- Australia

- /

- Metals and Mining

- /

- ASX:ION

Have Insiders Been Selling Southern Gold Limited (ASX:SAU) Shares This Year?

We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So before you buy or sell Southern Gold Limited (ASX:SAU), you may well want to know whether insiders have been buying or selling.

What Is Insider Selling?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, such insiders must disclose their trading activities, and not trade on inside information.

Insider transactions are not the most important thing when it comes to long-term investing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year'.

View our latest analysis for Southern Gold

The Last 12 Months Of Insider Transactions At Southern Gold

The insider, Paul Shadbolt, made the biggest insider sale in the last 12 months. That single transaction was for AU$481k worth of shares at a price of AU$0.25 each. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. It's of some comfort that this sale was conducted at a price well above the current share price, which is AU$0.097. So it may not shed much light on insider confidence at current levels. Paul Shadbolt was the only individual insider to sell over the last year.

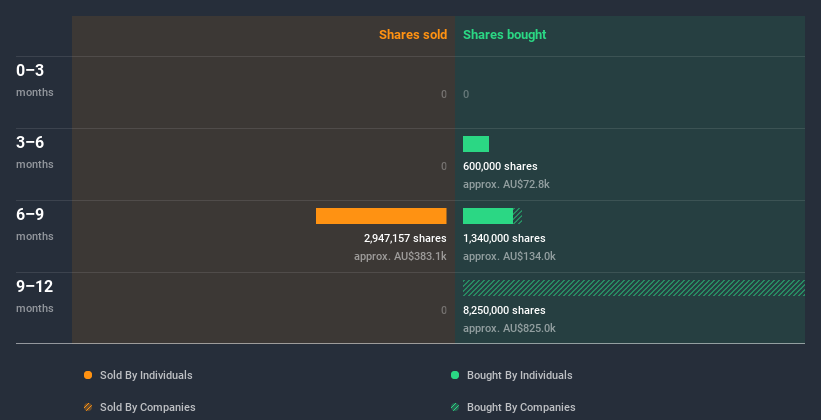

In the last twelve months insiders purchased 1.74m shares for AU$187k. But they sold 2.95m shares for AU$481k. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

I will like Southern Gold better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Does Southern Gold Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Our data indicates that Southern Gold insiders own about AU$2.0m worth of shares (which is 9.7% of the company). But they may have an indirect interest through a corporate structure that we haven't picked up on. Whilst better than nothing, we're not overly impressed by these holdings.

What Might The Insider Transactions At Southern Gold Tell Us?

There haven't been any insider transactions in the last three months -- that doesn't mean much. We don't take much encouragement from the transactions by Southern Gold insiders. We also note that, as far as we can see, insider ownership is fairly low, compared to other companies. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. For instance, we've identified 4 warning signs for Southern Gold (2 are a bit concerning) you should be aware of.

Of course Southern Gold may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Southern Gold or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Iondrive, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:ION

Iondrive

Engages in the development and commercialization of battery technology materials.

Flawless balance sheet moderate.

Market Insights

Community Narratives