- Australia

- /

- Metals and Mining

- /

- ASX:SVM

Discover 3 ASX Penny Stocks With Market Caps Over A$100M

Reviewed by Simply Wall St

As the Australian stock market wraps up a year marked by an 8.8% rise, traders are taking a cautious approach on the final trading day of 2024, with ASX 200 futures indicating a slight dip. Despite this end-of-year volatility, investors continue to explore opportunities beyond established names, turning their attention to penny stocks—companies that may be smaller or newer but still hold significant potential. While the term "penny stocks" might seem outdated, these investments can offer affordability and growth potential when backed by strong financials; in this article, we'll explore three such stocks that stand out for their balance sheet resilience and promise in today's market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.86 | A$237.13M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.955 | A$318.31M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.515 | A$319.37M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.745 | A$855.19M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$217.98M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.8975 | A$106.44M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,053 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Invictus Energy (ASX:IVZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Invictus Energy Limited is an independent upstream oil and gas company focused on the exploration and appraisal of oil and gas properties in northern Zimbabwe, Africa, with a market cap of A$113.73 million.

Operations: Invictus Energy Limited does not currently report any revenue segments.

Market Cap: A$113.73M

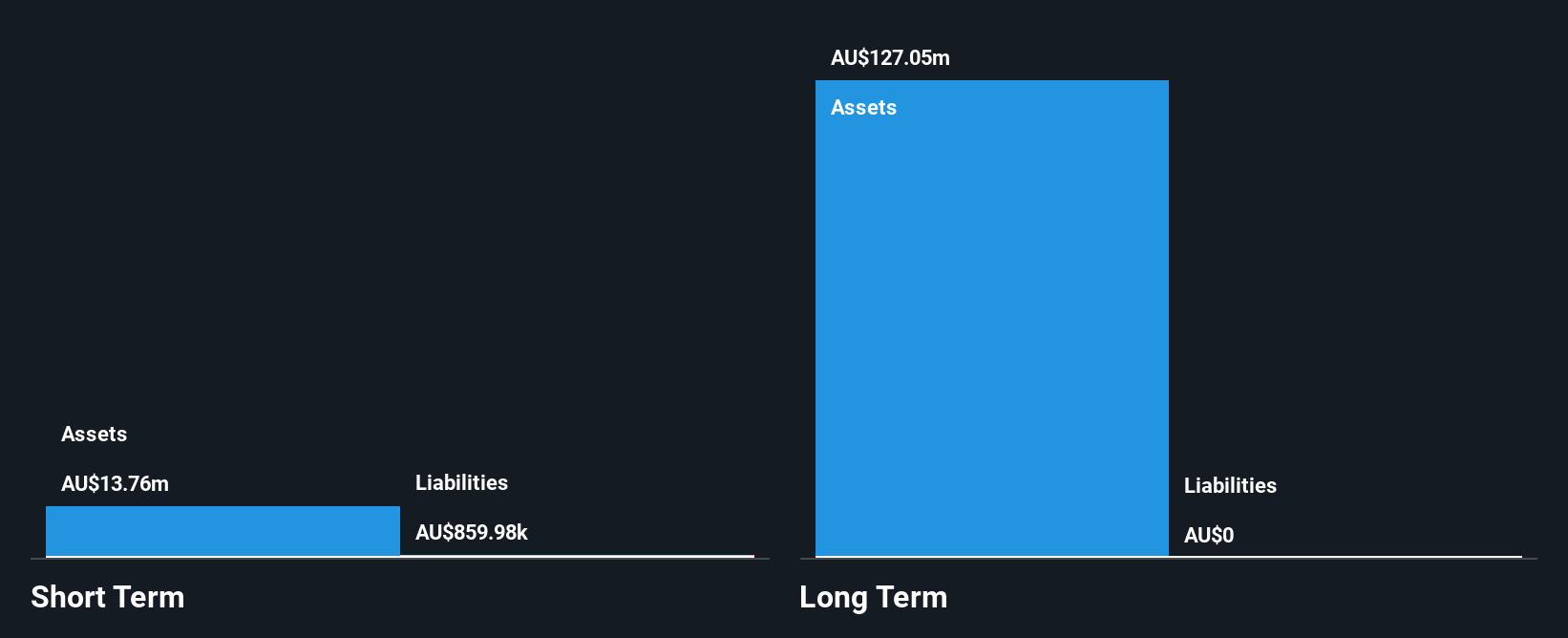

Invictus Energy Limited, with a market cap of A$113.73 million, is a pre-revenue company focused on oil and gas exploration in Zimbabwe. Despite having no significant revenue streams, its seasoned management team averages 6.5 years of tenure. The company has faced increasing losses over the past five years at a rate of 34% annually and reported a net loss of A$5 million for the year ending June 2024. While Invictus is debt-free and short-term assets exceed liabilities, shareholders experienced dilution with shares outstanding growing by 7.8%. Recent capital raising efforts have slightly extended its cash runway beyond one month.

- Click here and access our complete financial health analysis report to understand the dynamics of Invictus Energy.

- Review our historical performance report to gain insights into Invictus Energy's track record.

Mayne Pharma Group (ASX:MYX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mayne Pharma Group Limited is a specialty pharmaceutical company that manufactures and sells branded and generic products across Australia, New Zealand, the United States, Canada, Europe, Asia, and other international markets with a market cap of A$389.51 million.

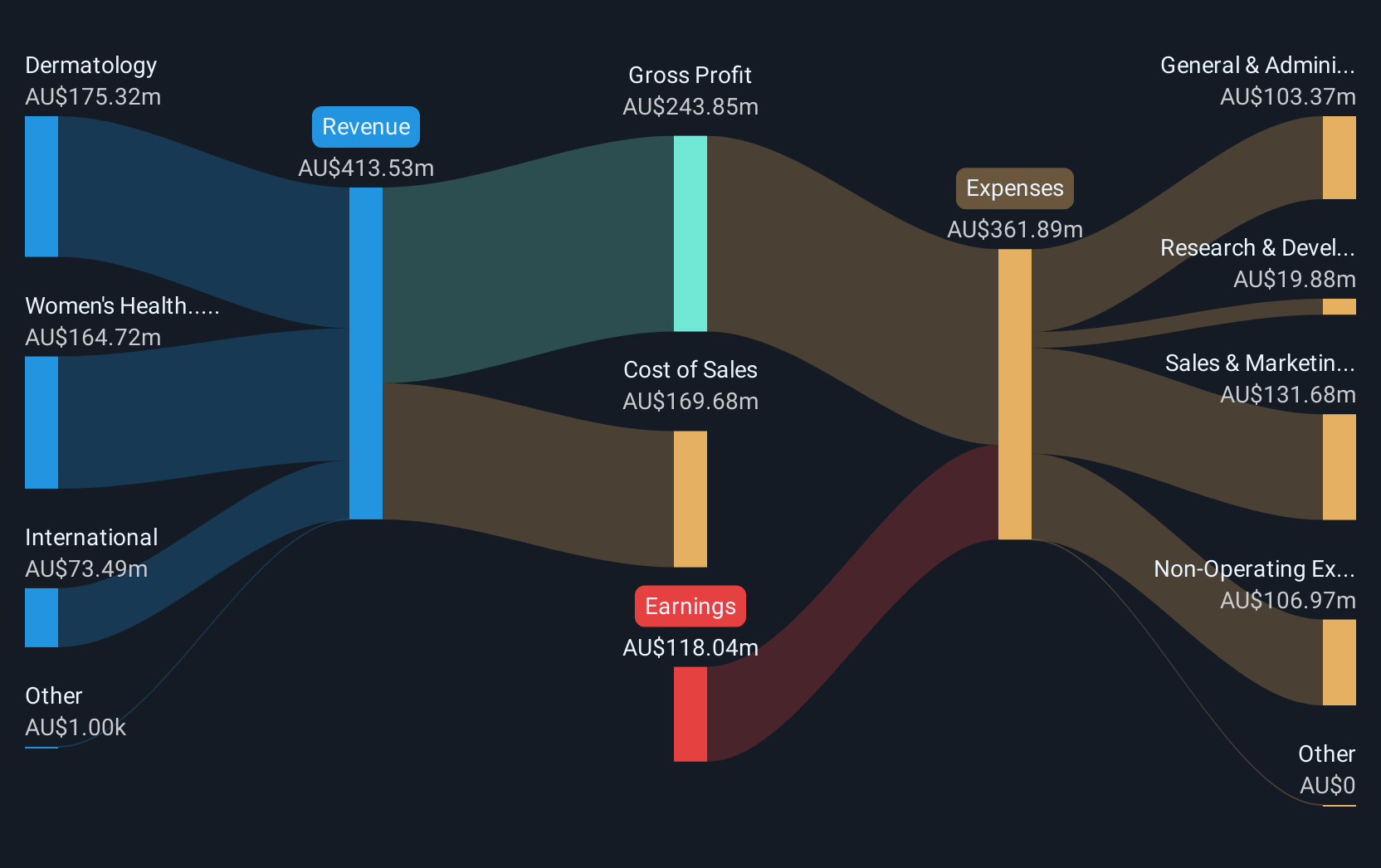

Operations: The company's revenue is primarily derived from its Dermatology segment at A$174.86 million, Women's Health at A$142.83 million, and International operations contributing A$70.71 million.

Market Cap: A$389.51M

Mayne Pharma Group, with a market cap of A$389.51 million, is currently unprofitable but shows potential in its financial structure. The company’s short-term assets of A$460.6 million exceed both its short-term and long-term liabilities, indicating robust liquidity management. Although it has more cash than total debt and a reduced debt-to-equity ratio from 36.5% to 7% over five years, the company faces challenges with increasing losses at an annual rate of 0.9%. Despite volatility stability and trading at good value compared to peers, its board lacks experience with an average tenure of 2.8 years.

- Take a closer look at Mayne Pharma Group's potential here in our financial health report.

- Gain insights into Mayne Pharma Group's outlook and expected performance with our report on the company's earnings estimates.

Sovereign Metals (ASX:SVM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sovereign Metals Limited, with a market cap of A$446.91 million, is involved in the exploration and development of mineral resource projects in Malawi through its subsidiaries.

Operations: Sovereign Metals Limited does not have any reported revenue segments.

Market Cap: A$446.91M

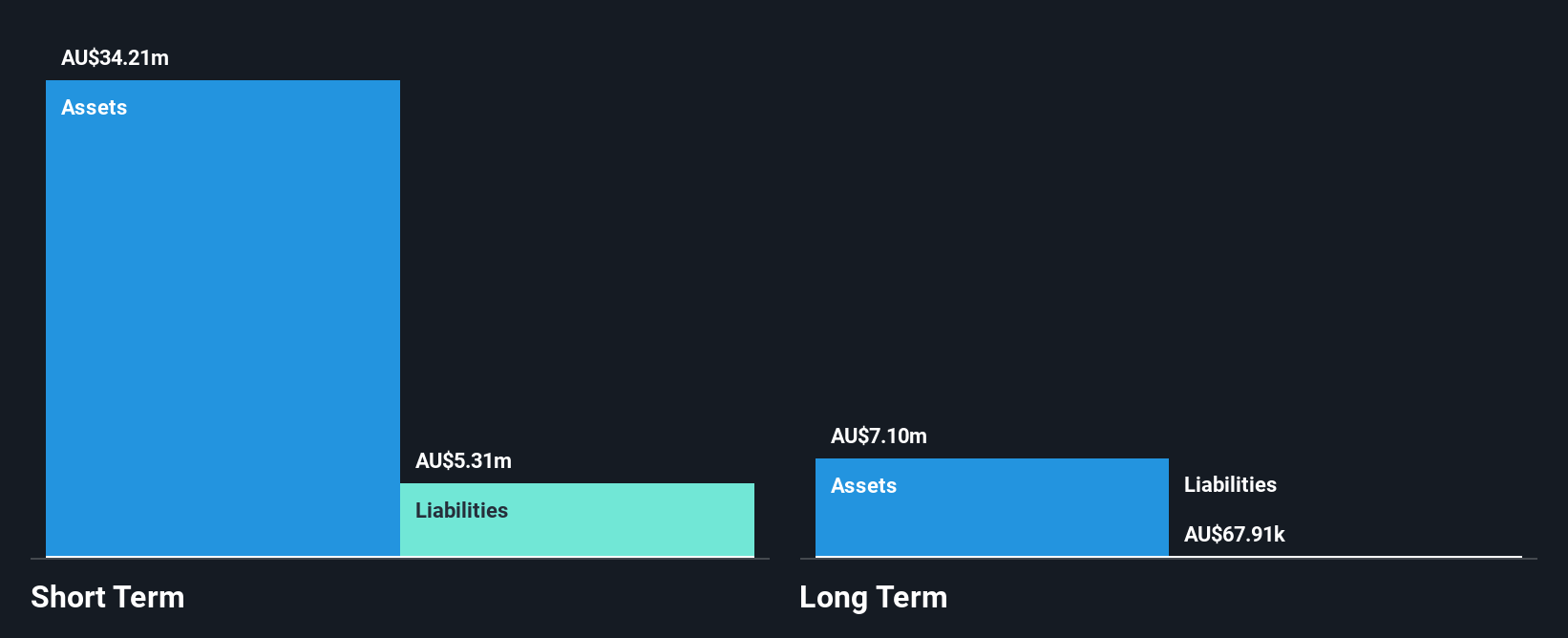

Sovereign Metals Limited, with a market cap of A$446.91 million, is pre-revenue and focused on the Kasiya Rutile-Graphite Project in Malawi. Recent mining trials confirmed efficient extraction methods for its high-grade rutile and graphite deposits. The company has no debt and maintains sufficient short-term assets (A$32.4M) to cover liabilities, though shareholders experienced dilution with a 6.6% increase in shares outstanding over the past year. Despite these strengths, Sovereign faces challenges with negative returns on equity (-54.14%) and an inexperienced management team averaging 1.2 years in tenure while remaining unprofitable without near-term profitability forecasts.

- Jump into the full analysis health report here for a deeper understanding of Sovereign Metals.

- Gain insights into Sovereign Metals' future direction by reviewing our growth report.

Taking Advantage

- Investigate our full lineup of 1,053 ASX Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SVM

Sovereign Metals

Engages in the exploration and development of mineral resource projects in Malawi.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives