Key Takeaways

- Increased demand for print and branded packaging, along with operational efficiencies, is driving stable earnings and supporting margin expansion.

- Diversification into digital and sustainable services strengthens client retention, captures new markets, and boosts resilience against shifting industry trends.

- Structural decline in print, high fixed costs, digital losses, industry competition, and sustainability trends pose persistent risks to margins, revenues, and long-term earnings growth.

Catalysts

About IVE Group- Engages in the marketing business in Australia.

- The resurgence of major retailers (like Coles and Bunnings) reinvesting in printed catalogs, supported by strong ROI research, signals a renewed commitment to print as part of omnichannel marketing. This could underpin resilient and potentially growing revenue streams and support earnings stability.

- Meaningful progress and client wins in packaging, 3PL, and brand activations-directly linked to e-commerce growth and demand for branded packaging-position IVE to capture expanding market opportunities, driving volume growth and supporting both revenue and margin expansion.

- Sustained investment in sustainability initiatives is aligned with increasing corporate and governmental focus on environmentally friendly supply chains, potentially enabling IVE to acquire new clients, retain existing clients, and earn premium pricing, positively impacting top-line revenue and net margin over time.

- Expansion and consolidation of operations into new, efficient supersites (Dandenong and Kemps Creek), along with continued automation and modernization, should yield operational efficiencies, lower unit costs, and support margin improvement and earnings growth in future periods.

- IVE's diversification into adjacent services (digital marketing, creative, data analytics, and content) targets secular shifts toward integrated, data-driven marketing solutions, which supports higher-margin revenues, diversifies risk, and builds earnings resilience against continued pressure on traditional print.

IVE Group Future Earnings and Revenue Growth

Assumptions

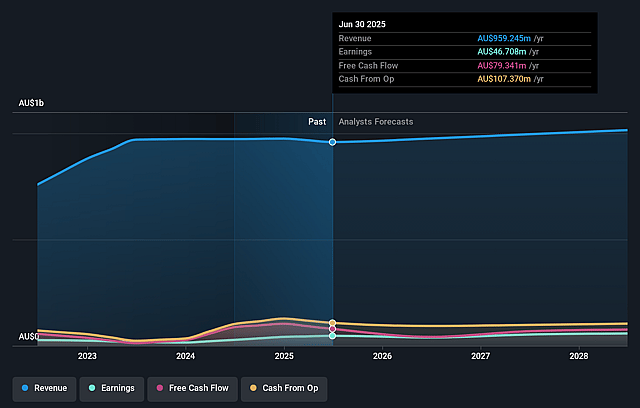

How have these above catalysts been quantified?- Analysts are assuming IVE Group's revenue will grow by 1.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.9% today to 5.7% in 3 years time.

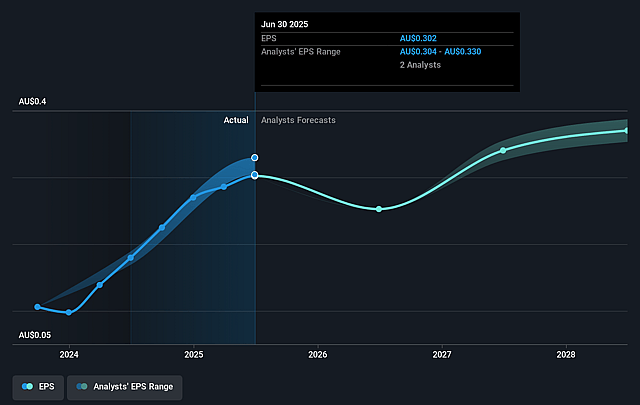

- Analysts expect earnings to reach A$57.8 million (and earnings per share of A$0.37) by about September 2028, up from A$46.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.6x on those 2028 earnings, up from 9.3x today. This future PE is lower than the current PE for the AU Media industry at 25.7x.

- Analysts expect the number of shares outstanding to decline by 0.46% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.27%, as per the Simply Wall St company report.

IVE Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing migration from print to digital media consumption-while the company cites consumer research showing effectiveness of print catalogs, management still expects print to hold steady or see a small decline over the coming years, suggesting continued long-term structural headwinds for core revenue streams, possibly leading to stagnant or falling revenues and margin pressure.

- Exposure to elevated fixed costs from significant investments in new long-term property leases and major capital expenditure on supersites and new facilities-if anticipated revenue and volume growth do not materialize or decline continues, profitability and earnings could be highly sensitive to any downturn, risking margin compression and lower returns on capital.

- Lasoo digital marketplace, while seeing improving metrics, is currently loss-making ($6.2 million operating loss in FY'25, with planned further losses before breakeven in FY'28); if market adoption slows, competitive threats increase, or digital monetization underperforms, this new business line could dilute group net margins and delay sustainable group earnings growth.

- Heightened competition and industry consolidation in the print, packaging, and 3PL sectors may drive price-based competition and margin pressure-although IVE Group is expanding into adjacencies and has acquisition plans, integration and execution risks remain, which could adversely affect earnings, net margins, and return on invested capital if synergies are not realized.

- Increasing environmental consciousness and regulatory scrutiny around sustainability, though partially addressed by IVE's ESG initiatives, may further incentivize clients to adopt paperless or alternative digital solutions, posing a long-term risk to IVE's traditional core demand and limiting growth in its addressable market, ultimately impacting revenues and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$3.25 for IVE Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$1.0 billion, earnings will come to A$57.8 million, and it would be trading on a PE ratio of 10.6x, assuming you use a discount rate of 7.3%.

- Given the current share price of A$2.81, the analyst price target of A$3.25 is 13.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.