- Australia

- /

- Metals and Mining

- /

- ASX:RRL

Regis Resources (ASX:RRL): Valuation Spotlight After Latest Quarterly Gold Production Results

Reviewed by Kshitija Bhandaru

Regis Resources (ASX:RRL) has released its quarterly operating results, reporting total group production of 90.4 thousand ounces for the quarter ended September 30, 2025. This update puts a spotlight on the company’s operational performance.

See our latest analysis for Regis Resources.

Regis Resources’ strong quarterly update comes after a remarkable run in its share price. The company has capped off a year-to-date share price return of 149.22%, driven by operational momentum and a brighter outlook for gold producers. The company’s three-year total shareholder return of 350.91% highlights the long-term payoff for those who stayed patient through market swings.

If today’s production results have you thinking bigger, this is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With such strong gains in both share price and operations, some investors may wonder if Regis Resources still has room to surprise, or if market optimism has already priced in future growth and left little on the table for new buyers.

Most Popular Narrative: 15.5% Overvalued

According to the most widely followed narrative, the fair value for Regis Resources sits below the current market price, suggesting that recent optimism may be running ahead of fundamentals. A closer look at analyst expectations sets the tone for deeper analysis.

The analysts have a consensus price target of A$4.445 for Regis Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$5.3, and the most bearish reporting a price target of just A$3.1.

What is the real driver behind this gap? It all comes down to how much future profit growth and margin expansion the narrative is factoring in. The entire valuation rests on a calculated bet about where gold prices, costs, and long-term project payoffs will land. Want to know the bullish and bearish numbers beneath the surface? Dive in for the real story powering that fair value call.

Result: Fair Value of $5.57 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks related to the McPhillamys project and potential declines in gold prices could quickly shift the narrative for Regis Resources.

Find out about the key risks to this Regis Resources narrative.

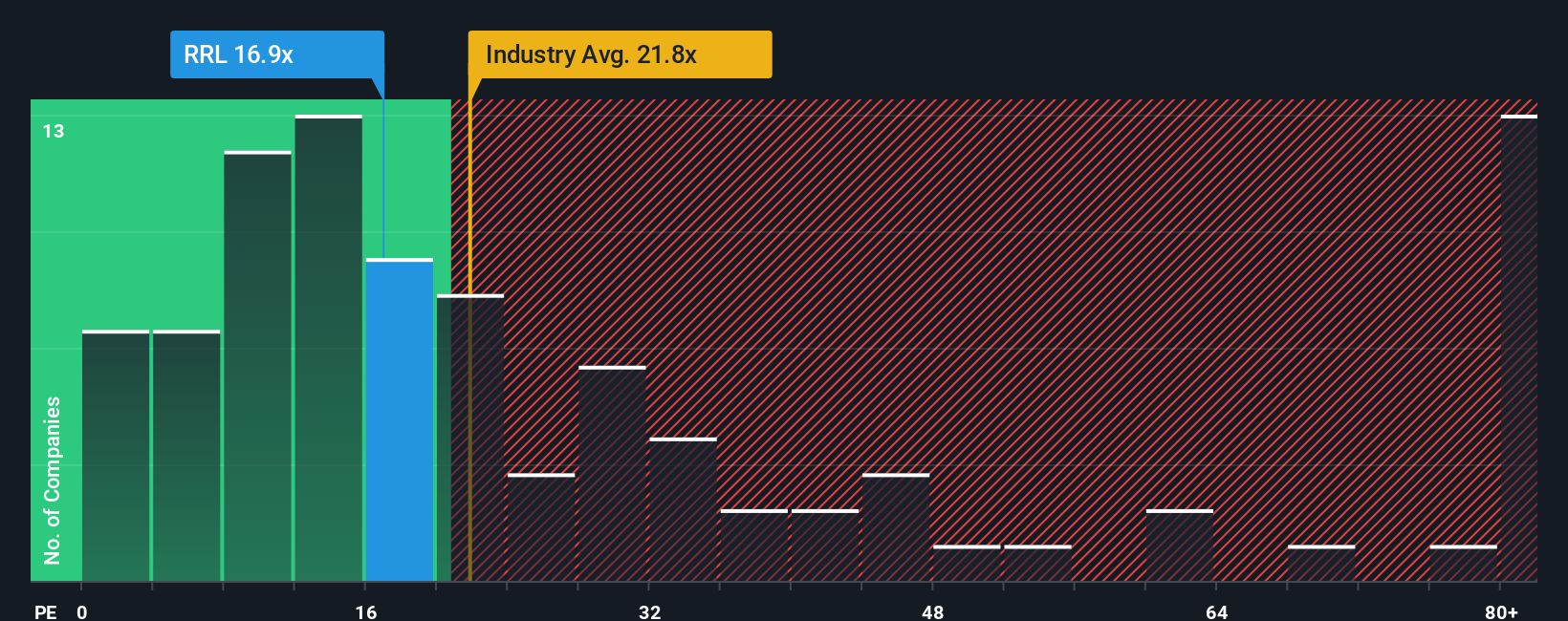

Another View: Multiple-Based Valuation Signals Opportunity

Looking at Regis Resources through the lens of its price-to-earnings ratio, the story shifts. The company trades at 19.1x earnings, which is notably lower than both the Australian Metals and Mining industry average of 22.6x and its peer average of 56.1x. Its current ratio is also below the estimated fair ratio of 22.4x. This implies the market may be undervaluing Regis compared to its potential and its competitors. Such a discount could present a value opportunity, but is it a true bargain or just a reflection of underlying risks? That is a tension worth exploring.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Regis Resources Narrative

Keep in mind, if you have your own perspective or want to dig deeper into the numbers, you can develop your own narrative in just a few minutes. Do it your way.

A great starting point for your Regis Resources research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take your next step with confidence and expand your watchlist to capture tomorrow’s opportunities before the crowd. Smart investors know the difference is in the details and timing. Here are three exceptional trends worth your attention right now:

- Turbocharge your income potential by zeroing in on high-yield opportunities through these 20 dividend stocks with yields > 3% offering reliable returns above 3%.

- Amplify your exposure to the future of healthcare by tapping into these 33 healthcare AI stocks driving breakthroughs in artificial intelligence and medical innovation.

- Seize an edge in fast-moving markets with these 871 undervalued stocks based on cash flows revealing companies trading below their true worth, setting up for greater upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RRL

Regis Resources

Engages in the exploration, evaluation, and development of gold projects in Australia.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives