- Australia

- /

- Metals and Mining

- /

- ASX:MRR

3 Promising ASX Penny Stocks With Market Caps Up To A$70M

Reviewed by Simply Wall St

The Australian market recently saw the ASX200 close down by 0.42%, with financials experiencing notable declines, while mining stocks provided some balance with gains. In such fluctuating market conditions, investors often seek opportunities in smaller companies that might offer growth potential and value. Penny stocks, although an older term, still capture interest when they are backed by strong financial fundamentals, offering a mix of affordability and growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$66.23M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$322.48M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.90 | A$237.13M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$249.92M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.94 | A$107.38M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.98 | A$324.01M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.90 | A$105.1M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.255 | A$108.43M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.93 | A$488.39M | ★★★★☆☆ |

Click here to see the full list of 1,051 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Carnaby Resources (ASX:CNB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Carnaby Resources Limited, with a market cap of A$60.18 million, is involved in the exploration and development of mineral properties in Australia through its subsidiaries.

Operations: No revenue segments are reported for the company.

Market Cap: A$60.18M

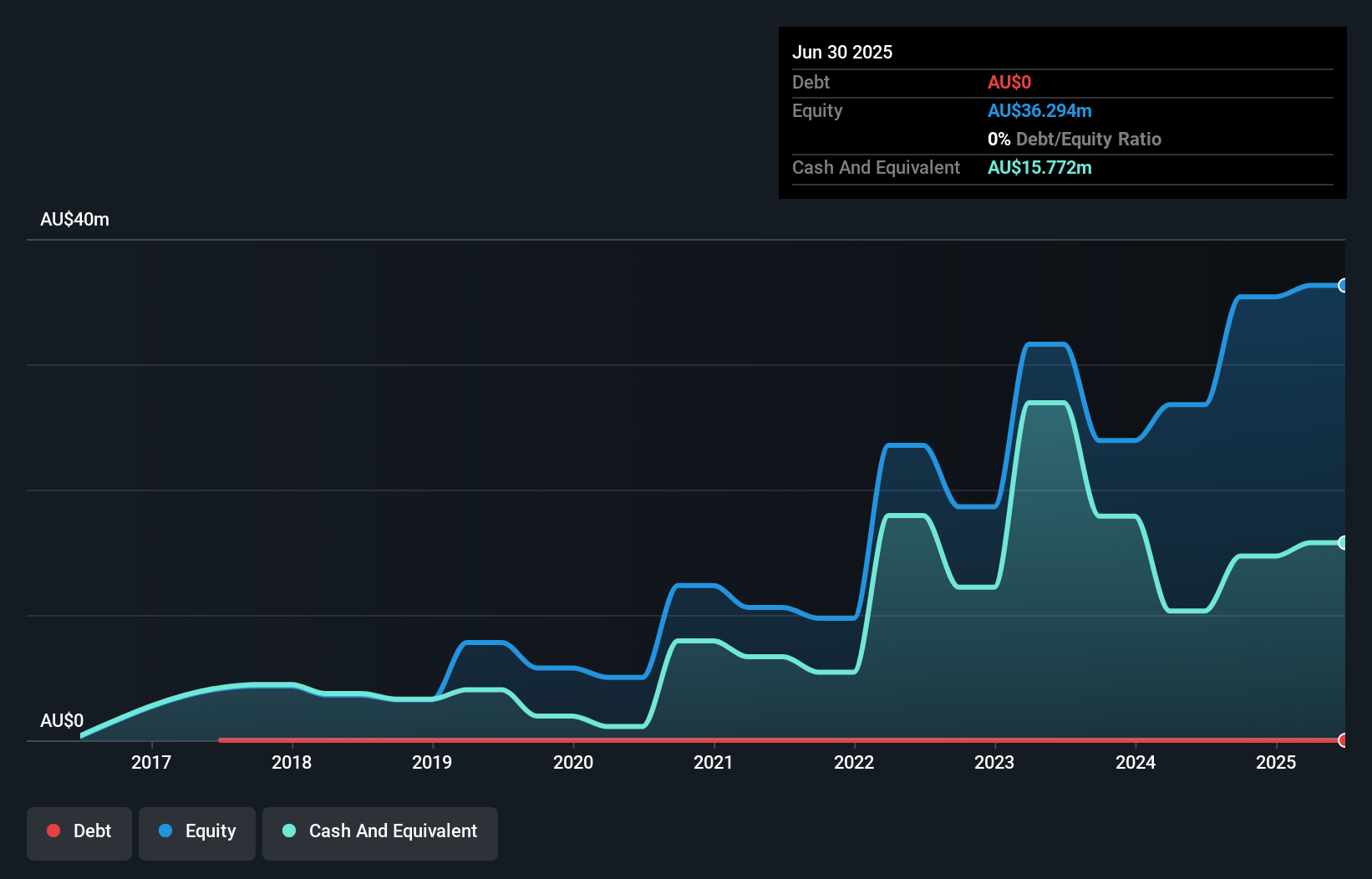

Carnaby Resources, with a market cap of A$60.18 million, remains a pre-revenue company focused on mineral exploration in Australia. The firm has maintained a stable weekly volatility of 10% over the past year but has experienced shareholder dilution with shares outstanding increasing by 5.6%. Despite being debt-free for five years, Carnaby is unprofitable and forecasts earnings growth of 65.98% annually. Short-term assets (A$10.8M) cover both short-term (A$2.6M) and long-term liabilities (A$515.1K). Recently, the company raised A$17.5 million through a follow-on equity offering to bolster its cash runway beyond the current forecasted ten months.

- Click to explore a detailed breakdown of our findings in Carnaby Resources' financial health report.

- Examine Carnaby Resources' earnings growth report to understand how analysts expect it to perform.

MinRex Resources (ASX:MRR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: MinRex Resources Limited is involved in the exploration and development of mineral properties, with a market cap of A$9.76 million.

Operations: The company's revenue segment is derived from exploration for gold and other minerals, amounting to A$0.006 million.

Market Cap: A$9.76M

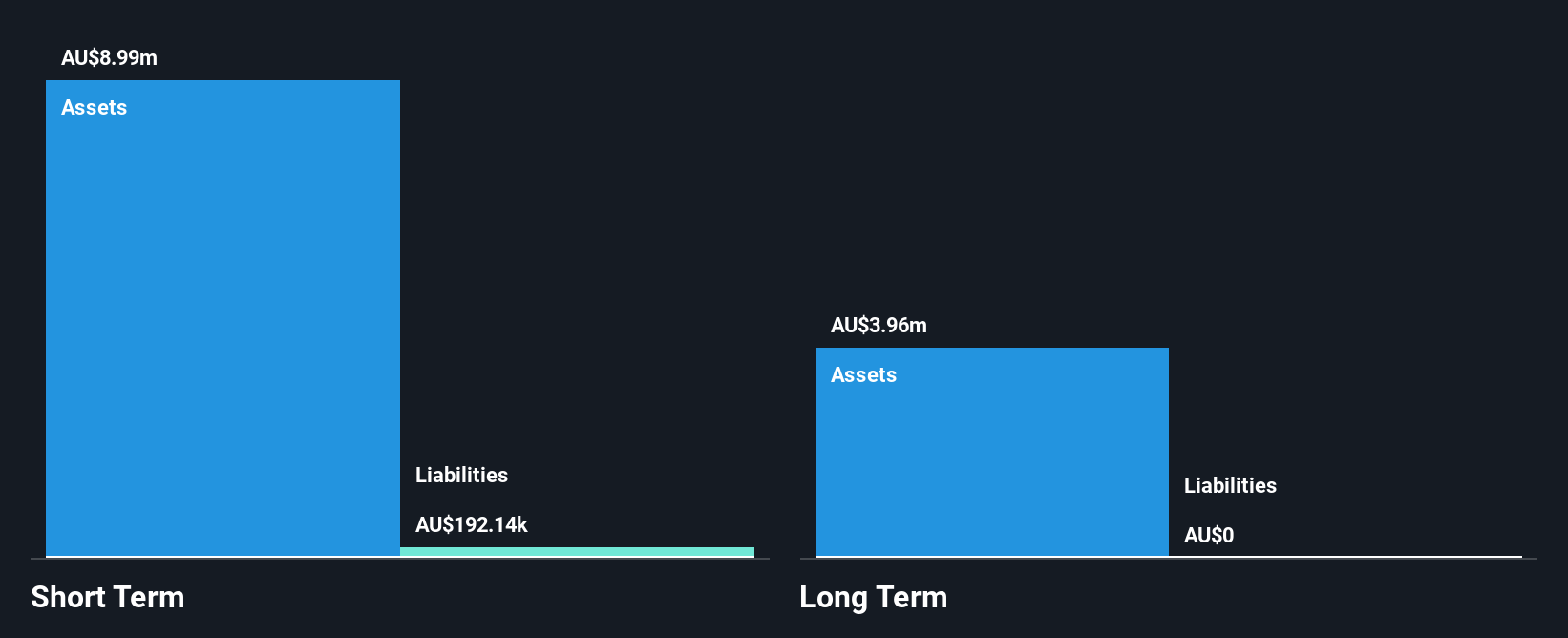

MinRex Resources, with a market cap of A$9.76 million, is a pre-revenue company engaged in mineral exploration. The firm has no debt but faces challenges with less than a year of cash runway and high weekly volatility at 16%, surpassing most Australian stocks. Its short-term assets (A$10M) comfortably cover both short-term (A$235.3K) and long-term liabilities (A$35.1K). Despite an inexperienced board with an average tenure of 1.7 years, the company has avoided shareholder dilution recently but remains unprofitable, with losses increasing by 53.4% annually over five years.

- Unlock comprehensive insights into our analysis of MinRex Resources stock in this financial health report.

- Gain insights into MinRex Resources' past trends and performance with our report on the company's historical track record.

Sunrise Energy Metals (ASX:SRL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sunrise Energy Metals Limited is involved in metal recovery and exploration of mineral tenements in Australia, with a market cap of A$22.11 million.

Operations: The company's revenue segment primarily comprises Metals, generating A$0.33 million.

Market Cap: A$22.11M

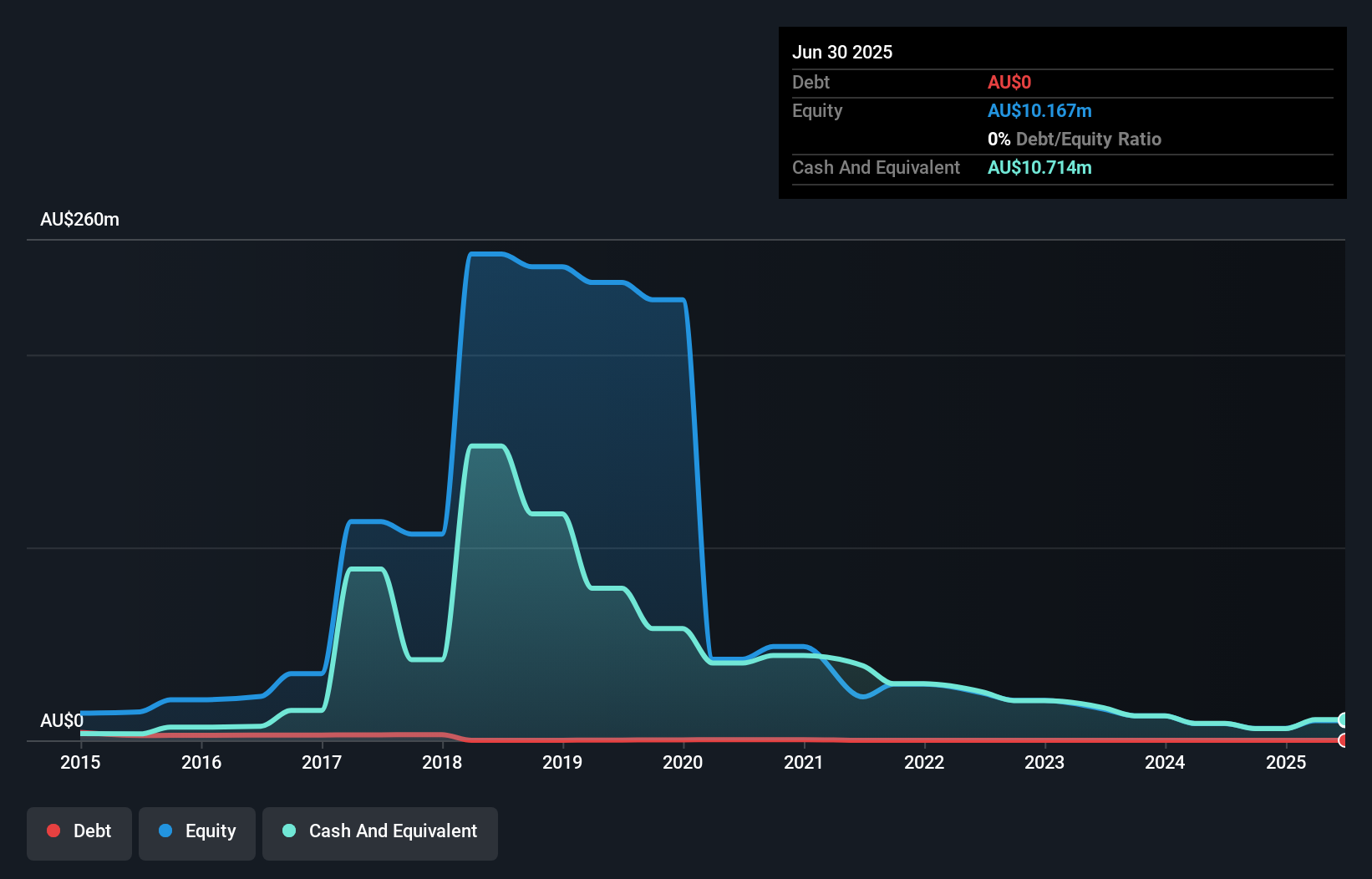

Sunrise Energy Metals, with a market cap of A$22.11 million, is pre-revenue, generating only A$0.33 million from its metals segment. The company is debt-free and has reduced its losses by 40.3% annually over the past five years, indicating some operational improvements despite being unprofitable. It maintains a solid cash position with more than a year of runway based on current free cash flow and can extend this to 1.1 years if growth continues at historical rates. Its experienced management team and board contribute stability, while short-term assets (A$9.3M) exceed liabilities comfortably, supporting financial resilience amidst high volatility reduction from 14% to 9%.

- Get an in-depth perspective on Sunrise Energy Metals' performance by reading our balance sheet health report here.

- Examine Sunrise Energy Metals' past performance report to understand how it has performed in prior years.

Make It Happen

- Take a closer look at our ASX Penny Stocks list of 1,051 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MRR

MinRex Resources

Engages in the exploration and development of mineral properties.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success