- Australia

- /

- Metals and Mining

- /

- ASX:CNB

3 ASX Penny Stocks With Market Caps Larger Than A$60M

Reviewed by Simply Wall St

The Australian market has been experiencing a slight downturn, with the ASX200 down 0.35% amid light trading volumes due to the Thanksgiving Day holidays in the US. Despite these broader market challenges, there remains interest in smaller companies that can offer unique investment opportunities. Penny stocks, while an older term, still capture attention for their potential value and growth prospects when backed by strong financials. In this article, we explore three penny stocks listed on the ASX that stand out for their financial strength and potential stability amidst current market conditions.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.99 | A$324.01M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.79 | A$231.32M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.545 | A$337.98M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.685 | A$825.78M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.69 | A$119.5M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.16 | A$69.71M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$2.05 | A$115.32M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.98 | A$491.35M | ★★★★☆☆ |

Click here to see the full list of 1,047 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Airtasker (ASX:ART)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Airtasker Limited operates technology-enabled online marketplaces for local services in Australia, with a market capitalization of A$138.26 million.

Operations: The company's revenue is derived from two segments: Established Marketplaces, generating A$45.22 million, and New Marketplaces, contributing A$1.42 million.

Market Cap: A$138.26M

Airtasker Limited, with a market cap of A$138.26 million, has shown resilience despite being unprofitable. The company's revenue increased to A$46.64 million for the year ended June 30, 2024, and it reduced its net loss from A$12.9 million to A$2.89 million year-over-year. Airtasker benefits from a strong balance sheet with short-term assets exceeding both short and long-term liabilities and remains debt-free. It secured a significant investment of $9.75 million in September 2024, enhancing its cash runway for over three years while maintaining positive free cash flow amidst stable volatility and no recent shareholder dilution.

- Get an in-depth perspective on Airtasker's performance by reading our balance sheet health report here.

- Examine Airtasker's earnings growth report to understand how analysts expect it to perform.

Carnaby Resources (ASX:CNB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Carnaby Resources Limited, with a market cap of A$68.77 million, is involved in the exploration and development of mineral properties in Australia through its subsidiaries.

Operations: Carnaby Resources Limited has not reported any revenue segments.

Market Cap: A$68.77M

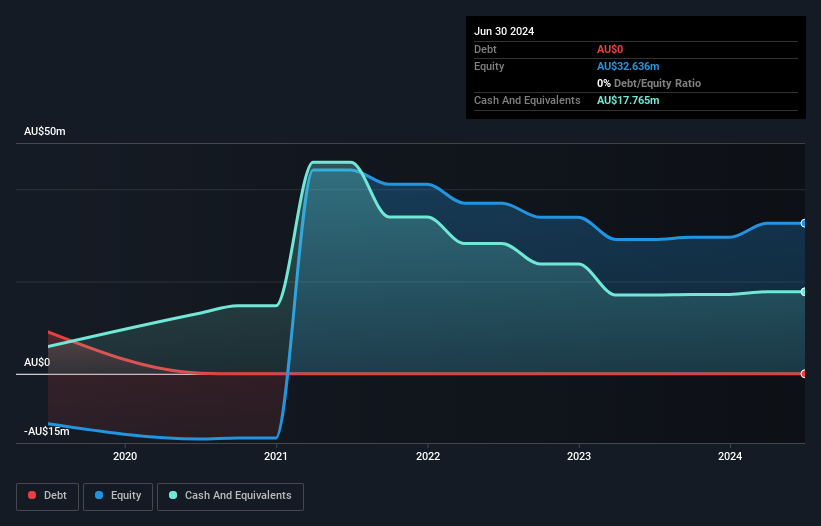

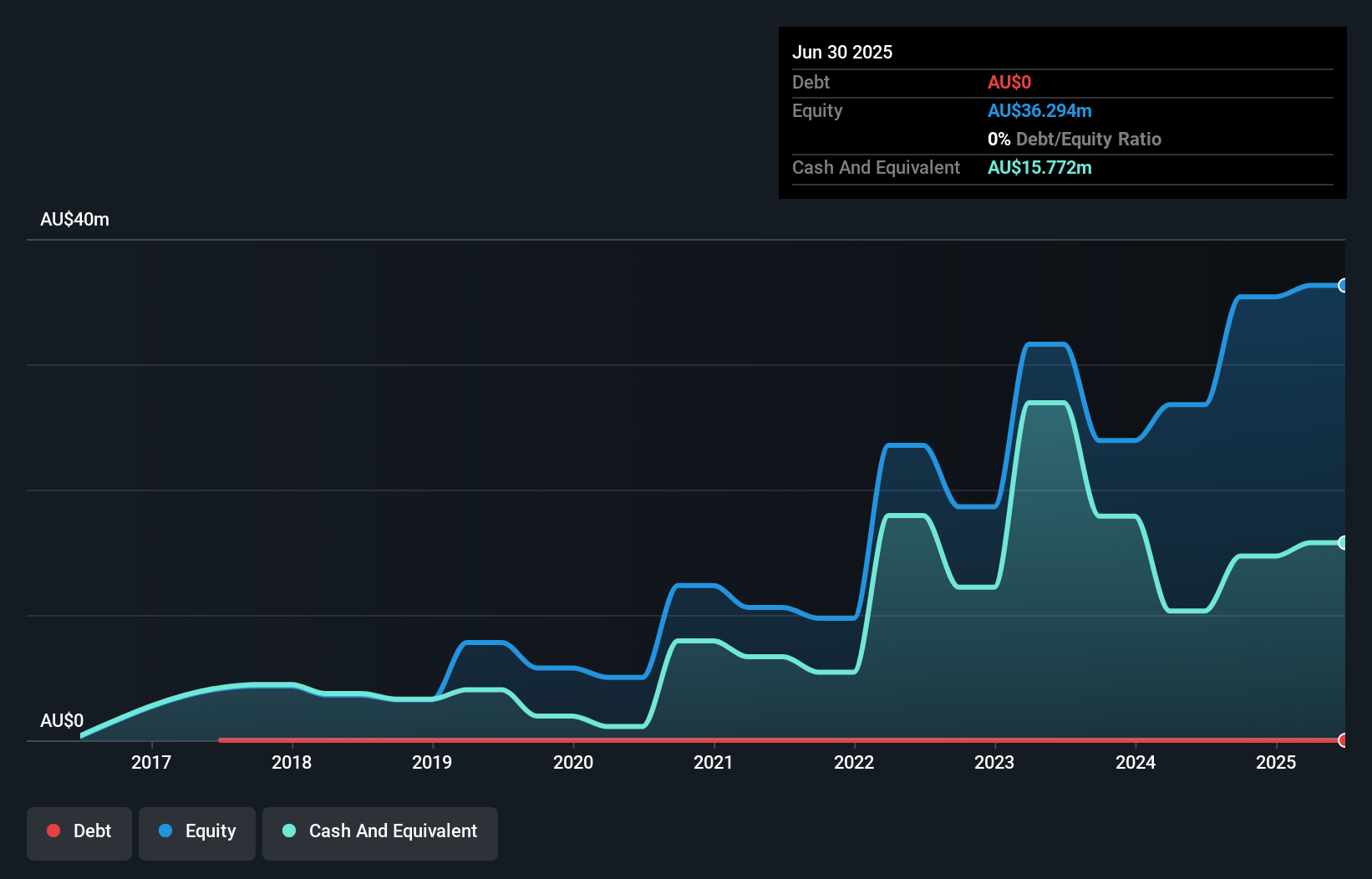

Carnaby Resources Limited, with a market cap of A$68.77 million, remains pre-revenue and unprofitable, having reported a net loss of A$12.09 million for the year ended June 30, 2024. The company recently filed a follow-on equity offering to raise A$17.5 million, indicating potential dilution for shareholders who have already seen shares outstanding increase by 5.6% over the past year. Despite its debt-free status and short-term assets exceeding liabilities, Carnaby faces financial challenges with less than one year of cash runway based on current free cash flow trends and volatile share price movements over recent months.

- Unlock comprehensive insights into our analysis of Carnaby Resources stock in this financial health report.

- Assess Carnaby Resources' future earnings estimates with our detailed growth reports.

Mach7 Technologies (ASX:M7T)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mach7 Technologies Limited offers enterprise imaging data sharing, storage, and interoperability solutions for healthcare enterprises globally, with a market cap of A$91.67 million.

Operations: The company's revenue is derived from Software Licenses (A$13.17 million), Professional Services (A$4.07 million), and Maintenance and Support (A$11.87 million).

Market Cap: A$91.67M

Mach7 Technologies, with a market cap of A$91.67 million, is unprofitable but shows potential in the healthcare sector through its innovative solutions like UnityVue. This newly launched radiology software platform integrates Mach7's diagnostic viewer with NewVue's workflow orchestrator, enhancing radiology workflows and productivity. Despite negative return on equity and increasing losses over five years, Mach7 has no debt and sufficient cash runway for over three years due to positive free cash flow growth. Analysts anticipate significant stock price appreciation, although the management team lacks extensive experience compared to its seasoned board of directors.

- Click to explore a detailed breakdown of our findings in Mach7 Technologies' financial health report.

- Learn about Mach7 Technologies' future growth trajectory here.

Next Steps

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,044 more companies for you to explore.Click here to unveil our expertly curated list of 1,047 ASX Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CNB

Carnaby Resources

Engages in the exploration and development of mineral properties in Australia.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives