- Australia

- /

- Capital Markets

- /

- ASX:RPL

3 ASX Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

In recent trading sessions, the Australian market has experienced a slight downturn, with the ASX200 slipping by 0.32% and sectors like Consumer Staples and Utilities underperforming. Amidst this environment, identifying growth stocks with high insider ownership can be appealing as they often signal confidence from those closest to the company’s operations, potentially offering resilience in fluctuating markets.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Genmin (ASX:GEN) | 12.3% | 117.7% |

| Catalyst Metals (ASX:CYL) | 14.8% | 33.1% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 67.1% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Pointerra (ASX:3DP) | 20.1% | 126.4% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Change Financial (ASX:CCA) | 26.2% | 99.7% |

Here we highlight a subset of our preferred stocks from the screener.

Regal Partners (ASX:RPL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market cap of A$1.29 billion.

Operations: The company generates revenue of A$198.50 million from the provision of investment management services.

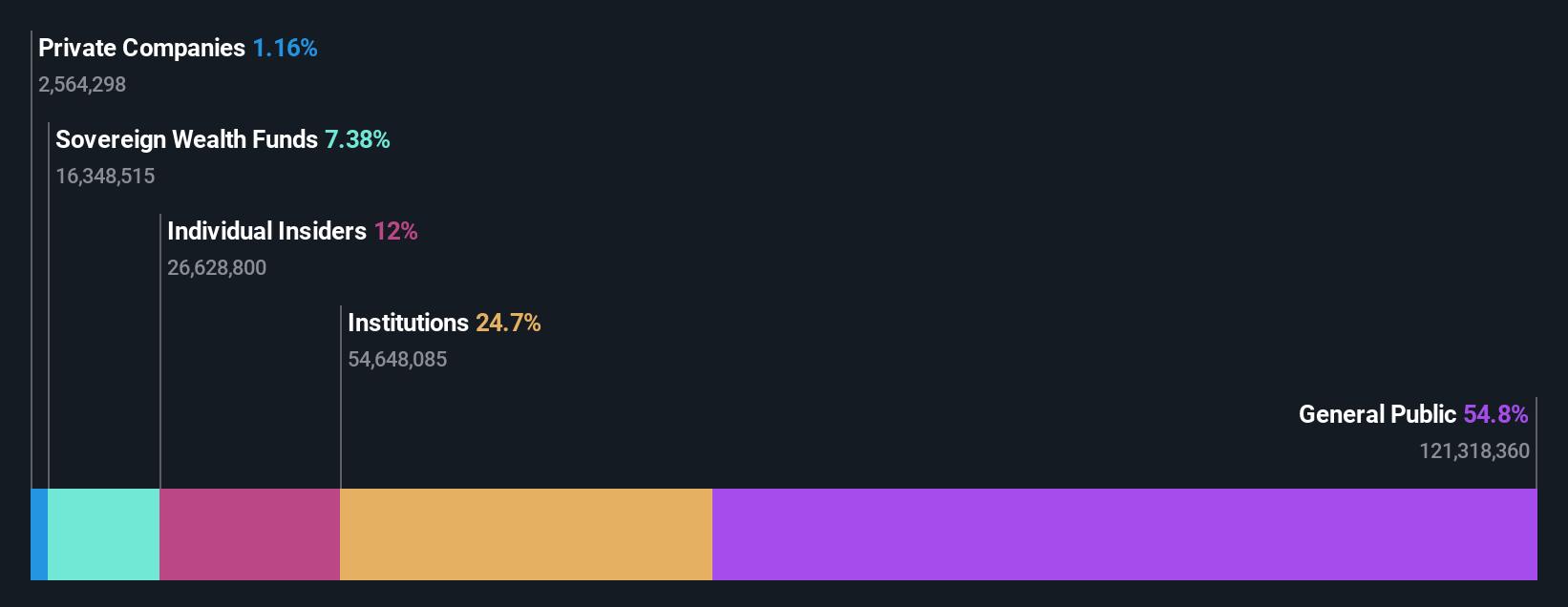

Insider Ownership: 39.7%

Revenue Growth Forecast: 16.8% p.a.

Regal Partners has demonstrated significant earnings growth, with a notable increase in revenue and net income for the first half of 2024. Despite trading below its estimated fair value, insider activity shows more substantial selling than buying recently. Earnings are forecast to grow significantly faster than the Australian market, although revenue growth is expected to be moderate. The company's dividend yield is not well covered by free cash flows, raising sustainability concerns despite recent increases.

- Dive into the specifics of Regal Partners here with our thorough growth forecast report.

- According our valuation report, there's an indication that Regal Partners' share price might be on the cheaper side.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across Australia, Asia, the Americas, Africa, and Europe with a market capitalization of A$644.55 million.

Operations: The company's revenue segments include A$31.41 million from Advisory and A$72.67 million from Software.

Insider Ownership: 10.5%

Revenue Growth Forecast: 10.4% p.a.

RPMGlobal Holdings has shown strong financial performance with earnings growing by 134.6% over the past year and net income reaching A$8.66 million, up from A$3.69 million previously. Insider buying has occurred more than selling in recent months, albeit not in large volumes. The company is forecasted to continue its growth trajectory, with earnings expected to grow at 22.6% annually, outpacing the broader Australian market's growth projections.

- Navigate through the intricacies of RPMGlobal Holdings with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, RPMGlobal Holdings' share price might be too optimistic.

Santana Minerals (ASX:SMI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Santana Minerals Limited focuses on the exploration and evaluation of gold and silver properties in New Zealand, Cambodia, and Mexico, with a market cap of A$442.94 million.

Operations: Santana Minerals Limited generates its revenue from the exploration and evaluation of gold and silver properties across New Zealand, Cambodia, and Mexico.

Insider Ownership: 19.5%

Revenue Growth Forecast: 120.1% p.a.

Santana Minerals is progressing with its Bendigo-Ophir Gold Project, having secured strategic land for water supply and completing significant resource definition drilling. Despite reporting a net loss of A$2.59 million for the fiscal year, this marks an improvement from the previous year. Analysts forecast earnings growth of 86.75% annually over the next three years, suggesting potential profitability ahead. Insider activity shows more buying than selling recently, indicating confidence in future prospects despite limited revenue generation currently.

- Take a closer look at Santana Minerals' potential here in our earnings growth report.

- The analysis detailed in our Santana Minerals valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Embark on your investment journey to our 95 Fast Growing ASX Companies With High Insider Ownership selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Regal Partners, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RPL

Flawless balance sheet and undervalued.

Market Insights

Community Narratives