- Australia

- /

- Metals and Mining

- /

- ASX:VUL

A Valuation Check on Vulcan Energy Resources (ASX:VUL) After Major Lionheart Project Contract Signed

Reviewed by Kshitija Bhandaru

Vulcan Energy Resources (ASX:VUL) just took a major step forward by signing a sizeable Engineering, Procurement and Construction contract for its Lionheart Project near Landau, Germany. This agreement helps move their integrated geothermal and lithium facility closer to reality.

See our latest analysis for Vulcan Energy Resources.

Fresh off this major contract signing, Vulcan Energy Resources has been making steady progress on multiple fronts, including new technology partnerships and key land acquisitions to advance its Lionheart Project. While these developments highlight momentum for the company, it is worth noting that the stock’s 1-year total shareholder return sits at just 0.47%, showing only modest gains. Over the longer term, performance has been mixed. However, recent steps could signal renewed interest from investors.

If this kind of project milestone sparked your interest, it could be the right moment to broaden your opportunities and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets despite strong project momentum, the real question for investors is whether Vulcan Energy Resources is now undervalued or if the market is already accounting for the growth ahead.

Price-to-Sales of 38.6x: Is it justified?

Vulcan Energy Resources trades at a lofty price-to-sales (P/S) ratio of 38.6x, which is much higher than its peer average. With a last close of A$6.16, investors are paying a premium for the company’s current sales compared to the sector.

The price-to-sales ratio measures how much investors are willing to pay per dollar of sales. For a company at Vulcan’s stage, with high growth forecasts but no current profits, this metric becomes especially relevant in assessing valuation.

The implication is clear. The market is expecting substantial future growth from Vulcan. However, with its price-to-sales multiple far greater than peers, there may be debate over whether optimism is already priced in. When compared to the Australian Metals and Mining industry average of 116.4x, Vulcan appears attractively valued within its sector. Notably, the fair price-to-sales ratio is estimated at 83.9x, which is significantly higher than the current level and could hint at further upside if the company delivers on its growth story.

Explore the SWS fair ratio for Vulcan Energy Resources

Result: Price-to-Sales of 38.6x (ABOUT RIGHT)

However, ongoing losses and reliance on future growth projections still pose risks. These factors could challenge the optimistic outlook for Vulcan Energy Resources.

Find out about the key risks to this Vulcan Energy Resources narrative.

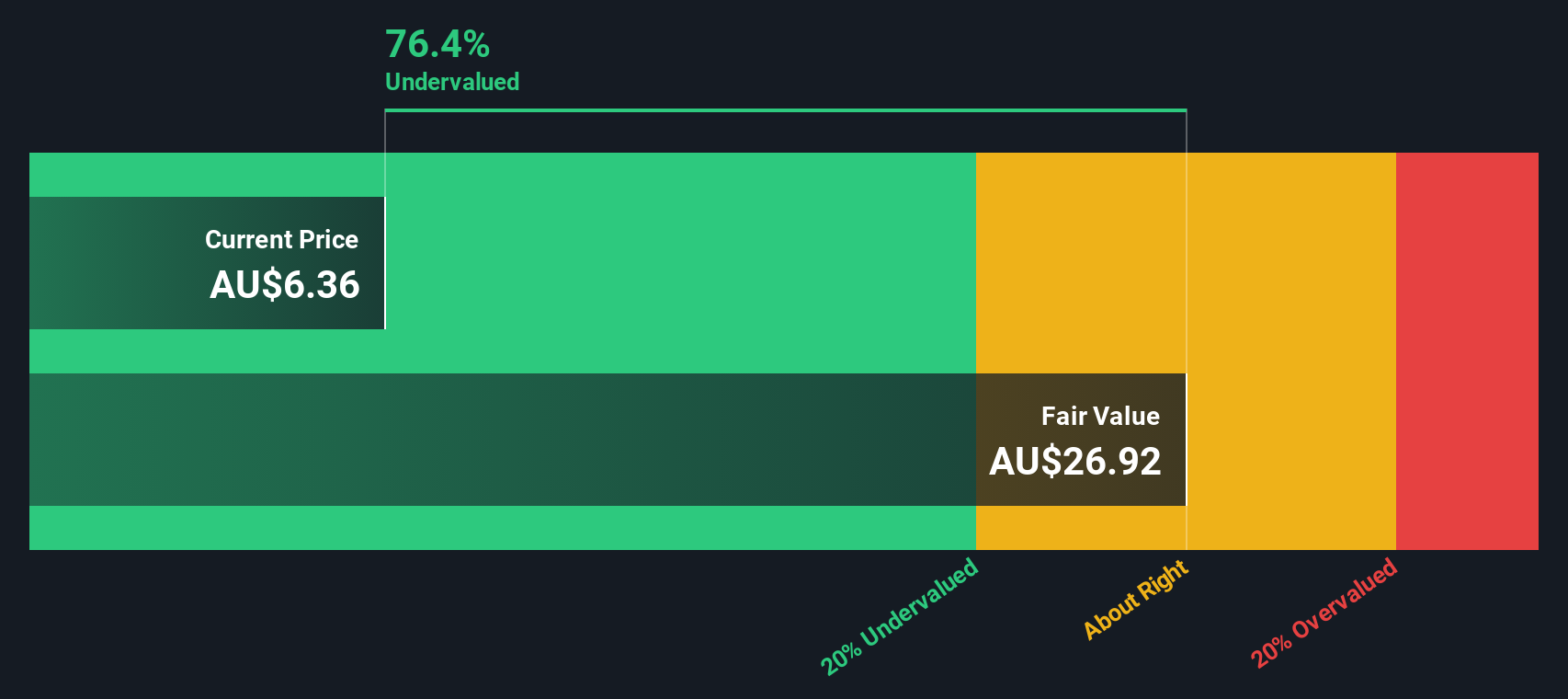

Another View: SWS DCF Model Shows Even Deeper Discount

Looking at the SWS DCF model provides a strikingly different perspective. Based on the DCF approach, Vulcan Energy Resources shares trade at a steep discount, about 77% below its estimated fair value of A$27.30. This suggests the market may be significantly underestimating long-term potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vulcan Energy Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vulcan Energy Resources Narrative

If you have a different viewpoint or want to dig into the numbers yourself, you can create a personalized story in just a few minutes. So why not Do it your way

A great starting point for your Vulcan Energy Resources research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

There is a world of opportunity beyond Vulcan Energy Resources. Smart investors like you always have their eye on the next big thing. Don’t let standout stock ideas pass you by when it could make all the difference to your portfolio.

- Uncover these 896 undervalued stocks based on cash flows and spot stocks trading below their true worth. This gives you a chance to seize value others might overlook.

- Boost your income by checking out these 19 dividend stocks with yields > 3%, which offers reliable yields above 3%. See which companies stand out for their payouts.

- Capitalize on breakthroughs in AI innovation by tracking these 24 AI penny stocks that could define the next wave of technology growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VUL

Vulcan Energy Resources

Engages in the geothermal energy, and lithium exploration and production activities in Europe, Germany, and Australia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.