- Australia

- /

- Metals and Mining

- /

- ASX:LU7

Esports Mogul (ASX:ESH) Is In A Good Position To Deliver On Growth Plans

We can readily understand why investors are attracted to unprofitable companies. For example, Esports Mogul (ASX:ESH) shareholders have done very well over the last year, with the share price soaring by 133%. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given its strong share price performance, we think it's worthwhile for Esports Mogul shareholders to consider whether its cash burn is concerning. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Esports Mogul

Does Esports Mogul Have A Long Cash Runway?

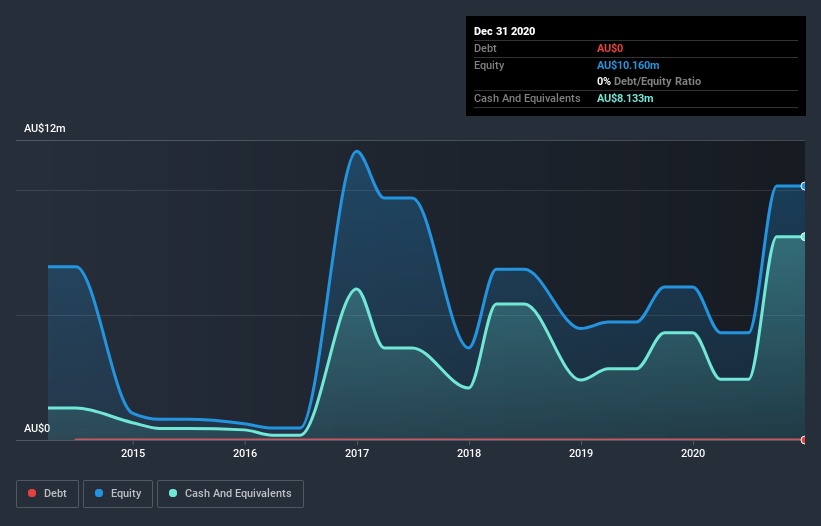

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In December 2020, Esports Mogul had AU$8.1m in cash, and was debt-free. Looking at the last year, the company burnt through AU$4.1m. So it had a cash runway of about 2.0 years from December 2020. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. Depicted below, you can see how its cash holdings have changed over time.

How Is Esports Mogul's Cash Burn Changing Over Time?

Whilst it's great to see that Esports Mogul has already begun generating revenue from operations, last year it only produced AU$304k, so we don't think it is generating significant revenue, at this point. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. As it happens, the company's cash burn reduced by 13% over the last year, which suggests that management are maintaining a fairly steady rate of business development, albeit with a slight decrease in spending. Admittedly, we're a bit cautious of Esports Mogul due to its lack of significant operating revenues. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Easily Can Esports Mogul Raise Cash?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Esports Mogul to raise more cash in the future. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Esports Mogul has a market capitalisation of AU$40m and burnt through AU$4.1m last year, which is 10% of the company's market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

How Risky Is Esports Mogul's Cash Burn Situation?

The good news is that in our view Esports Mogul's cash burn situation gives shareholders real reason for optimism. Not only was its cash runway quite good, but its cash burn relative to its market cap was a real positive. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. On another note, we conducted an in-depth investigation of the company, and identified 5 warning signs for Esports Mogul (2 are a bit unpleasant!) that you should be aware of before investing here.

Of course Esports Mogul may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Esports Mogul, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:LU7

Lithium Universe

Focuses on operating as a mineral exploration and development company.

Medium-low risk with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion