Slammed 33% Aspermont Limited (ASX:ASP) Screens Well Here But There Might Be A Catch

Aspermont Limited (ASX:ASP) shareholders won't be pleased to see that the share price has had a very rough month, dropping 33% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 73% loss during that time.

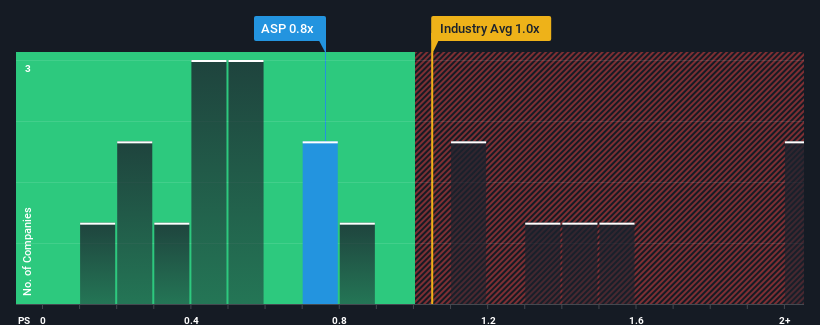

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Aspermont's P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Media industry in Australia is also close to 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Aspermont

What Does Aspermont's P/S Mean For Shareholders?

Aspermont has been doing a decent job lately as it's been growing revenue at a reasonable pace. It might be that many expect the respectable revenue performance to only match most other companies over the coming period, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Aspermont, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Aspermont's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Aspermont's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 2.8%. Revenue has also lifted 27% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 0.6% shows it's a great look while it lasts.

In light of this, it's peculiar that Aspermont's P/S sits in line with the majority of other companies. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Bottom Line On Aspermont's P/S

With its share price dropping off a cliff, the P/S for Aspermont looks to be in line with the rest of the Media industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Aspermont revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Aspermont that you should be aware of.

If these risks are making you reconsider your opinion on Aspermont, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ASP

Aspermont

Provides market specific content across the resource sectors through a combination of print, digital media channels, and face to face networking channels in Australia and internationally.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives