- Australia

- /

- Metals and Mining

- /

- ASX:ZIM

Undiscovered Gems in Australia to Watch This August 2025

Reviewed by Simply Wall St

As the ASX200 remains steady, with Real Estate, Financials, and Industrials leading the charge while Energy and Health Care lag behind, investors are keenly observing how economic shifts impact small-cap companies. In this dynamic environment, identifying undiscovered gems requires a focus on resilience and growth potential amidst sector fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Peet | 53.46% | 12.70% | 31.21% | ★★★★☆☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Generation Development Group (ASX:GDG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Generation Development Group Limited focuses on the marketing and management of life insurance and life investment products and services in Australia, with a market cap of A$2.70 billion.

Operations: GDG generates revenue through its life insurance and life investment products and services in Australia. The company's market cap stands at approximately A$2.70 billion.

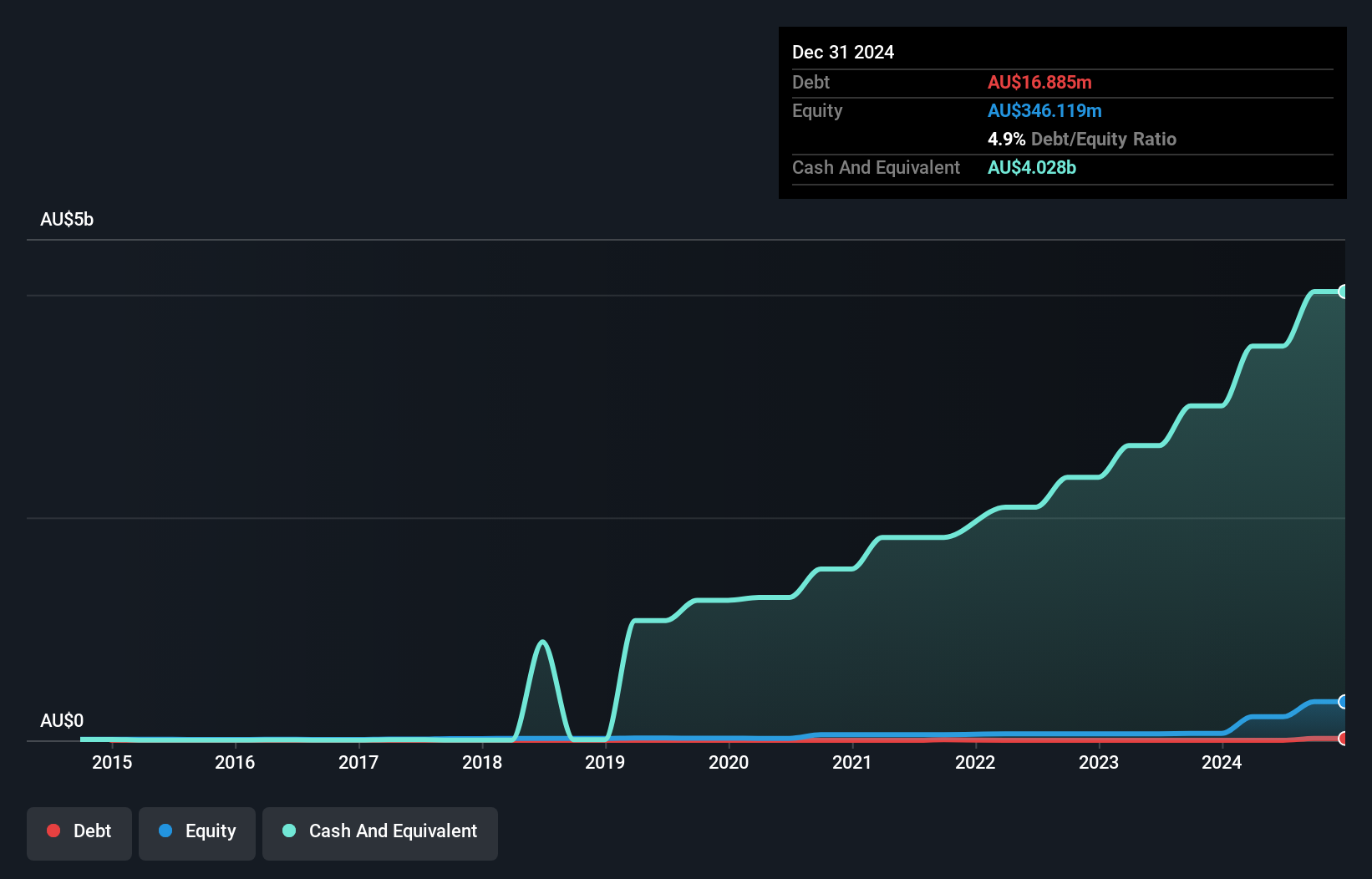

Generation Development Group, a nimble player in the Australian life insurance and investment sector, reported a substantial leap in net income to A$38.25 million for the year ending June 2025, up from A$5.84 million previously. Earnings per share also rose to A$0.1163 from A$0.0301, reflecting strong performance despite recent shareholder dilution concerns. With no debt on its books and positive free cash flow of approximately A$8 million as of June 2025, GDG is poised for growth with strategic acquisitions like Evidentia enhancing its market position amid demographic shifts favoring annuity products. However, integration risks and potential policy changes present challenges ahead.

Kina Securities (ASX:KSL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kina Securities Limited operates as a provider of commercial banking, financial services, fund administration, investment management, and share brokerage in Papua New Guinea with a market capitalization of A$401.43 million.

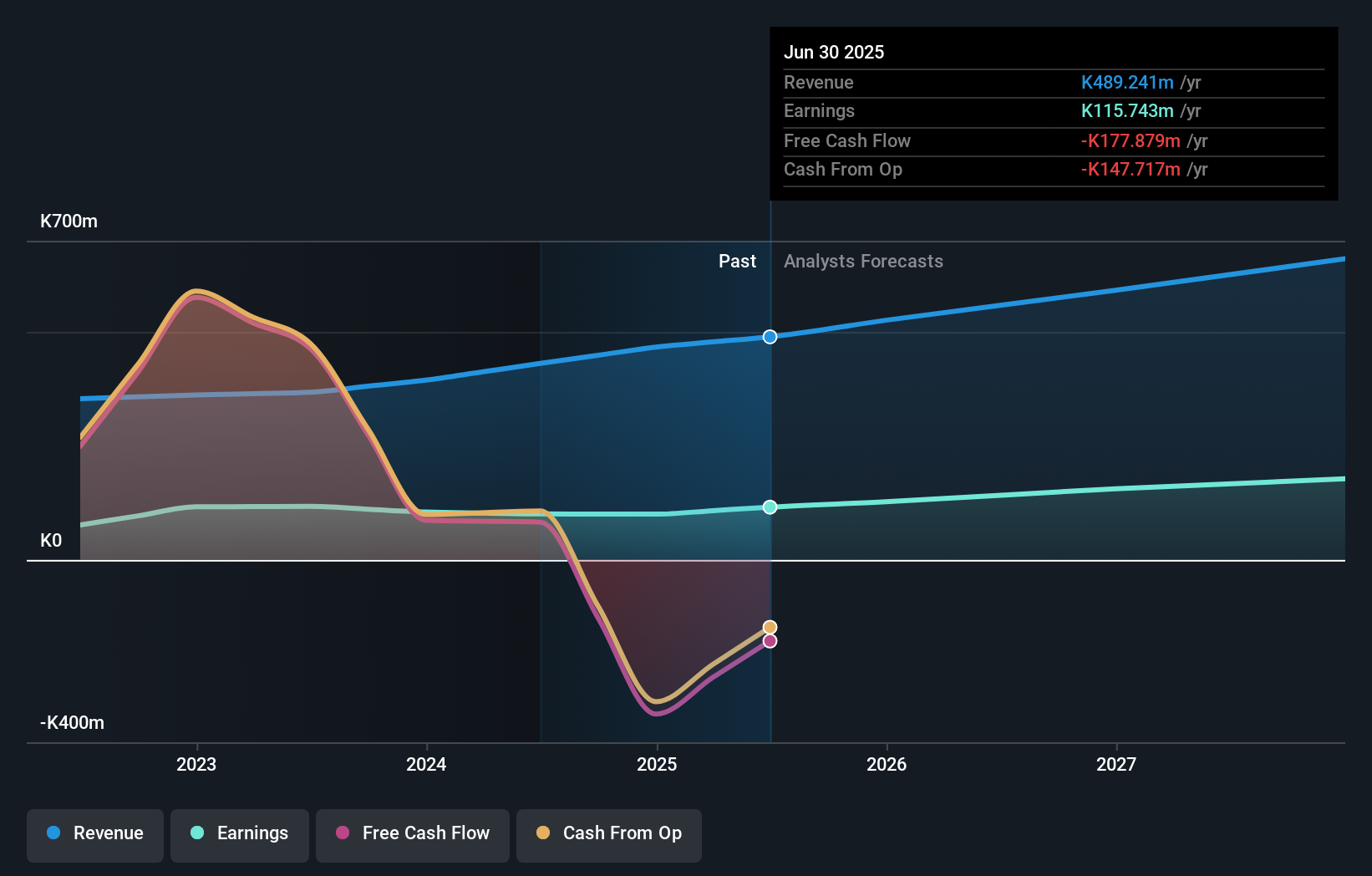

Operations: Kina Securities generates revenue primarily from its Banking & Finance segment, which contributed PGK 441.25 million, and Wealth Management, adding PGK 50.19 million. The company reported a net profit margin of 26%, indicating efficient cost management relative to its revenue streams.

Kina Securities, a financial entity with PGK5.4 billion in assets and PGK680.3 million in equity, offers an intriguing mix of potential growth and challenges. With 95% of its liabilities from low-risk customer deposits, the company has a solid funding base despite high bad loans at 7.7%. Its price-to-earnings ratio of 9.4x is attractive compared to the market average of 19x, indicating good value for investors seeking opportunities in smaller companies. However, a low allowance for bad loans at 27% could pose risks amidst rising operational costs and volatile revenue streams from multinational clients impacting profitability stability.

Zimplats Holdings (ASX:ZIM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zimplats Holdings Limited is involved in the production of platinum and associated metals in Zimbabwe, with a market capitalization of A$1.74 billion.

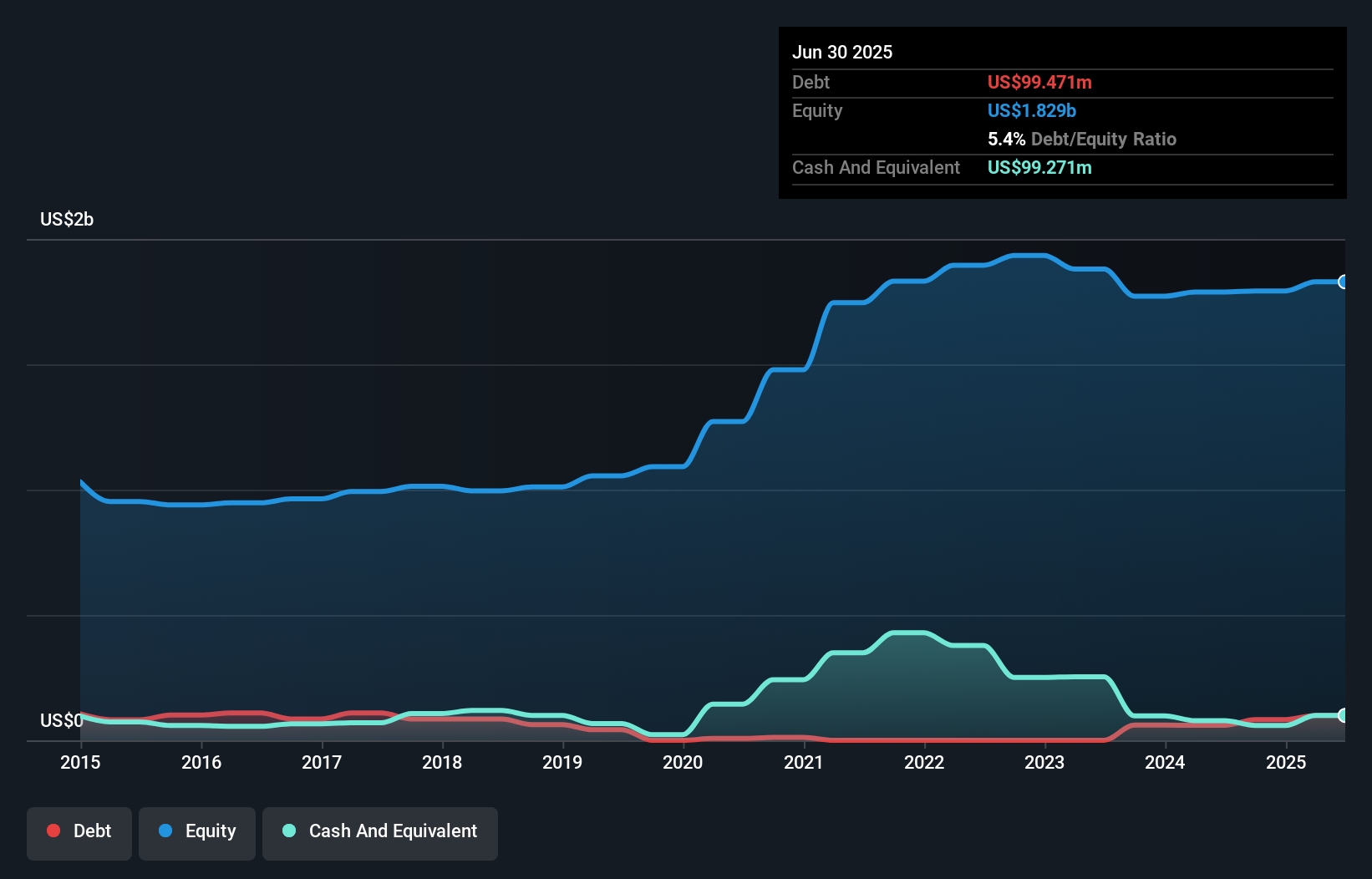

Operations: Zimplats Holdings generates revenue primarily from its metals and mining segment, specifically gold and other precious metals, totaling $826.59 million. The company's financial performance is influenced by its ability to manage costs associated with the production of these metals.

Zimplats Holdings, a notable player in the mining sector, has shown impressive growth with earnings surging by 393% over the past year, significantly outpacing the industry average of 14%. Despite a challenging five-year period where earnings declined by 42% annually, recent results reflect resilience with net income climbing to US$40.5 million from US$8.22 million last year. The company boasts high-quality earnings and maintains a satisfactory net debt to equity ratio of 0.01%, indicating prudent financial management. While free cash flow remains negative, Zimplats' profitability ensures that cash runway isn't an immediate concern for future operations.

- Delve into the full analysis health report here for a deeper understanding of Zimplats Holdings.

Gain insights into Zimplats Holdings' past trends and performance with our Past report.

Summing It All Up

- Explore the 51 names from our ASX Undiscovered Gems With Strong Fundamentals screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zimplats Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ZIM

Zimplats Holdings

Engages in the production and sales of platinum group and associated metals in Zimbabwe.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives