- Australia

- /

- Metals and Mining

- /

- ASX:EMR

ASX Growth Stocks With High Insider Ownership To Watch

Reviewed by Simply Wall St

The Australian market is navigating a complex landscape marked by high local inflation, an RBA pause, and geopolitical tensions, all contributing to volatility in sectors such as utilities and discretionary spending. In this environment of uncertainty, growth companies with high insider ownership can offer a unique perspective on potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 12.1% | 91.2% |

| Titomic (ASX:TTT) | 11.3% | 74.9% |

| Pointerra (ASX:3DP) | 23.4% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Lunnon Metals (ASX:LM8) | 10.3% | 31.2% |

| Gratifii (ASX:GTI) | 17.8% | 137.7% |

| Findi (ASX:FND) | 33.6% | 91.2% |

| Echo IQ (ASX:EIQ) | 17.9% | 49.9% |

| Adveritas (ASX:AV1) | 18.8% | 96.8% |

| Acrux (ASX:ACR) | 15.1% | 121.1% |

Let's dive into some prime choices out of the screener.

Emerald Resources (ASX:EMR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$3.36 billion.

Operations: The company generates revenue primarily from its mine operations, amounting to A$430.41 million.

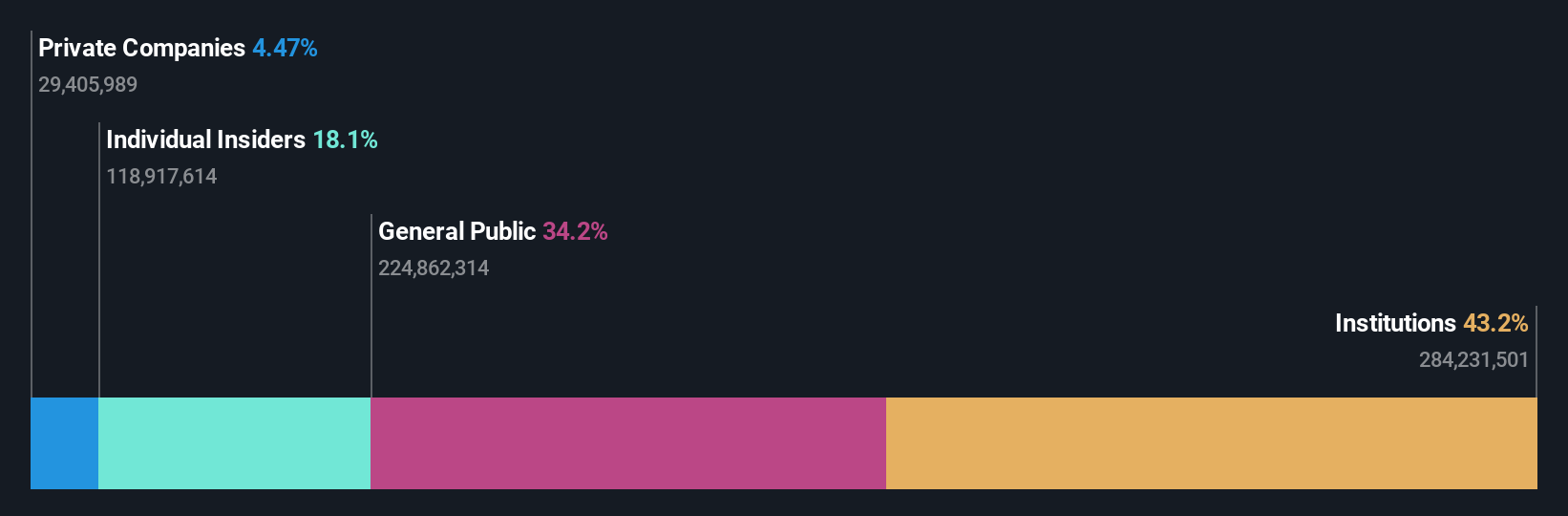

Insider Ownership: 18.1%

Return On Equity Forecast: 40% (2028 estimate)

Emerald Resources demonstrates strong growth potential with forecasted revenue and earnings growth significantly outpacing the Australian market. Recent full-year results show sales increased to A$437.79 million, while net income rose to A$87.61 million, reflecting solid operational performance. Despite no substantial insider trading activity recently, high insider ownership aligns management interests with shareholders. Trading well below estimated fair value suggests potential undervaluation, offering an attractive proposition for investors focused on growth companies with high insider ownership in Australia.

- Click to explore a detailed breakdown of our findings in Emerald Resources' earnings growth report.

- Our comprehensive valuation report raises the possibility that Emerald Resources is priced lower than what may be justified by its financials.

Titomic (ASX:TTT)

Simply Wall St Growth Rating: ★★★★★★

Overview: Titomic Limited provides manufacturing and technology solutions for high-performance metal additive manufacturing across Australia, the United States, and Europe, with a market cap of A$480.61 million.

Operations: The company's revenue primarily comes from the development and sale of additive manufacturing technology, generating A$9.43 million.

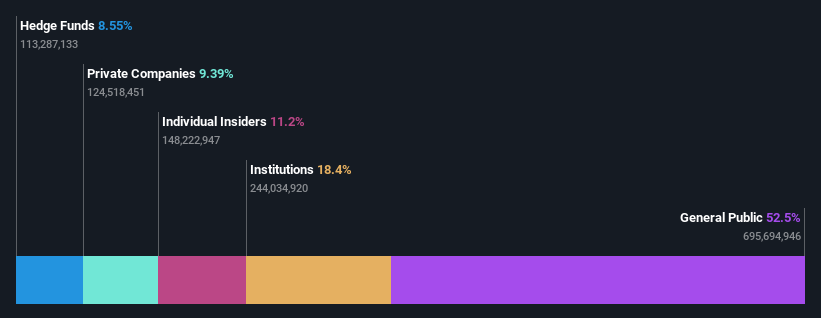

Insider Ownership: 11.3%

Return On Equity Forecast: 32% (2028 estimate)

Titomic is expanding its global footprint with new facilities in Europe and the UK, enhancing its capabilities in advanced manufacturing. Despite a net loss of A$19.89 million for the fiscal year ending June 2025, revenue increased to A$9.43 million from A$7.7 million previously. The company forecasts strong revenue growth at 46.1% annually and expects profitability within three years, driven by strategic leadership appointments and investments in defense and aerospace sectors.

- Dive into the specifics of Titomic here with our thorough growth forecast report.

- Our valuation report unveils the possibility Titomic's shares may be trading at a premium.

Vulcan Steel (ASX:VSL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vulcan Steel Limited, with a market cap of A$1.05 billion, operates in New Zealand and Australia focusing on the sale and distribution of steel and metal products.

Operations: The company's revenue segments consist of NZ$409.74 million from steel and NZ$538.41 million from metals.

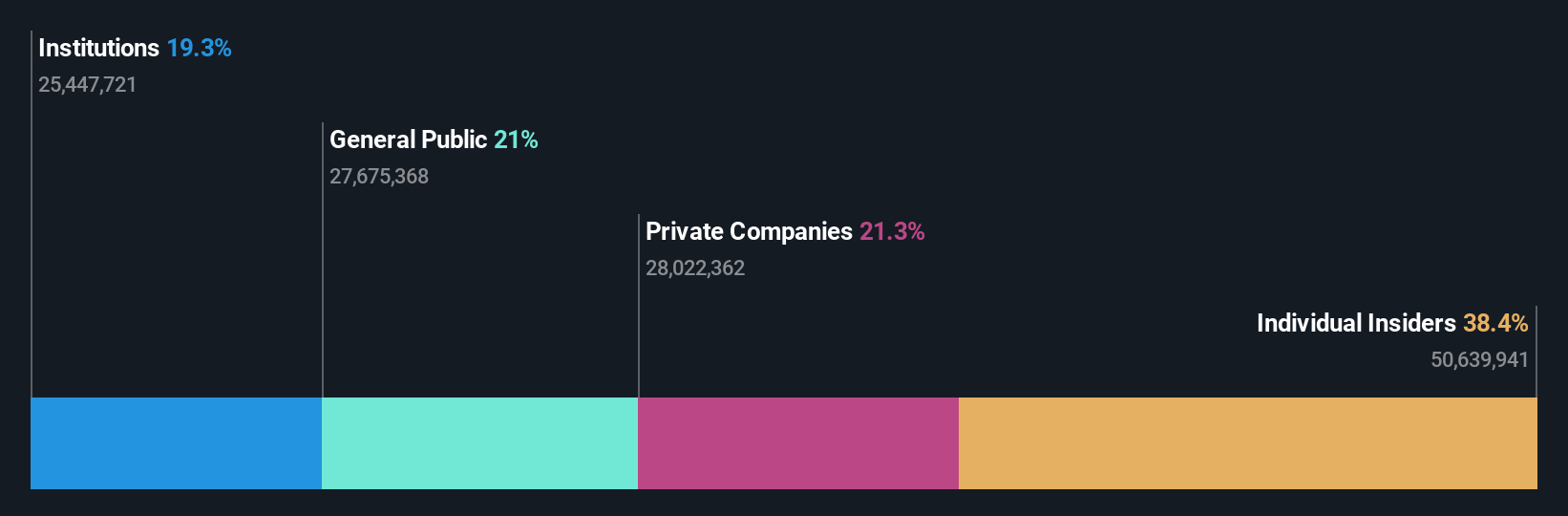

Insider Ownership: 33.5%

Return On Equity Forecast: 35% (2028 estimate)

Vulcan Steel has seen substantial insider buying over the past three months, indicating confidence in its growth potential. Despite a drop from the S&P Global BMI Index and declining sales and net income for FY2025, its earnings are forecast to grow significantly at 32.6% annually, outpacing the Australian market. The company recently completed a follow-on equity offering of A$87.13 million, potentially strengthening its financial position despite current challenges with interest coverage and profit margins.

- Get an in-depth perspective on Vulcan Steel's performance by reading our analyst estimates report here.

- Our valuation report here indicates Vulcan Steel may be overvalued.

Make It Happen

- Investigate our full lineup of 110 Fast Growing ASX Companies With High Insider Ownership right here.

- Interested In Other Possibilities? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Emerald Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EMR

Emerald Resources

Engages in the exploration and development of mineral reserves in Cambodia and Australia.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives