- Australia

- /

- Metals and Mining

- /

- ASX:S32

Should Leadership Changes and Cannington Sale Talks Prompt a Strategy Rethink for South32 (ASX:S32) Investors?

Reviewed by Sasha Jovanovic

- South32 Limited has announced the retirement of two long-standing independent directors following its 2025 Annual General Meeting and revealed that Chair Karen Wood AM will retire in February 2026, with Stephen Pearce elected as her successor.

- This wave of leadership changes coincides with speculation around the potential sale of the company's Cannington silver mine, one of the world's largest, amid heightened silver market activity.

- We will explore how the appointment of Stephen Pearce as incoming Chair may shape South32's strategic direction and investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

South32 Investment Narrative Recap

To be a shareholder in South32, you need to believe in its ability to unlock value through asset sales and portfolio upgrades, while managing the risks tied to maturing mines and complex operating environments. The latest wave of board changes, including future succession to new Chair Stephen Pearce, appears unlikely to materially shift the short-term catalyst, which is market speculation over the possible sale of the Cannington silver mine. The biggest immediate risk remains uncertainty over sustaining or extending production at mature assets, especially as Cannington’s reserve life tightens and operational complexity increases.

The rumored Cannington mine sale, spurred by ongoing silver price strength and heightened buyer interest, stands out as the most relevant recent announcement. The outcome could influence both near-term cash generation and longer-term portfolio mix, as South32 balances divesting mature assets against investing in future-facing growth projects. The company’s approach to this process, at a time of leadership turnover, directly intersects with what many see as the core short-term investment debate.

However, in contrast to the potential upside, investors should be mindful of the operational risks tied to South32’s maturing mining portfolio and...

Read the full narrative on South32 (it's free!)

South32's outlook anticipates $6.8 billion in revenue and $1.1 billion in earnings by 2028. This is based on a projected 4.5% annual revenue growth rate and a $782 million increase in earnings from the current $318 million.

Uncover how South32's forecasts yield a A$3.26 fair value, a 3% upside to its current price.

Exploring Other Perspectives

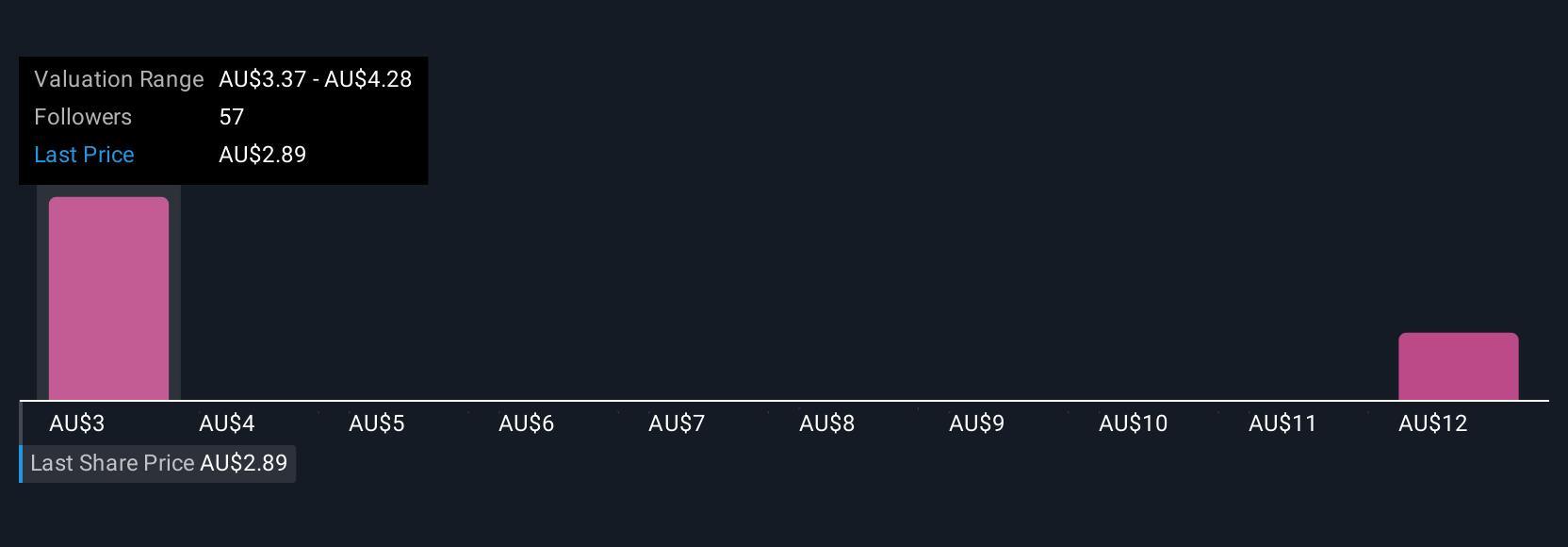

Simply Wall St Community members shared 7 independent fair value estimates for South32 ranging from A$2.50 to A$11.67. While many see silver mine divestment as a key catalyst, opinions differ on how this will shape future earnings potential and stability, see how the community’s varied views might align with your own expectations.

Explore 7 other fair value estimates on South32 - why the stock might be worth over 3x more than the current price!

Build Your Own South32 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your South32 research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free South32 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate South32's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:S32

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives