- Australia

- /

- Trade Distributors

- /

- ASX:IPG

ASX Penny Stocks To Watch: IPD Group And Two More Top Picks

Reviewed by Simply Wall St

The Australian stock market recently saw a slight dip, with the ASX 200 closing at 8,541 points. Despite this, certain sectors like Real Estate and IT have shown resilience, while others such as Utilities and Financials have faced challenges. For investors interested in smaller or newer companies, penny stocks—though an older term—can still present valuable opportunities for growth. These stocks often represent underappreciated chances to invest in companies with strong financial foundations and the potential for long-term success.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.24 | A$105.67M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.61 | A$116.42M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.76 | A$425.54M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.32 | A$2.64B | ✅ 4 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.735 | A$458.75M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.19 | A$751.63M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.10 | A$705.94M | ✅ 4 ⚠️ 2 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.715 | A$226.78M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.35 | A$158.96M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.76 | A$141.76M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 1,007 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

IPD Group (ASX:IPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IPD Group Limited distributes electrical infrastructure in Australia and has a market cap of A$319.38 million.

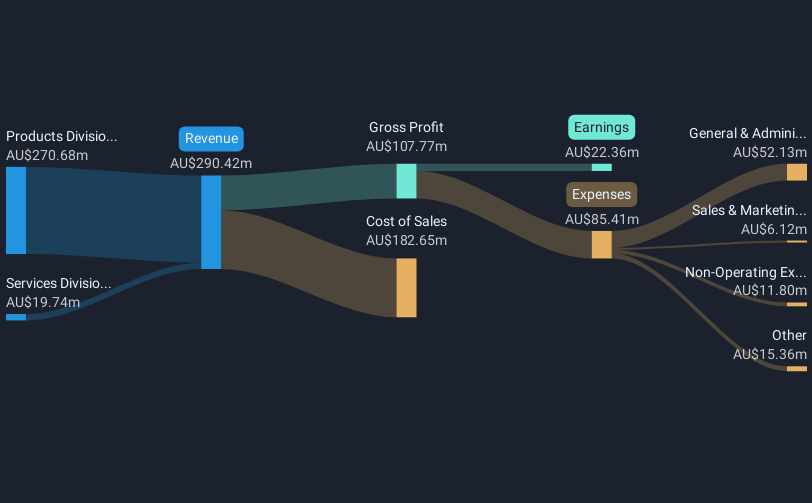

Operations: The company's revenue is derived from its Products Division, which generated A$325.32 million, and its Services Division, contributing A$21.30 million.

Market Cap: A$319.38M

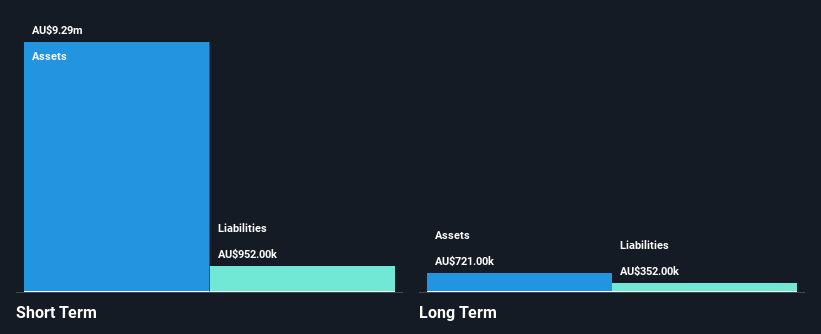

IPD Group Limited, with a market cap of A$319.38 million, has shown robust earnings growth, significantly outpacing the Trade Distributors industry. Its financial health is solid with short-term assets exceeding liabilities and a satisfactory net debt to equity ratio of 1.4%. The company boasts high-quality earnings and well-covered interest payments by EBIT at 20.8 times coverage. Despite trading below its estimated fair value by 37.6%, IPD's Return on Equity remains low at 16.5%. Analysts are optimistic about potential price appreciation, forecasting continued earnings growth albeit at a slower pace than in previous years.

- Click here to discover the nuances of IPD Group with our detailed analytical financial health report.

- Evaluate IPD Group's prospects by accessing our earnings growth report.

Sunrise Energy Metals (ASX:SRL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sunrise Energy Metals Limited focuses on metal recovery and exploration of mineral tenements in Australia, with a market cap of A$58.65 million.

Operations: The company's revenue is derived from its metals segment, amounting to A$0.24 million.

Market Cap: A$58.65M

Sunrise Energy Metals, with a market cap of A$58.65 million, is pre-revenue and focuses on metal recovery and exploration. The company is debt-free and has a seasoned management team with an average tenure of 9.9 years. Its short-term assets exceed both short- and long-term liabilities, indicating solid financial health despite its unprofitability. Recent developments include a follow-on equity offering raising A$7.5 million to support operations and exploration activities at the Syerston Scandium Project, which has shown promising assay results for high-grade scandium mineralisation. The company's share price remains highly volatile, reflecting typical penny stock characteristics.

- Click to explore a detailed breakdown of our findings in Sunrise Energy Metals' financial health report.

- Gain insights into Sunrise Energy Metals' historical outcomes by reviewing our past performance report.

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Southern Cross Electrical Engineering Limited offers electrical, instrumentation, communications, security, and maintenance services to the resources, commercial, and infrastructure sectors in Australia with a market cap of A$458.75 million.

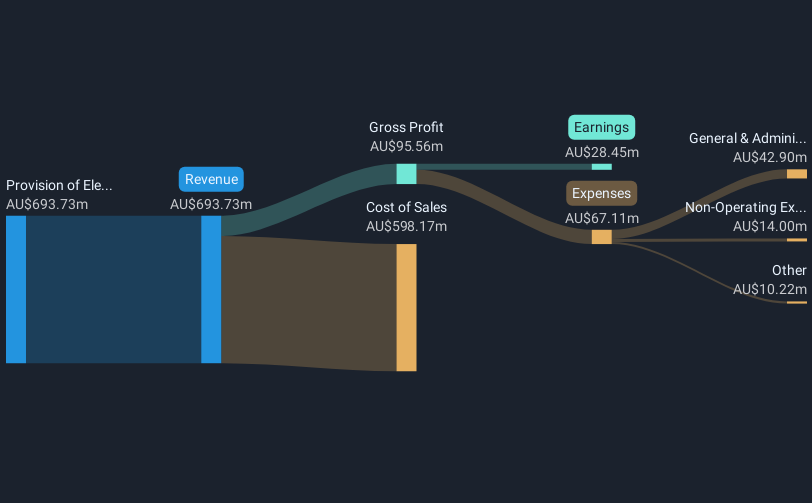

Operations: The company generates revenue of A$693.73 million from its electrical services, which include instrumentation, communications, security, and maintenance for the resources, commercial, and infrastructure sectors in Australia.

Market Cap: A$458.75M

Southern Cross Electrical Engineering, with a market cap of A$458.75 million, is not pre-revenue and generates significant income from its electrical services. The company boasts stable weekly volatility at 6% and has shown impressive earnings growth of 42.3% over the past year, outpacing the broader construction industry. Its financial health is robust, with short-term assets covering both short- and long-term liabilities. Despite trading below its estimated fair value by 23.1%, it maintains high-quality earnings without shareholder dilution in recent times. However, its return on equity remains low at 14.6%, and dividends are unstable.

- Take a closer look at Southern Cross Electrical Engineering's potential here in our financial health report.

- Assess Southern Cross Electrical Engineering's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Gain an insight into the universe of 1,007 ASX Penny Stocks by clicking here.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IPG

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives