- Australia

- /

- Real Estate

- /

- ASX:FRI

ASX Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

The Australian market has faced a challenging period, with the ASX200 closing down 1.3% amid concerns over US tariffs on Aussie steel and aluminium. Despite these broader market struggles, penny stocks continue to capture investor interest due to their affordability and potential for significant growth. While the term 'penny stocks' might seem outdated, these smaller or newer companies can still offer intriguing opportunities when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.58 | A$74.53M | ★★★★★★ |

| Bisalloy Steel Group (ASX:BIS) | A$3.20 | A$151.84M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.575 | A$112.92M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.23 | A$345.4M | ★★★★★☆ |

| CTI Logistics (ASX:CLX) | A$1.62 | A$126.38M | ★★★★☆☆ |

| West African Resources (ASX:WAF) | A$2.09 | A$2.38B | ★★★★★★ |

| GR Engineering Services (ASX:GNG) | A$2.57 | A$429.67M | ★★★★★★ |

| Regal Partners (ASX:RPL) | A$2.96 | A$992.78M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.93 | A$242.43M | ★★★★★★ |

| Accent Group (ASX:AX1) | A$1.80 | A$1.02B | ★★★★☆☆ |

Click here to see the full list of 1,003 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Finbar Group (ASX:FRI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Finbar Group Limited, with a market cap of A$204.09 million, is involved in property development and investment activities in Australia through its subsidiaries.

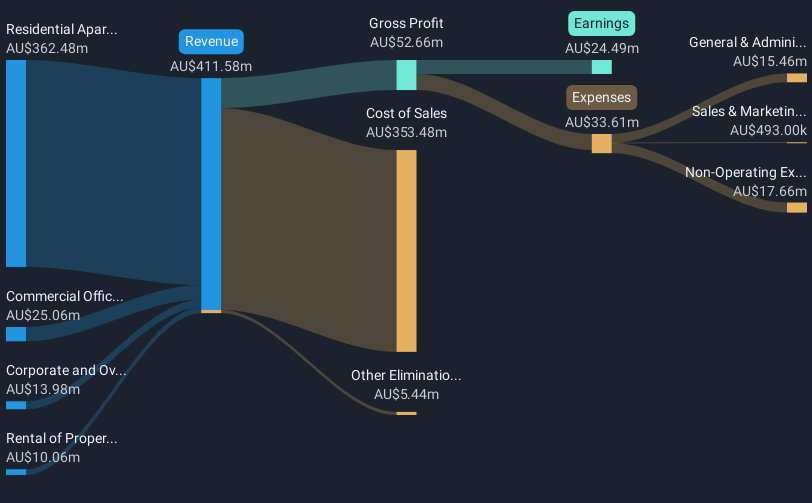

Operations: The company's revenue is primarily derived from Residential Apartment Development at A$362.48 million, followed by Commercial Office/Retail Development at A$25.06 million and Rental of Property at A$10.06 million.

Market Cap: A$204.09M

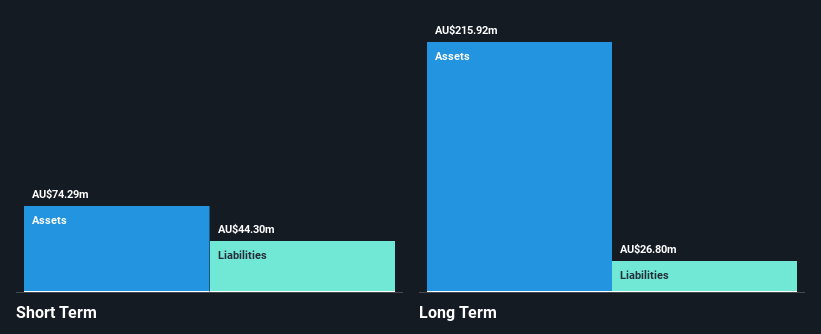

Finbar Group Limited, with a market cap of A$204.09 million, has shown significant growth in earnings, increasing by 386.7% over the past year. The company's revenue is primarily driven by residential apartment development at A$362.48 million and commercial office/retail development at A$25.06 million. Despite lower net profit margins compared to last year (6% vs 22.6%), Finbar's debt is well-covered by operating cash flow (348.1%). Recent financial results for the half-year ended December 31, 2024, reported sales of A$218.29 million and net income of A$9.37 million, highlighting improved performance from the previous year.

- Navigate through the intricacies of Finbar Group with our comprehensive balance sheet health report here.

- Explore historical data to track Finbar Group's performance over time in our past results report.

GTN (ASX:GTN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GTN Limited operates broadcast media advertising platforms that provide traffic and news information reports to radio stations in Australia, Canada, the United Kingdom, and Brazil, with a market cap of A$112.92 million.

Operations: The company's revenue is derived from advertising, totaling A$186.15 million.

Market Cap: A$112.92M

GTN Limited, with a market cap of A$112.92 million, has shown robust earnings growth of 52.6% over the past year, surpassing the media industry's average. The company's revenue from advertising reached A$186.15 million, while its net profit margin improved to 3.3%. GTN's financial health is solid with short-term assets exceeding liabilities and debt well-covered by operating cash flow at a very large percentage. Despite a low return on equity of 2.8%, GTN's debt-to-equity ratio has significantly reduced over five years to 1.2%. Recent executive changes include Ben Brooks as the new CFO, enhancing leadership stability amidst ongoing business developments like share buybacks and dividend increases.

- Jump into the full analysis health report here for a deeper understanding of GTN.

- Review our growth performance report to gain insights into GTN's future.

Nuix (ASX:NXL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nuix Limited offers investigative analytics and intelligence software solutions across various regions including the Asia Pacific, the Americas, Europe, the Middle East, and Africa with a market cap of A$1.13 billion.

Operations: The company generates revenue through its Software & Programming segment, which reported A$227.32 million.

Market Cap: A$1.13B

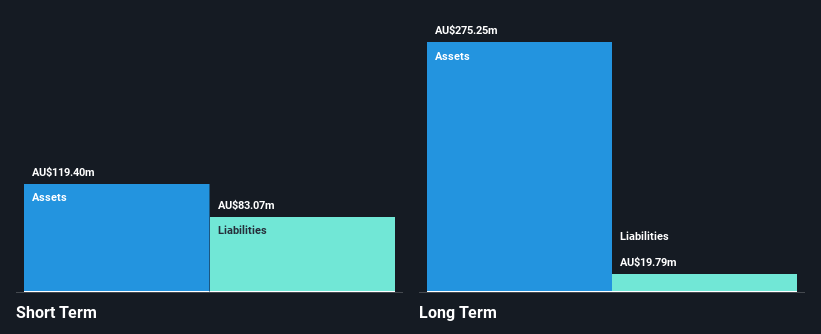

Nuix Limited, with a market cap of A$1.13 billion, operates in the software sector and reported revenue of A$105.2 million for the half-year ending December 31, 2024. Despite being unprofitable with a net loss of A$10.4 million, Nuix maintains financial stability through positive free cash flow and no debt obligations. The company has sufficient cash runway for over three years under current conditions, supported by short-term assets exceeding liabilities significantly. While earnings are forecasted to grow annually by 52.64%, past profitability challenges persist as losses have increased over five years at a rate of 25.4% per year.

- Click here to discover the nuances of Nuix with our detailed analytical financial health report.

- Assess Nuix's future earnings estimates with our detailed growth reports.

Where To Now?

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,000 more companies for you to explore.Click here to unveil our expertly curated list of 1,003 ASX Penny Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FRI

Finbar Group

Engages in the property development and investment in Australia.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives