- Australia

- /

- Metals and Mining

- /

- ASX:CRI

Is Venture Minerals (ASX:VMS) In A Good Position To Deliver On Growth Plans?

We can readily understand why investors are attracted to unprofitable companies. Indeed, Venture Minerals (ASX:VMS) stock is up 250% in the last year, providing strong gains for shareholders. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So notwithstanding the buoyant share price, we think it's well worth asking whether Venture Minerals' cash burn is too risky. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

View our latest analysis for Venture Minerals

How Long Is Venture Minerals' Cash Runway?

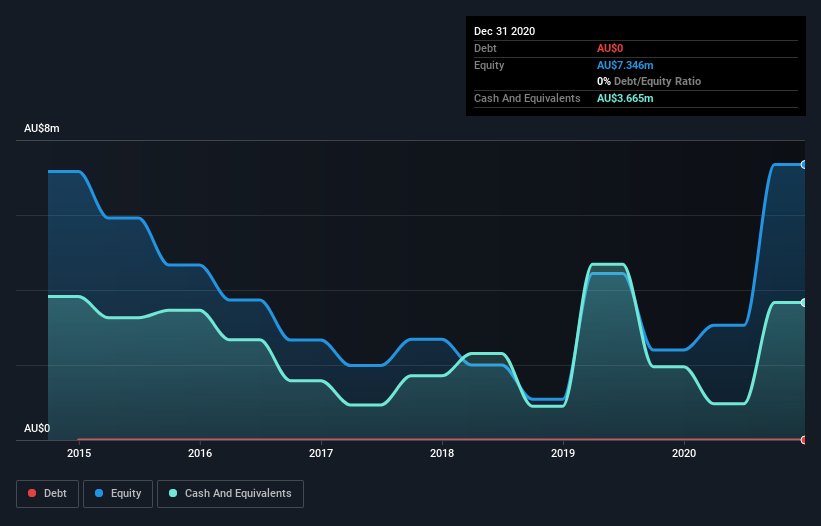

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at December 2020, Venture Minerals had cash of AU$3.7m and no debt. Looking at the last year, the company burnt through AU$4.3m. That means it had a cash runway of around 10 months as of December 2020. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. You can see how its cash balance has changed over time in the image below.

How Is Venture Minerals' Cash Burn Changing Over Time?

Although Venture Minerals had revenue of AU$60k in the last twelve months, its operating revenue was only AU$10k in that time period. We don't think that's enough operating revenue for us to understand too much from revenue growth rates, since the company is growing off a low base. So we'll focus on the cash burn, today. Over the last year its cash burn actually increased by 7.6%, which suggests that management are increasing investment in future growth, but not too quickly. That's not necessarily a bad thing, but investors should be mindful of the fact that will shorten the cash runway. Admittedly, we're a bit cautious of Venture Minerals due to its lack of significant operating revenues. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Hard Would It Be For Venture Minerals To Raise More Cash For Growth?

Since its cash burn is increasing (albeit only slightly), Venture Minerals shareholders should still be mindful of the possibility it will require more cash in the future. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Venture Minerals' cash burn of AU$4.3m is about 3.1% of its AU$140m market capitalisation. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

Is Venture Minerals' Cash Burn A Worry?

On this analysis of Venture Minerals' cash burn, we think its cash burn relative to its market cap was reassuring, while its cash runway has us a bit worried. We don't think its cash burn is particularly problematic, but after considering the range of factors in this article, we do think shareholders should be monitoring how it changes over time. On another note, Venture Minerals has 4 warning signs (and 2 which are a bit unpleasant) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you’re looking to trade Venture Minerals, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:CRI

Critica

Engages in the exploration and development of mineral resources in Australia.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.