- Australia

- /

- Metals and Mining

- /

- ASX:CCM

ASX Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 closing up 0.36% at 8,408 points, buoyed by a favorable tariff outcome under the new Trump administration and a strong performance in sectors like Discretionary and Health Care. Amidst these shifting dynamics, investors often look towards penny stocks—smaller or newer companies that offer growth potential at lower price points—as an intriguing investment avenue. While the term 'penny stocks' might seem outdated, their ability to combine affordability with growth potential remains relevant today; this article will explore several promising options that stand out for their financial strength in this evolving market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.585 | A$68.57M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.92 | A$242.1M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.55 | A$108.01M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.945 | A$316.68M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.12 | A$328.36M | ★★★★☆☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$240.95M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.985 | A$110.44M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.33 | A$65.63M | ★★★★★☆ |

Click here to see the full list of 1,026 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Cadoux (ASX:CCM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cadoux Limited focuses on the exploration, evaluation, and development of mineral properties in Australia and Southeast Asia, with a market cap of A$20.40 million.

Operations: No revenue segments have been reported.

Market Cap: A$20.4M

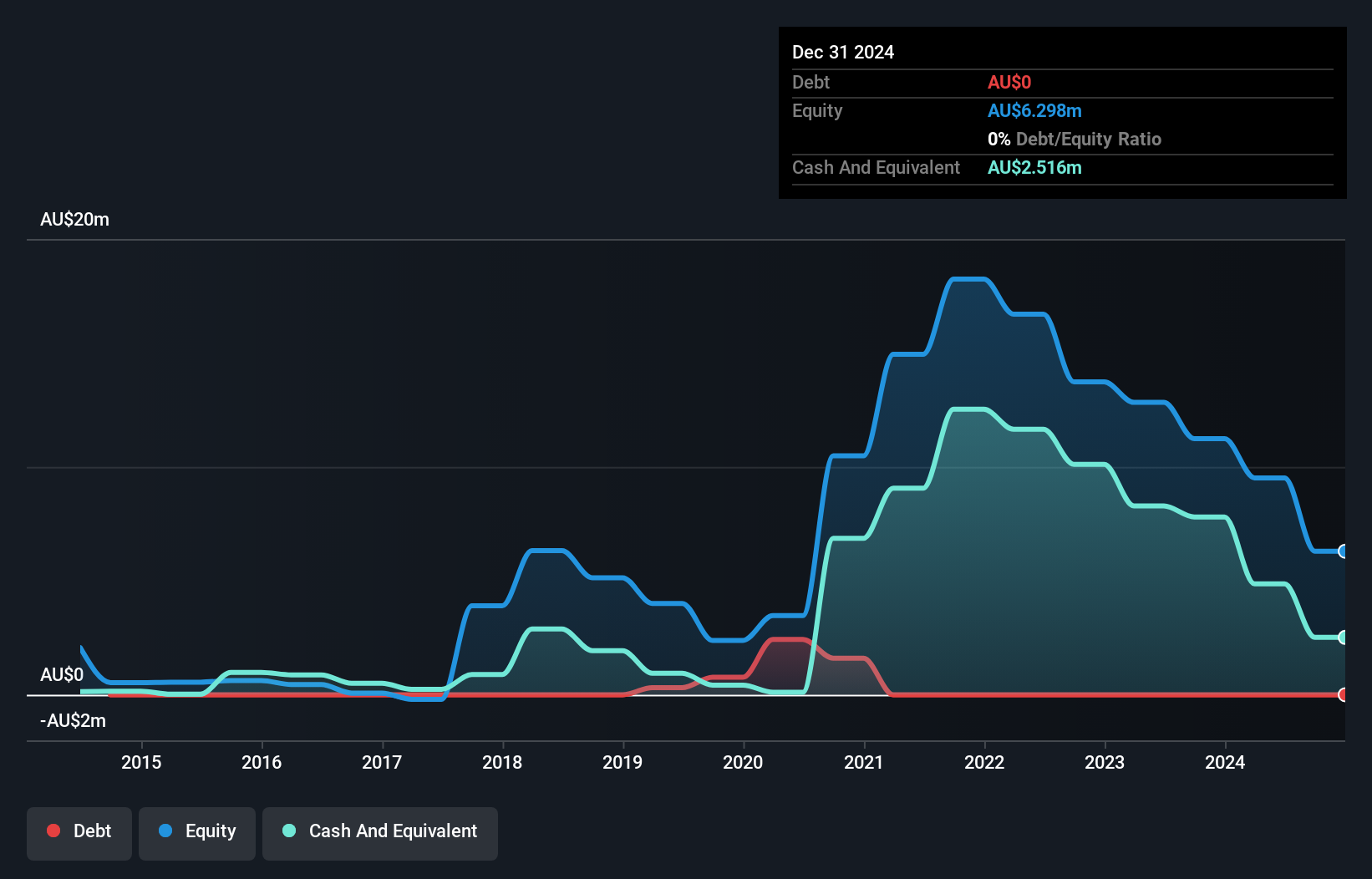

Cadoux Limited, with a market cap of A$20.40 million, is pre-revenue and focuses on mineral exploration in Australia and Southeast Asia. The company is debt-free, has no long-term liabilities, and its seasoned management team boasts an average tenure of 13.9 years. Despite being unprofitable with increasing losses over the past five years at a rate of 6.6% annually, earnings are forecasted to grow significantly by 110.8% per year. Cadoux's cash runway is less than one year if free cash flow continues to decline but extends beyond a year based on current levels. Its share price remains highly volatile despite stable weekly volatility over the past year compared to other Australian stocks.

- Navigate through the intricacies of Cadoux with our comprehensive balance sheet health report here.

- Understand Cadoux's earnings outlook by examining our growth report.

Pengana Capital Group (ASX:PCG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pengana Capital Group (ASX:PCG) is a publicly owned investment manager with a market capitalization of A$80.96 million.

Operations: The company generates revenue of A$40.48 million from the development, offering, and management of investment funds.

Market Cap: A$80.96M

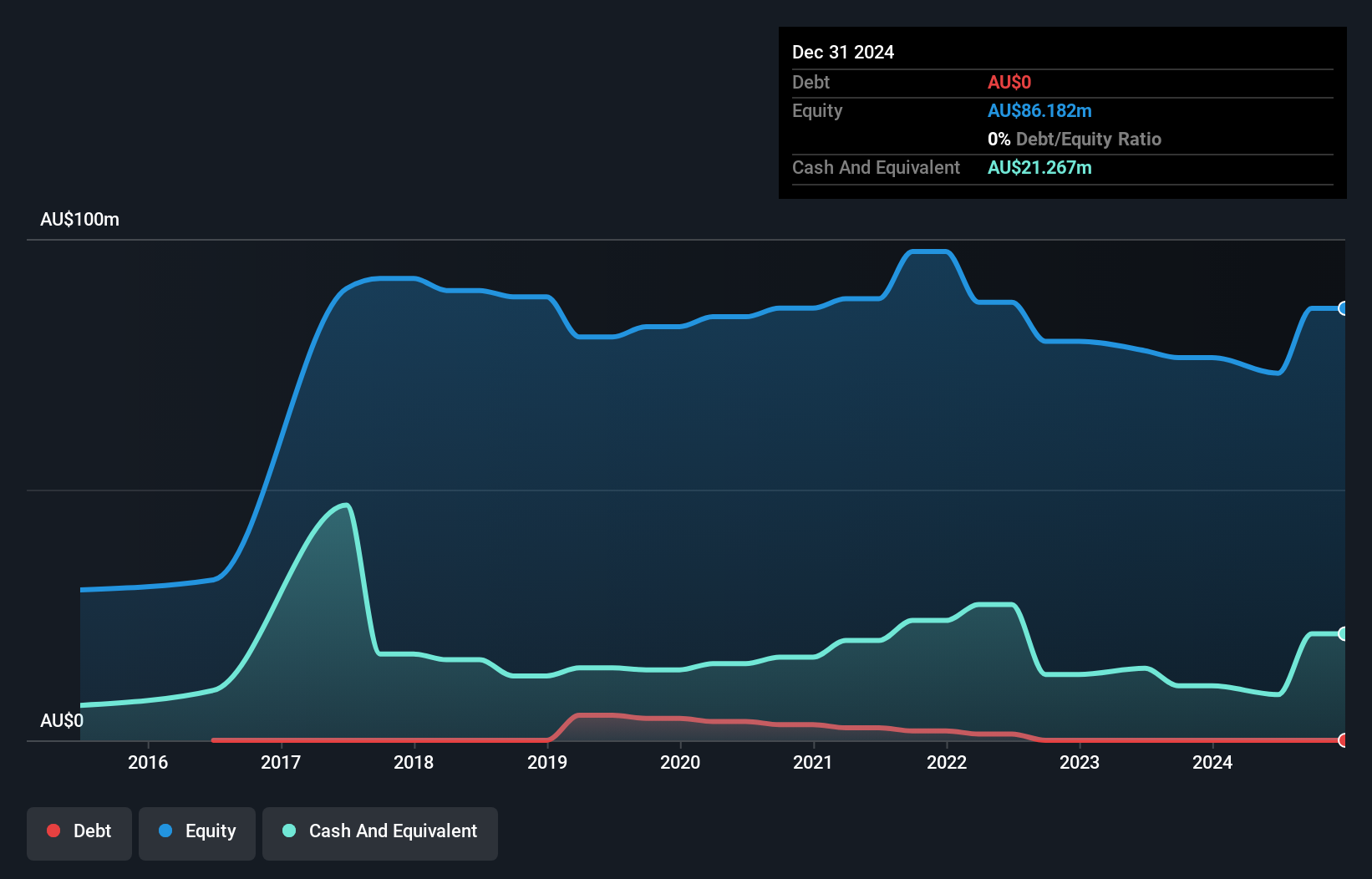

Pengana Capital Group, with a market cap of A$80.96 million, remains unprofitable but has effectively reduced losses by 22.9% annually over the past five years. The company is debt-free, and its short-term assets of A$18.3 million surpass both short-term and long-term liabilities, indicating solid financial stability. Despite not covering dividends well through earnings or cash flow, Pengana's shares trade below estimated fair value by 30.3%. The management and board are experienced with average tenures exceeding seven years each. Earnings growth is projected at a robust 78.91% annually despite current profitability challenges.

- Dive into the specifics of Pengana Capital Group here with our thorough balance sheet health report.

- Examine Pengana Capital Group's earnings growth report to understand how analysts expect it to perform.

Volt Resources (ASX:VRC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Volt Resources Limited is a critical minerals and battery materials company with a market capitalization of A$14.56 million.

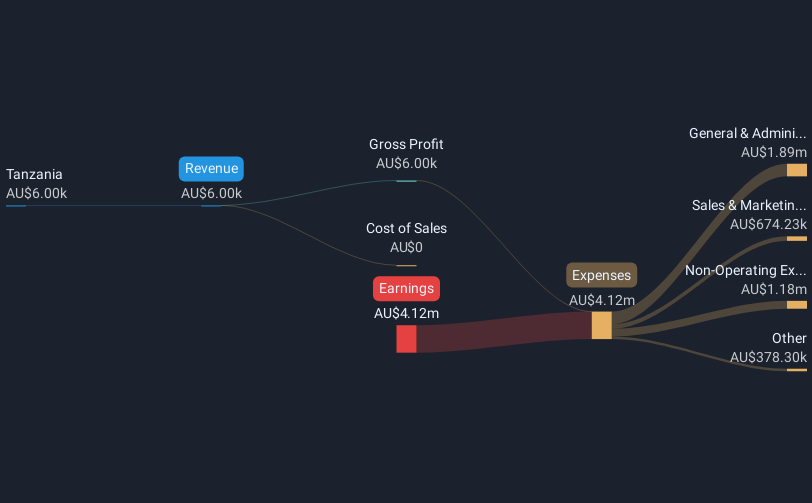

Operations: The company's revenue is primarily derived from its operations in Tanzania, amounting to A$0.01 million.

Market Cap: A$14.56M

Volt Resources Limited, with a market cap of A$14.56 million, is pre-revenue and currently unprofitable. Recent completion of a follow-on equity offering raised A$1.226 million, which may provide temporary financial relief given its short-term assets (A$133K) do not cover liabilities (A$6.5M). The company has reduced its debt-to-equity ratio significantly over five years to 0.9%, yet remains highly volatile with a share price fluctuating considerably over the past three months. Management's average tenure is two years, indicating some experience, but the board's shorter tenure suggests relative inexperience at the governance level.

- Click here and access our complete financial health analysis report to understand the dynamics of Volt Resources.

- Understand Volt Resources' track record by examining our performance history report.

Taking Advantage

- Investigate our full lineup of 1,026 ASX Penny Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CCM

Cadoux

Engages in the exploration, evaluation, and development of mineral properties in Australia and the Southeast Asia.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion