- Australia

- /

- Consumer Finance

- /

- ASX:ZIP

ASX Penny Stocks Worth Watching With At Least A$50M Market Cap

Reviewed by Simply Wall St

The Australian market experienced a mixed day, with fluctuations driven by movements in major stocks like Commonwealth Bank and BHP, highlighting the ongoing sector rotations and economic impacts from global events. In such a volatile landscape, investors often look beyond the giants to find opportunities in lesser-known areas of the market. Penny stocks, despite their somewhat outdated name, continue to intrigue investors for their potential to offer both value and growth; this article will explore three such stocks that stand out for their financial resilience and potential long-term promise.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.39 | A$111.77M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.09 | A$98.59M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.615 | A$117.26M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.03 | A$467.17M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.40 | A$2.74B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.86 | A$491.8M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.69 | A$904.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$4.05 | A$192.17M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.91 | A$153.84M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 461 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Mad Paws Holdings (ASX:MPA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Mad Paws Holdings Limited, with a market cap of A$52.81 million, offers pet care services across Australia.

Operations: The company's revenue is derived from two main segments: Marketplace, contributing A$8.34 million, and Ecommerce and Subscription, generating A$19.60 million.

Market Cap: A$52.81M

Mad Paws Holdings Limited, with a market cap of A$52.81 million, is currently unprofitable and trading at 82.3% below its estimated fair value. The company has seen increased volatility in its share price over the past year and maintains more cash than debt, though short-term liabilities exceed short-term assets by A$4 million. Despite revenue growth forecasts of 9.36% annually, profitability is not expected in the next three years. Recently, Rover Group entered into an agreement to acquire Mad Paws for A$65.5 million pending divestment of certain businesses and regulatory approvals.

- Click to explore a detailed breakdown of our findings in Mad Paws Holdings' financial health report.

- Gain insights into Mad Paws Holdings' outlook and expected performance with our report on the company's earnings estimates.

Zeotech (ASX:ZEO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zeotech Limited is involved in the exploration and evaluation of mineral properties in Australia, with a market cap of A$127.86 million.

Operations: The company's revenue is derived from its exploration activities, totaling A$0.98 million.

Market Cap: A$127.86M

Zeotech Limited, with a market cap of A$127.86 million, is pre-revenue, generating less than US$1 million from exploration activities. The company maintains a stable weekly volatility of 11% and has not seen significant shareholder dilution over the past year. Despite being debt-free and having short-term assets exceeding liabilities, Zeotech faces challenges with a cash runway under one year if current free cash flow trends continue. The management team is relatively new with an average tenure of 1.2 years, while the board has more experience averaging five years in tenure. Recent discussions focus on their AusPozz Project Pre-Feasibility Study.

- Get an in-depth perspective on Zeotech's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Zeotech's track record.

Zip Co (ASX:ZIP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zip Co Limited provides digital retail finance and payment solutions to consumers and SMEs in Australia, New Zealand, Canada, and the United States, with a market cap of A$3.81 billion.

Operations: The company's revenue from Australia and New Zealand (ANZ) is A$412.94 million.

Market Cap: A$3.81B

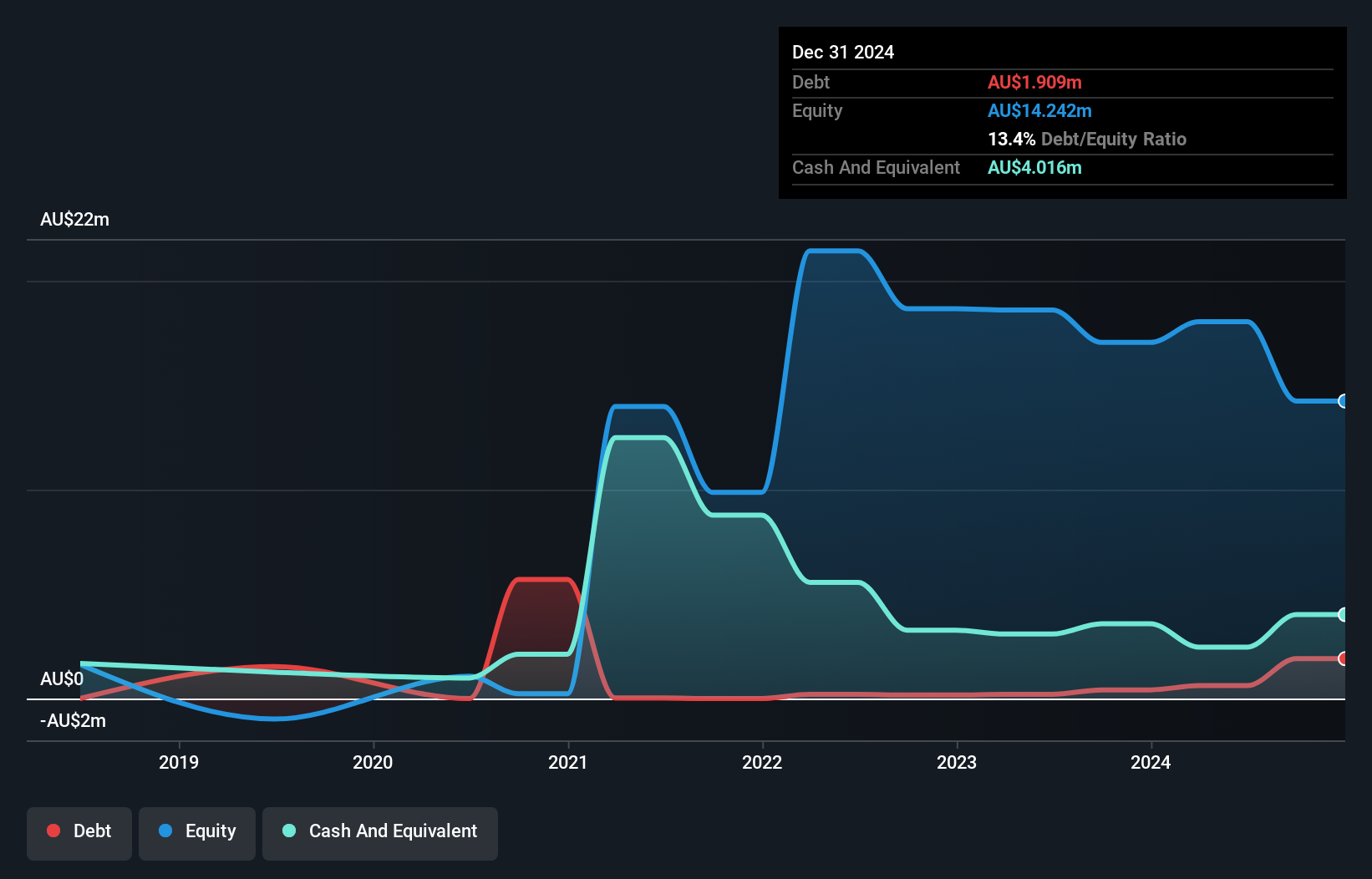

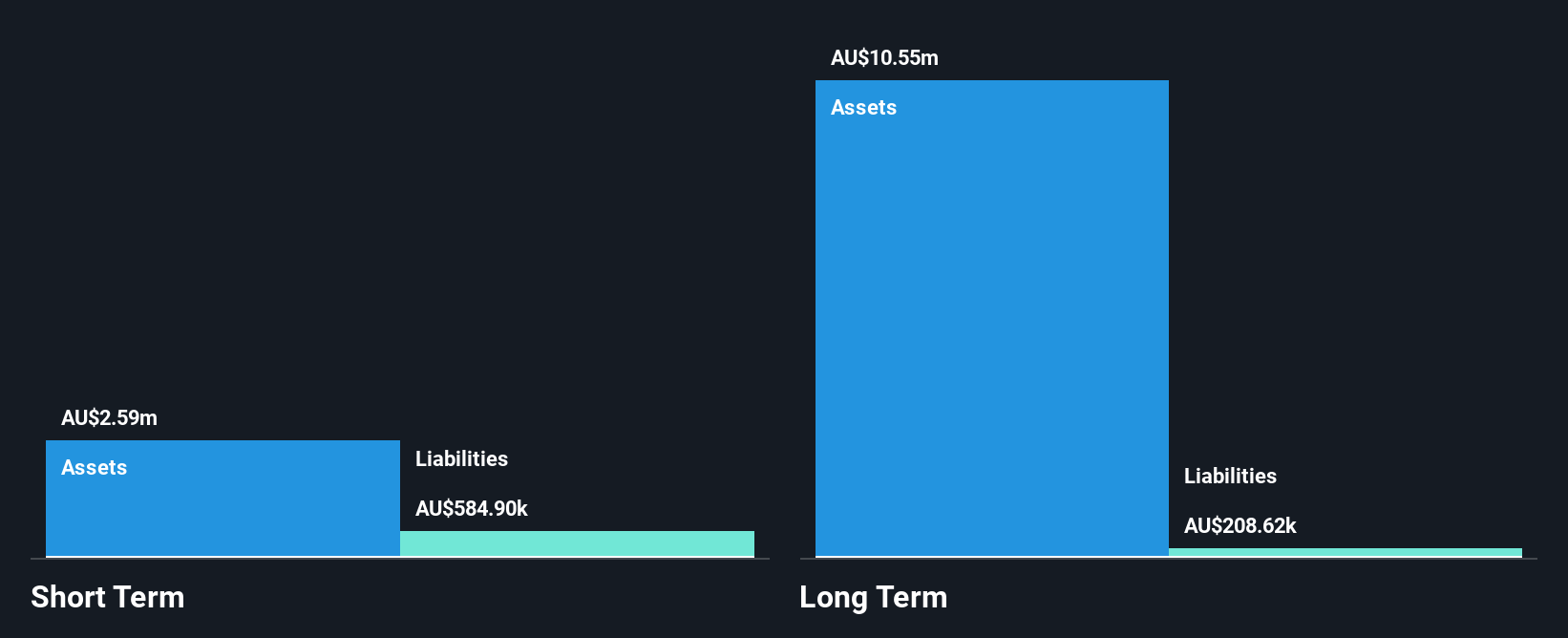

Zip Co Limited, with a market cap of A$3.81 billion, is currently unprofitable but has managed to maintain a positive free cash flow and sufficient cash runway for over three years. Despite a high net debt to equity ratio of 299.8%, the company's short-term assets significantly exceed its liabilities, providing some financial stability. Recent developments include a partnership with CardCash.com to offer Buy Now, Pay Later options, enhancing consumer flexibility amid economic uncertainty. Although Zip's management and board are relatively new, the company has reduced its losses by 9.3% annually over the past five years while maintaining stable weekly volatility at 10%.

- Unlock comprehensive insights into our analysis of Zip Co stock in this financial health report.

- Explore Zip Co's analyst forecasts in our growth report.

Taking Advantage

- Investigate our full lineup of 461 ASX Penny Stocks right here.

- Seeking Other Investments? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zip Co might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ZIP

Zip Co

Engages in the provision of digital retail finance, personal finance, and payments solutions in Australia, New Zealand, and the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives