- Australia

- /

- Metals and Mining

- /

- ASX:CHN

ASX Penny Stocks To Consider In June 2025

Reviewed by Simply Wall St

As Australian shares face pressure from a hold by the U.S. Federal Reserve and declining iron ore prices, market participants are closely watching economic indicators such as jobs data and housing price forecasts. In these shifting conditions, investors might find value in exploring penny stocks—companies often smaller or newer that can offer unique opportunities despite their outdated moniker. By focusing on those with solid financials, investors may uncover hidden gems that combine affordability with growth potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.05 | A$96.71M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$114.51M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.73 | A$420.92M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.22 | A$2.53B | ✅ 4 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.69 | A$446.85M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.20 | A$753.99M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.07 | A$695.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.705 | A$223.61M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.36 | A$159.43M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.76 | A$141.76M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 1,006 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Chalice Mining (ASX:CHN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chalice Mining Limited is a mineral exploration and evaluation company with a market capitalization of A$601.05 million.

Operations: Chalice Mining Limited does not report specific revenue segments.

Market Cap: A$601.05M

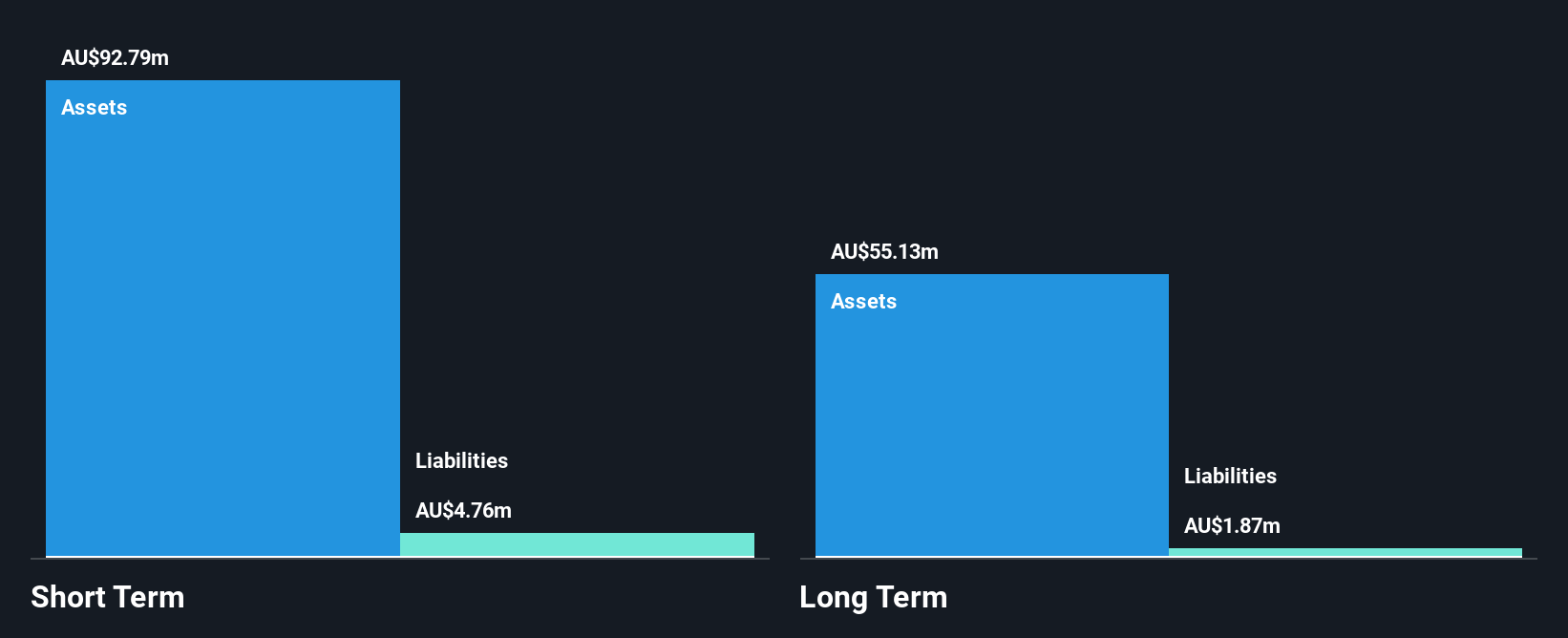

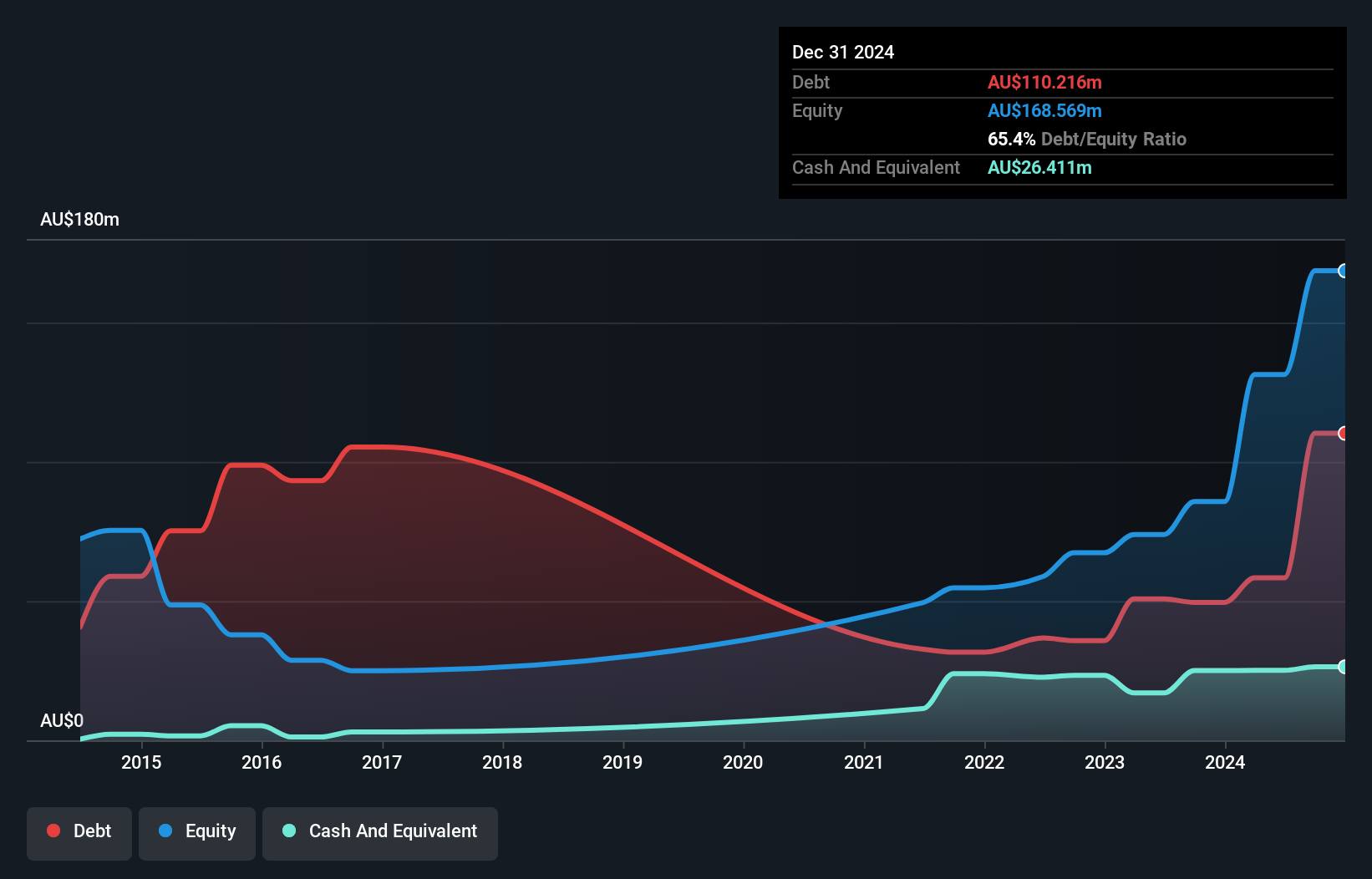

Chalice Mining Limited, with a market cap of A$601.05 million, is pre-revenue and unprofitable, generating less than US$1m in revenue. Despite its lack of profitability, the company has no debt and maintains a robust cash position with short-term assets significantly exceeding liabilities. The management and board are experienced, with average tenures of 2.8 and 4.3 years respectively. While earnings are forecast to decline by an average of 9.6% over the next three years, Chalice Mining's revenue is expected to grow significantly at 46.57% annually, supported by a sufficient cash runway for over three years even if free cash flow decreases historically by 18.9%.

- Click here to discover the nuances of Chalice Mining with our detailed analytical financial health report.

- Understand Chalice Mining's earnings outlook by examining our growth report.

Tasmea (ASX:TEA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tasmea Limited offers shutdown, maintenance, emergency breakdown, and capital upgrade services in Australia with a market cap of A$754 million.

Operations: Tasmea Limited has not reported any specific revenue segments.

Market Cap: A$753.99M

Tasmea Limited, with a market cap of A$754 million, shows promising financial indicators despite its high debt levels. The company's earnings have grown significantly by 75.3% over the past year, outpacing the construction industry average and reflecting accelerated profit growth compared to its five-year average of 39.9%. Its net profit margins have improved from last year, and return on equity is high at 25.2%. While Tasmea's dividend yield of 3.13% isn't well covered by free cash flows, interest payments are well covered by EBIT (10.7x). Recent announcements include a special dividend and positive earnings guidance for FY26 amidst sustained demand and strategic execution.

- Click here and access our complete financial health analysis report to understand the dynamics of Tasmea.

- Assess Tasmea's future earnings estimates with our detailed growth reports.

Wagners Holding (ASX:WGN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wagners Holding Company Limited produces and sells construction materials across Australia, the United States, New Zealand, the United Kingdom, PNG, and Malaysia with a market cap of A$380.87 million.

Operations: Wagners Holding generates revenue through its Construction Materials segment at A$235.11 million, Project Services at A$146.75 million, Earth Friendly Concrete at A$0.11 million, and Composite Fibre Technology at A$63.02 million.

Market Cap: A$380.87M

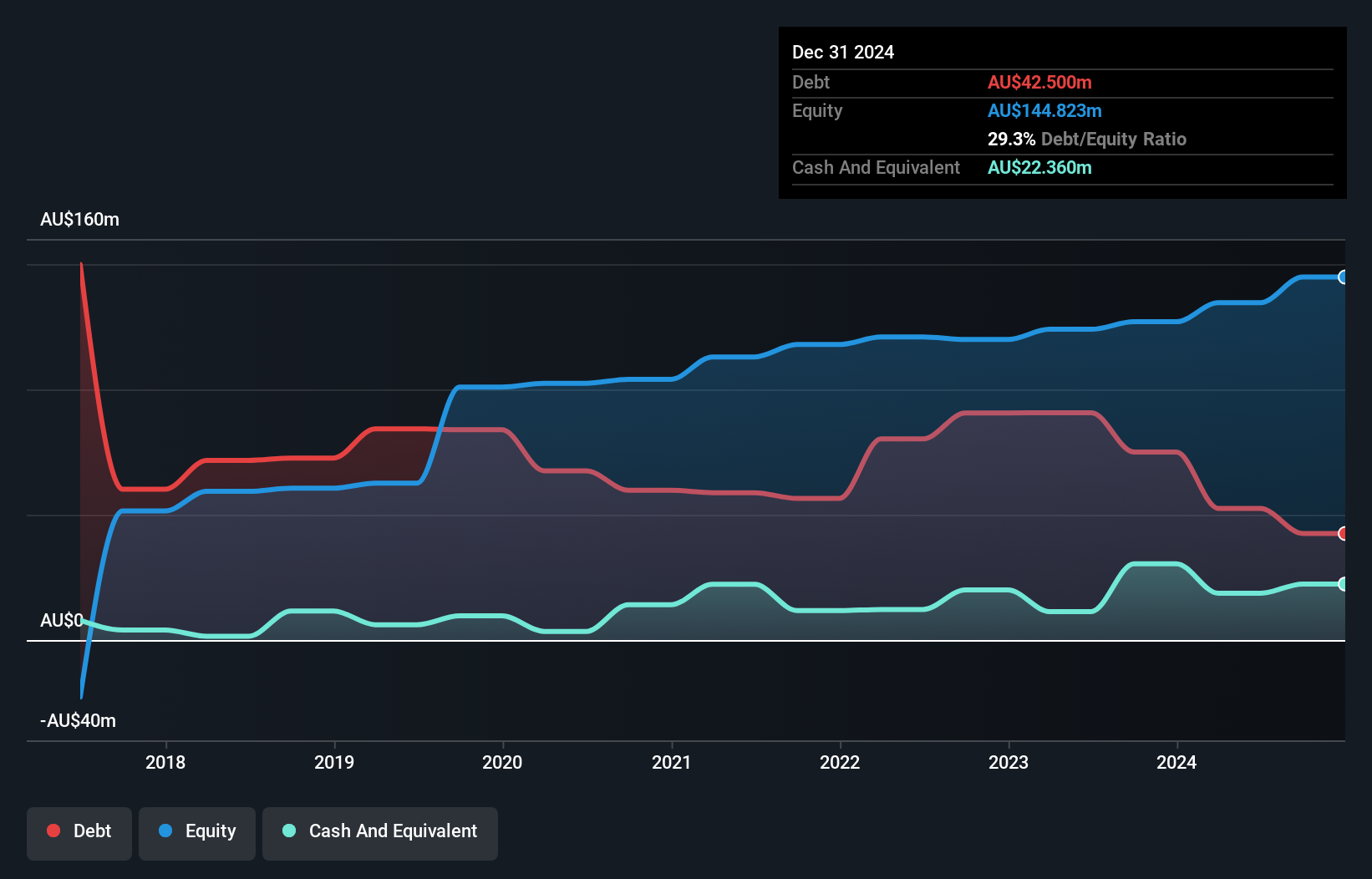

Wagners Holding, with a market cap of A$380.87 million, demonstrates solid financial health and growth potential in the penny stock sector. The company's earnings have surged by 195.5% over the past year, significantly outpacing its five-year average of 24.6%, while also exceeding industry trends. Its net profit margins have improved to 4.5% from last year's 1.3%. Debt management appears robust with a reduced debt-to-equity ratio from 83.1% to 29.3% over five years and satisfactory interest coverage by EBIT (3.3x). However, Wagners' short-term assets do not fully cover long-term liabilities, posing a potential risk factor for investors to consider.

- Get an in-depth perspective on Wagners Holding's performance by reading our balance sheet health report here.

- Explore Wagners Holding's analyst forecasts in our growth report.

Where To Now?

- Jump into our full catalog of 1,006 ASX Penny Stocks here.

- Ready For A Different Approach? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CHN

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives