- Australia

- /

- Metals and Mining

- /

- ASX:WGX

Westgold Resources (ASX:WGX) adds AU$62m to market cap in the past 7 days, though investors from a year ago are still down 45%

It is doubtless a positive to see that the Westgold Resources Limited (ASX:WGX) share price has gained some 36% in the last three months. But that is minimal compensation for the share price under-performance over the last year. The cold reality is that the stock has dropped 45% in one year, under-performing the market.

On a more encouraging note the company has added AU$62m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

View our latest analysis for Westgold Resources

Westgold Resources wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Westgold Resources increased its revenue by 12%. That's not a very high growth rate considering it doesn't make profits. Given this lacklustre revenue growth, the share price drop of 45% seems pretty appropriate. It's important not to lose sight of the fact that profitless companies must grow. But if you buy a loss making company then you could become a loss making investor.

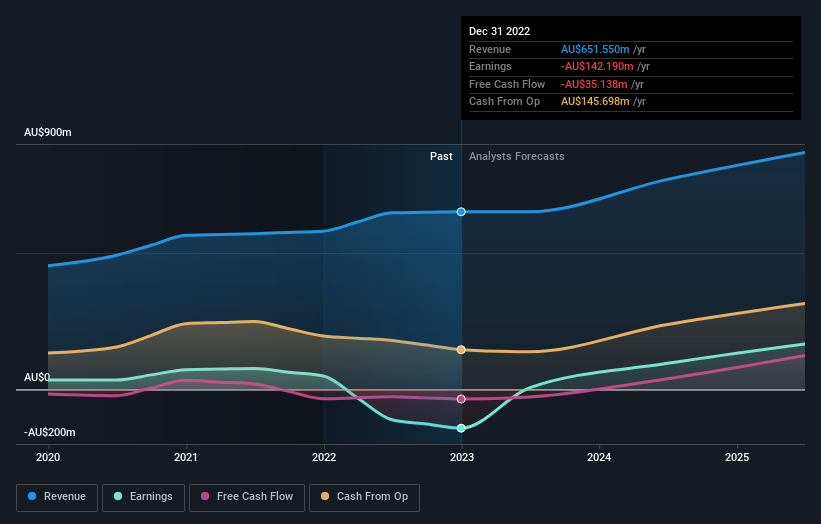

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market gained around 1.8% in the last year, Westgold Resources shareholders lost 45%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Westgold Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:WGX

Westgold Resources

Engages in the exploration, development, and operation of gold mines in Western Australia.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success