- Australia

- /

- Basic Materials

- /

- ASX:WGN

3 ASX Penny Stocks With Market Caps Over A$100M

Reviewed by Simply Wall St

The Australian market has seen a slight pullback, with the ASX200 down 0.34% as tensions in Ukraine drive demand for haven assets like gold, which has surged above $US2,640 an ounce. Amidst these broader market movements, investors are considering various strategies to navigate current conditions. Penny stocks, though an older term, still represent opportunities in smaller or less-established companies that can offer value and growth potential when supported by strong financials. We've identified three such stocks that stand out for their balance sheet strength and potential upside.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.60 | A$70.33M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$148.62M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$2.04 | A$332.15M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.53 | A$328.68M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.80 | A$232.15M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.66 | A$813.53M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.205 | A$1.11B | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.875 | A$127.72M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.94 | A$487.41M | ★★★★☆☆ |

Click here to see the full list of 1,044 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Frontier Digital Ventures (ASX:FDV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Frontier Digital Ventures Limited is a private equity firm focused on investing in and developing online classifieds businesses in emerging markets, with a market cap of A$184.27 million.

Operations: The company's revenue is derived from its investments in online classifieds businesses across various regions, with notable contributions from Infocasas (A$23.49 million), Fincaraiz (A$13.26 million), Encuentra24 (A$11.30 million), Avito (A$7.92 million), and Yapo (A$7.86 million).

Market Cap: A$184.27M

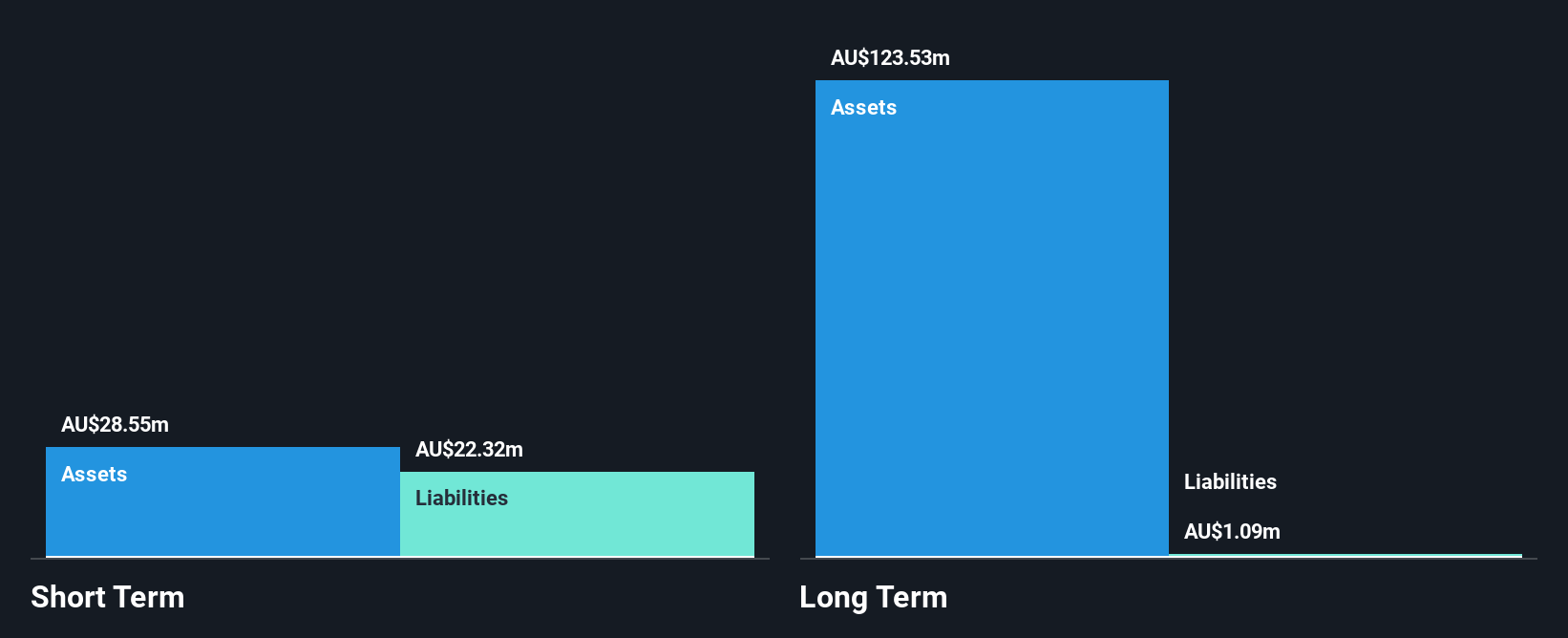

Frontier Digital Ventures, with a market cap of A$184.27 million, invests in online classifieds across emerging markets. Despite being unprofitable with a negative return on equity of -1.82%, the company has shown revenue growth, reporting A$35.49 million for the first half of 2024 compared to A$31.18 million the previous year and reducing its net loss from A$9.91 million to A$1.47 million year-on-year. The firm maintains more cash than debt and has not faced significant shareholder dilution recently, although its shares were delisted from OTC Equity due to inactivity in October 2024.

- Dive into the specifics of Frontier Digital Ventures here with our thorough balance sheet health report.

- Gain insights into Frontier Digital Ventures' outlook and expected performance with our report on the company's earnings estimates.

MyState (ASX:MYS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: MyState Limited, with a market cap of A$444.88 million, operates in Australia offering banking, trustee, and managed fund products and services through its subsidiaries.

Operations: The company generates revenue through its Banking segment (A$135.47 million), Wealth Management services (A$15.68 million), and Corporate and Consolidation activities (A$0.08 million).

Market Cap: A$444.88M

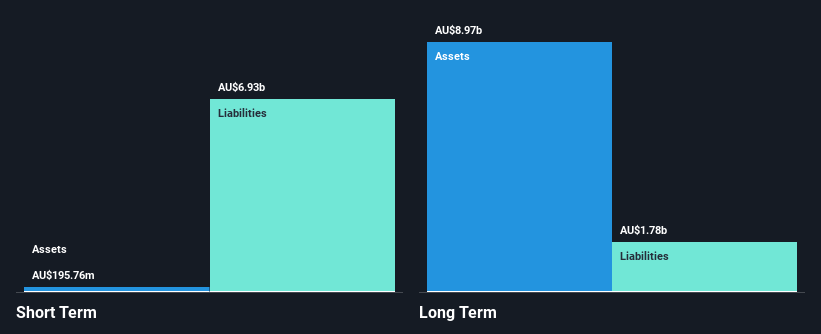

MyState Limited, with a market cap of A$444.88 million, operates in the financial sector and has faced challenges with negative earnings growth over the past year. Despite this, it maintains a stable weekly volatility of 4% and an experienced management team with an average tenure of 5.1 years. The company’s loans to assets ratio is appropriate at 88%, but its loans to deposits ratio is high at 128%. MyState's return on equity is low at 7.6%, though it benefits from primarily low-risk funding sources and forecasts suggest earnings growth of 11.9% annually.

- Navigate through the intricacies of MyState with our comprehensive balance sheet health report here.

- Examine MyState's earnings growth report to understand how analysts expect it to perform.

Wagners Holding (ASX:WGN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wagners Holding Company Limited produces and sells construction materials across Australia, the United States, New Zealand, the United Kingdom, PNG & Malaysia with a market cap of A$266.42 million.

Operations: The company's revenue is primarily derived from Construction Materials at A$224.39 million, Project Services contributing A$206.20 million, Composite Fibre Technology generating A$59.38 million, and Earth Friendly Concrete accounting for A$0.27 million.

Market Cap: A$266.42M

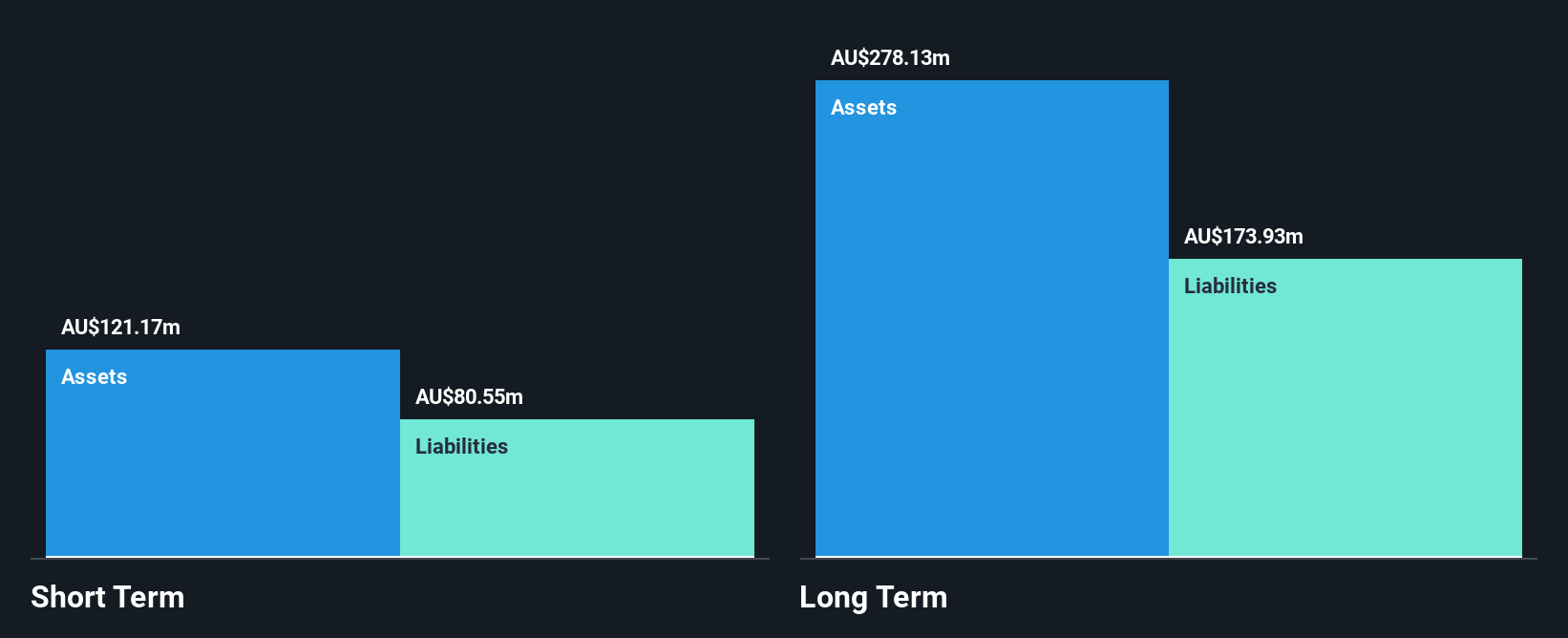

Wagners Holding Company Limited, with a market cap of A$266.42 million, has shown significant earnings growth of 229.2% over the past year, surpassing industry averages. The company recently resumed dividend payments for the first time since 2018, reflecting improved financial health with net income rising to A$10.28 million from A$3.12 million last year. While its short-term assets cover liabilities and debt is well-managed by operating cash flow, long-term liabilities remain uncovered by short-term assets. Despite a low return on equity at 7.6%, Wagners' debt reduction efforts and stable management team enhance its investment profile among penny stocks in Australia.

- Jump into the full analysis health report here for a deeper understanding of Wagners Holding.

- Review our growth performance report to gain insights into Wagners Holding's future.

Taking Advantage

- Navigate through the entire inventory of 1,044 ASX Penny Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wagners Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WGN

Wagners Holding

Engages in the production and sale of construction materials in Australia, the United States, New Zealand, the United Kingdom, and PNG & Malaysia.

Proven track record with adequate balance sheet.