- Australia

- /

- Metals and Mining

- /

- ASX:WAF

Could Government Partnership Talks Shift West African Resources' (ASX:WAF) Long-Term Strategic Priorities?

Reviewed by Sasha Jovanovic

- Earlier this week, West African Resources announced ongoing discussions with the Burkina Faso government following a request to increase the government’s equity share in the Kiaka gold project, while proposing enhanced national participation as an alternative to direct equity transfer.

- An important insight from these events is that while operational forecasts and site activities at both Kiaka and Sanbrado remain unchanged, the situation highlights broader themes of government involvement and evolving partnership models in West African gold mining ventures.

- We'll explore how the ongoing negotiations about project ownership at Kiaka could influence West African Resources' investment narrative and future outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

West African Resources Investment Narrative Recap

To believe in West African Resources, investors need confidence in its ability to deliver rising gold production and maintain operational stability in Burkina Faso amid shifting regulatory and government partnership dynamics. The recent negotiations about the Kiaka project’s ownership structure have created short-term share price volatility, but importantly, the company’s 2025 production guidance has not changed, meaning the primary short-term catalyst, commissioning and ramp-up at Kiaka, remains on track. For now, the key risk remains government involvement rather than production delays or cost overruns.

The company’s July 2025 guidance reaffirmed targeted production levels at Kiaka (100,000 to 150,000 oz) and Sanbrado (190,000 to 210,000 oz) for the coming year, underscoring that operational initiatives and output ambitions are unchanged despite current government talks. This update is the most relevant to the ongoing dialogue, as it addresses near-term execution of the main catalyst investors are watching, the start-up and scaling of Kiaka.

However, against a backdrop of steady operational goals, investors should stay aware of ongoing political and regulatory negotiations in Burkina Faso, as...

Read the full narrative on West African Resources (it's free!)

West African Resources' narrative projects A$2.2 billion in revenue and A$782.2 million in earnings by 2028. This requires 35.7% yearly revenue growth and a A$454.7 million earnings increase from A$327.5 million today.

Uncover how West African Resources' forecasts yield a A$4.00 fair value, a 48% upside to its current price.

Exploring Other Perspectives

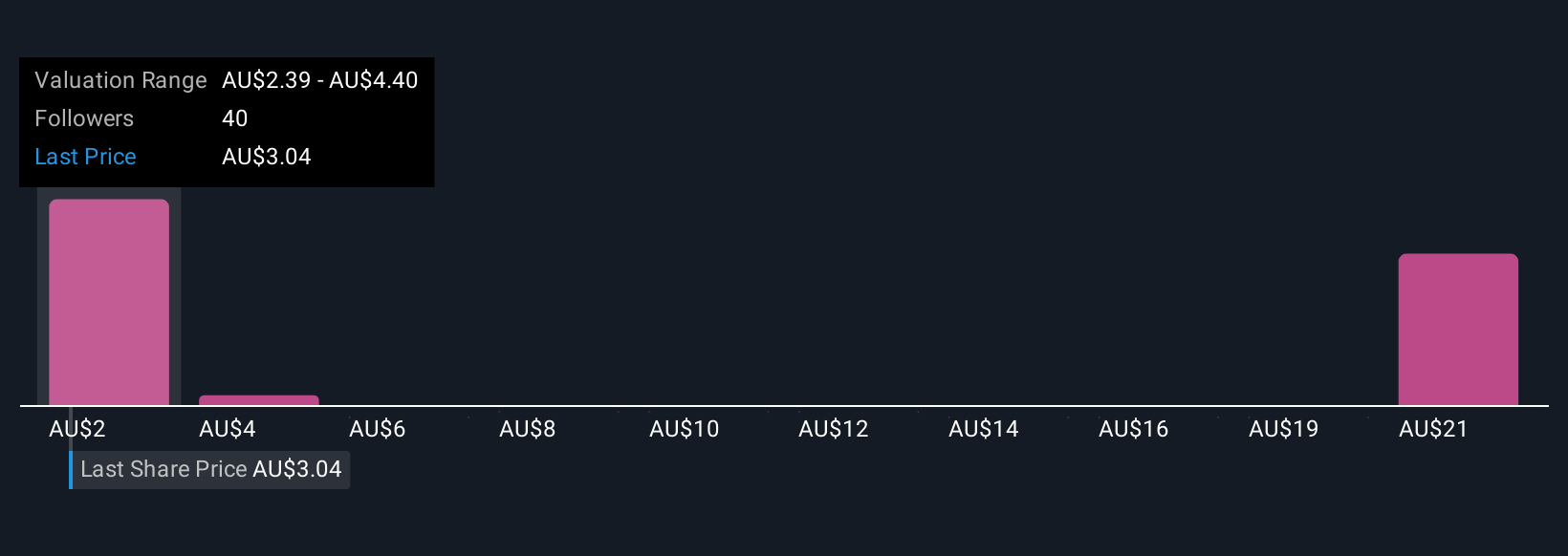

Simply Wall St Community members currently value West African Resources between A$3.40 and A$20.79 per share based on 10 distinct forecasts. Meanwhile, recent government talks highlight that project ownership and partnership terms can influence company outcomes in ways not always captured by growth expectations alone.

Explore 10 other fair value estimates on West African Resources - why the stock might be worth just A$3.40!

Build Your Own West African Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your West African Resources research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free West African Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate West African Resources' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West African Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WAF

West African Resources

Engages in the mining, mineral processing, acquisition, exploration, and project development of gold projects in West Africa.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success