- Australia

- /

- Metals and Mining

- /

- ASX:RSG

Resolute Mining (ASX:RSG): Assessing Valuation After Lower Production, Sales, and Revised 2025 Guidance

Reviewed by Simply Wall St

Resolute Mining (ASX:RSG) has released its latest quarterly update, revealing lower gold production and sales for both the recent quarter and the year so far. The company also announced a narrowed production outlook and revised cost guidance.

See our latest analysis for Resolute Mining.

After a blockbuster start to the year, Resolute Mining’s 1-day share price rebound of 3% comes on the heels of a difficult month, with a 24% share price decline over 30 days weighing on investor sentiment. Still, with year-to-date share price gains topping 100% and a remarkable 3-year total shareholder return of 363%, this gold miner’s longer-term momentum remains impressive even as short-term risks have come back into focus.

If you’re watching mining shakeups and want to spot new opportunities, consider broadening your search and discover fast growing stocks with high insider ownership.

With a sharp pullback in recent weeks, but a massive year-to-date rally, the question now hangs: is Resolute Mining undervalued after the latest results, or is the market already factoring in its future growth prospects?

Most Popular Narrative: 41.2% Undervalued

Compared to its last close of A$0.85, the most widely followed narrative assigns Resolute Mining a fair value of A$1.45. This marked difference highlights ambitious financial projections. The gap between current price and narrative fair value depends on expectations of continued expansion and margin improvements.

The Doropo, ABC, and La Debo projects in Côte d'Ivoire, alongside the Syama Sulphide Conversion Project and life extension at Mako (through Bantaco and Tomboronkoto), are expected to significantly increase production volumes to over 500,000 ounces by 2028. This could drive sustained top-line growth and greater economies of scale that can enhance profitability.

Want a breakdown of the math behind this bold valuation? Discover which future production surges, profit jumps, and capital allocation strategies might be powering their outlook. Find out what key assumptions could send this stock soaring or stall its momentum. These numbers may surprise you.

Result: Fair Value of $1.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operational disruptions in Mali and potential permitting delays in Côte d'Ivoire could threaten Resolute Mining's ambitious growth trajectory.

Find out about the key risks to this Resolute Mining narrative.

Another View: Looking at Valuation Multiples

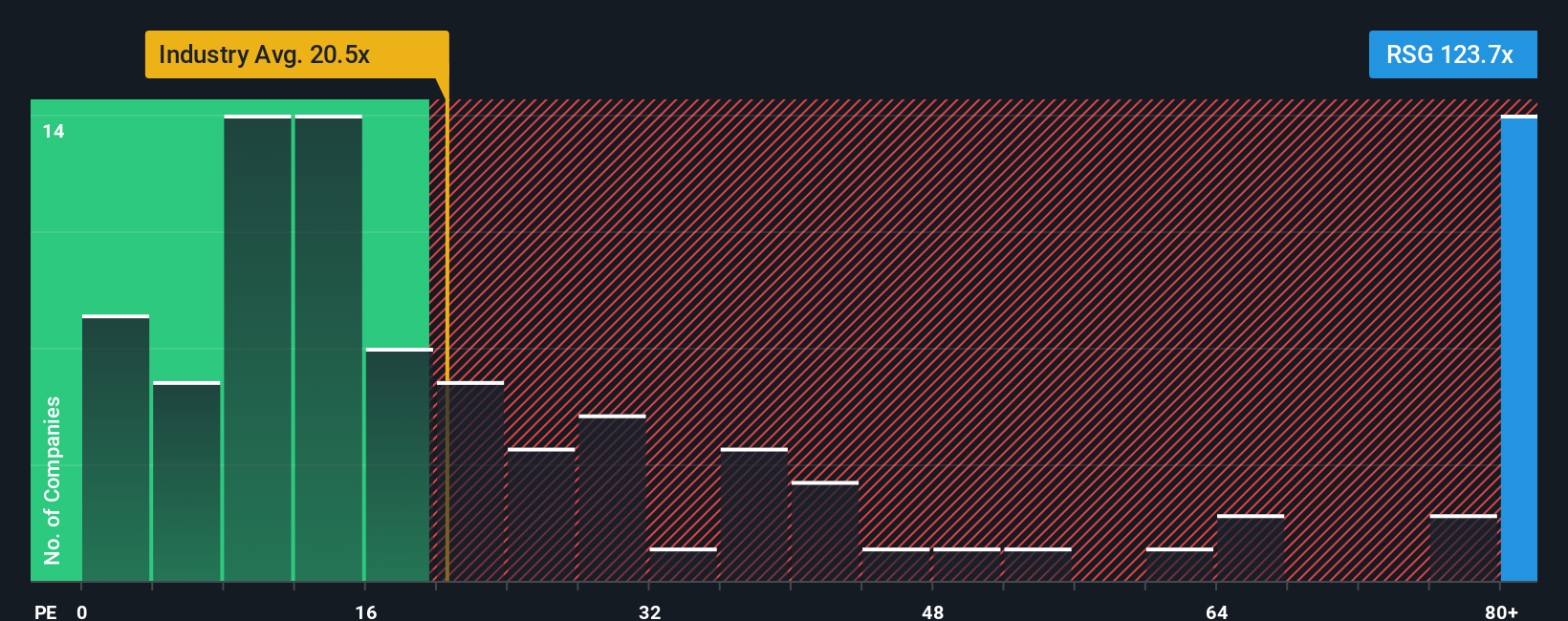

While the discounted cash flow model points to undervaluation, a closer look at the price-to-earnings ratio tells a different story. At 123.7x, Resolute Mining trades much higher than its sector average of 19.9x and the fair ratio of 34.1x. This large premium raises questions about whether future growth is being priced in aggressively, potentially increasing the risk for new investors. Is the market too optimistic, or is there something the multiples are missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Resolute Mining Narrative

If you think the story looks different or want to dig deeper into the numbers yourself, it only takes a few minutes to shape your own perspective, so Do it your way.

A great starting point for your Resolute Mining research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let promising opportunities pass you by. Expand your strategy and target stocks primed for growth, sustainable dividends, or transformative innovation using these tools:

- Tap into unique potential by scanning these 844 undervalued stocks based on cash flows, which features companies trading below intrinsic value and showing strong growth factors.

- Capture consistent income as you browse these 20 dividend stocks with yields > 3%, with yields above 3% for investors seeking returns without extra risk.

- Stay ahead of tech trends by reviewing these 26 AI penny stocks, highlighting emerging innovators at the forefront of artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RSG

Resolute Mining

Engages in mining, prospecting, and exploration of mineral properties in Africa.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion