- Australia

- /

- Metals and Mining

- /

- ASX:IDA

Airtasker Leads Our Trio Of ASX Penny Stocks To Consider

Reviewed by Simply Wall St

The Australian market recently saw the ASX200 close down 0.25% at 8,160 points, with gold reaching record highs as investors sought safety amid global uncertainties. For those looking beyond established names, penny stocks can offer intriguing opportunities despite their somewhat outdated label. These smaller or newer companies often present a chance for growth at lower price points, and when supported by strong financials, they can provide potential returns with reduced risk compared to typical perceptions of this investment category.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$144.03M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.61 | A$72.09M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.895 | A$104.82M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.805 | A$281.08M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.525 | A$322.48M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$828.23M | ★★★★★☆ |

| Joyce (ASX:JYC) | A$4.35 | A$124.48M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.14 | A$63.17M | ★★★★★★ |

| Perenti (ASX:PRN) | A$1.175 | A$1.08B | ★★★★★★ |

| SRG Global (ASX:SRG) | A$1.12 | A$682.42M | ★★★★★★ |

Click here to see the full list of 1,033 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Airtasker (ASX:ART)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Airtasker Limited operates a technology-enabled online marketplace for local services in Australia, with a market cap of A$126.92 million.

Operations: The company's revenue is derived from Established Marketplaces, which contribute A$45.22 million, and New Marketplaces, which add A$1.42 million.

Market Cap: A$126.92M

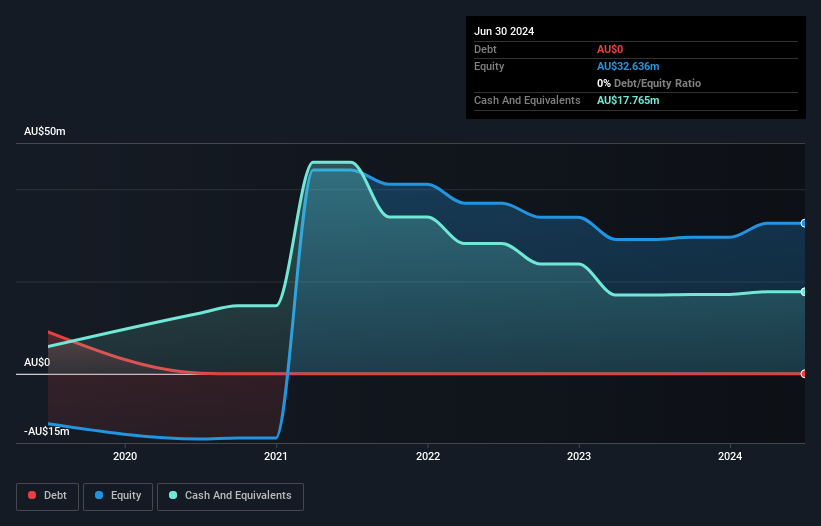

Airtasker, with a market cap of A$126.92 million, presents an intriguing opportunity in the penny stock landscape. Despite being unprofitable, the company has shown resilience by reducing losses over the past five years and maintaining a cash runway exceeding three years due to positive free cash flow. The recent private placement of A$9.75 million from investors like iHeartMedia and TelevisaUnivision highlights external confidence in its potential growth trajectory. Airtasker's revenue for FY24 reached A$46.64 million, up from A$44.17 million previously, while net loss significantly decreased from A$12.9 million to A$2.89 million year-on-year.

- Navigate through the intricacies of Airtasker with our comprehensive balance sheet health report here.

- Gain insights into Airtasker's future direction by reviewing our growth report.

Archer Materials (ASX:AXE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Archer Materials Limited is an Australian technology company focused on developing and commercializing semiconductor devices and sensors for quantum computing and medical diagnostics, with a market cap of A$64.99 million.

Operations: The company generates revenue from its Materials Technology Research and Development segment, amounting to A$2.14 million.

Market Cap: A$64.99M

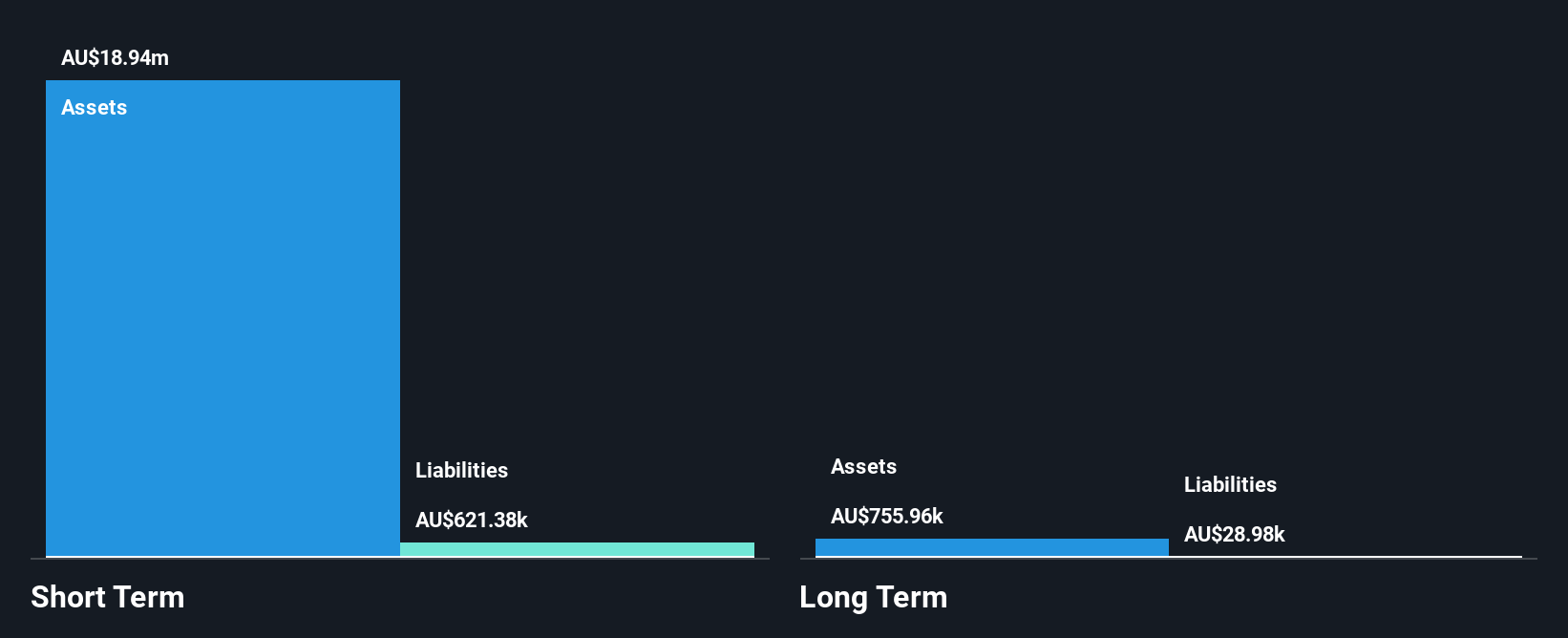

Archer Materials, with a market cap of A$64.99 million, is focused on semiconductor technology and remains pre-revenue with earnings reported at A$3.08 million for FY24. The company is unprofitable but has reduced its net loss to A$4.8 million from A$9.05 million the previous year, showing some financial improvement. Archer's management and board are seasoned, contributing to stability in leadership amid its development phase. With no debt and a robust cash runway exceeding three years, Archer maintains financial flexibility as it continues to pursue technological advancements in quantum computing and medical diagnostics sectors without significant shareholder dilution recently.

- Jump into the full analysis health report here for a deeper understanding of Archer Materials.

- Examine Archer Materials' past performance report to understand how it has performed in prior years.

Indiana Resources (ASX:IDA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Indiana Resources Limited is a gold exploration company based in Australia with a market capitalization of A$63.44 million.

Operations: The company generates its revenue primarily from exploration activities, amounting to A$0.21 million.

Market Cap: A$63.44M

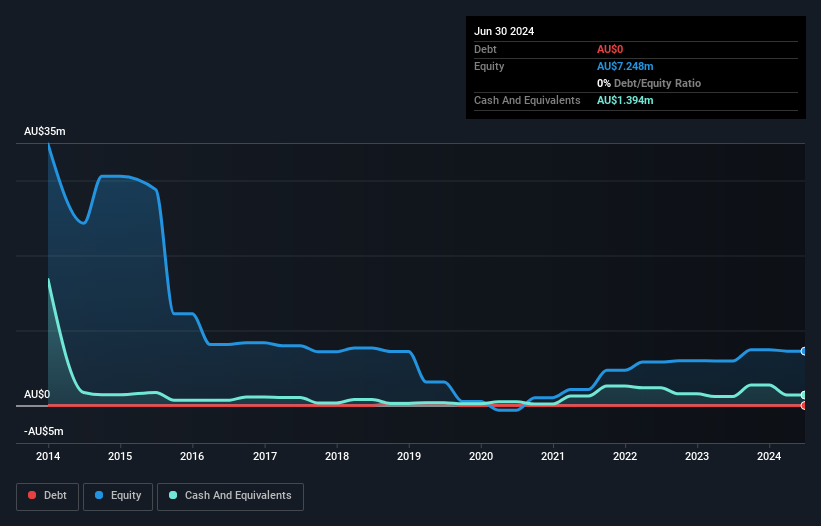

Indiana Resources, with a market cap of A$63.44 million, is a gold exploration company that remains pre-revenue, generating only A$0.21 million from exploration activities. The company is debt-free and has short-term assets of A$1.8 million exceeding both its short-term and long-term liabilities. However, it faces challenges with less than a year of cash runway and recent shareholder dilution by 3.6%. Despite being unprofitable with increased net losses to A$4.17 million for FY24, Indiana has reduced losses over five years at 26% annually while undergoing board changes to strengthen corporate governance expertise.

- Get an in-depth perspective on Indiana Resources' performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Indiana Resources' track record.

Next Steps

- Click this link to deep-dive into the 1,033 companies within our ASX Penny Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IDA

Indiana Resources

Engages in the exploration of rare earth elements, gold, and base metals in Australia.

Flawless balance sheet and good value.

Market Insights

Community Narratives