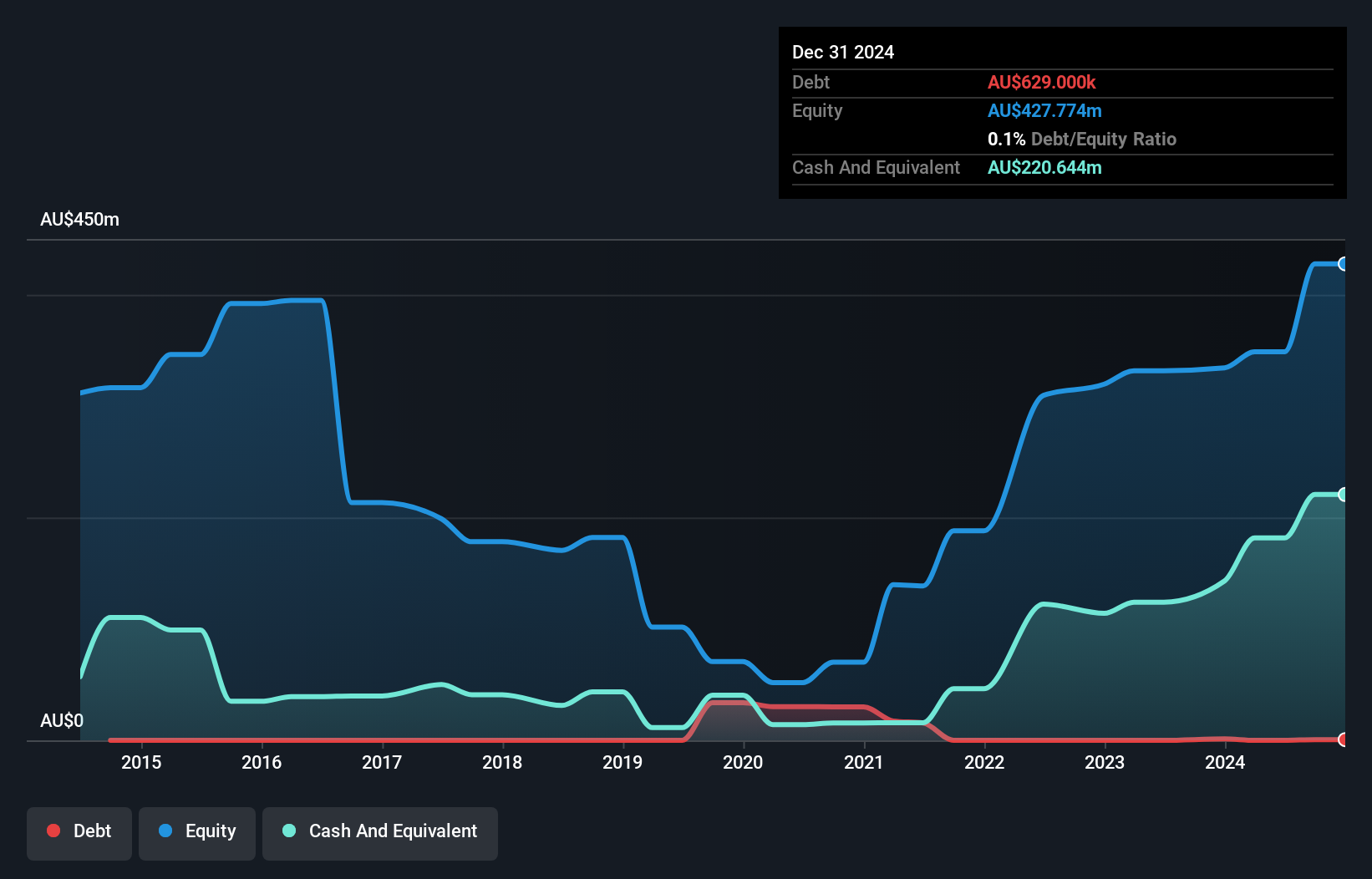

Metals X, a notable player in the Australian mining sector, has seen its earnings skyrocket by 708% over the past year, largely due to a significant A$38.4 million one-off gain. The company is debt-free now, contrasting with a debt-to-equity ratio of 58% five years ago. Trading at a price-to-earnings ratio of 5.3x, it offers good value compared to the broader market's 22.1x average. Despite its robust past performance and positive free cash flow position, future earnings are forecasted to decline by an average of 33% annually over the next three years.

Summing It All Up

- Unlock our comprehensive list of 60 ASX Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IGL

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion