- Australia

- /

- Commercial Services

- /

- ASX:CLG

ASX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the Australian market prepares for a festive break, with the ASX 200 expected to open slightly in the green, investors are keeping an eye on potential opportunities amid global economic fluctuations and local fiscal strategies. For those interested in smaller or newer companies, penny stocks—despite their somewhat outdated moniker—can still present intriguing investment possibilities. This article explores three such stocks that may offer hidden value through strong financial foundations and potential for long-term growth.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.89 | A$307.73M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.625 | A$796.38M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$1.915 | A$107.42M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.87 | A$237.96M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$193.32M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.89 | A$482.47M | ★★★★☆☆ |

Click here to see the full list of 1,054 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Close the Loop (ASX:CLG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Close the Loop Ltd is involved in the collection and recycling of electronic equipment, imaging consumables, plastics, paper and cartons across Australia, Europe, South Africa, and the United States with a market cap of A$119.67 million.

Operations: The company's revenue is derived from two main segments: Packaging, which generates A$66.83 million, and Resource Recovery, contributing A$146.13 million.

Market Cap: A$119.67M

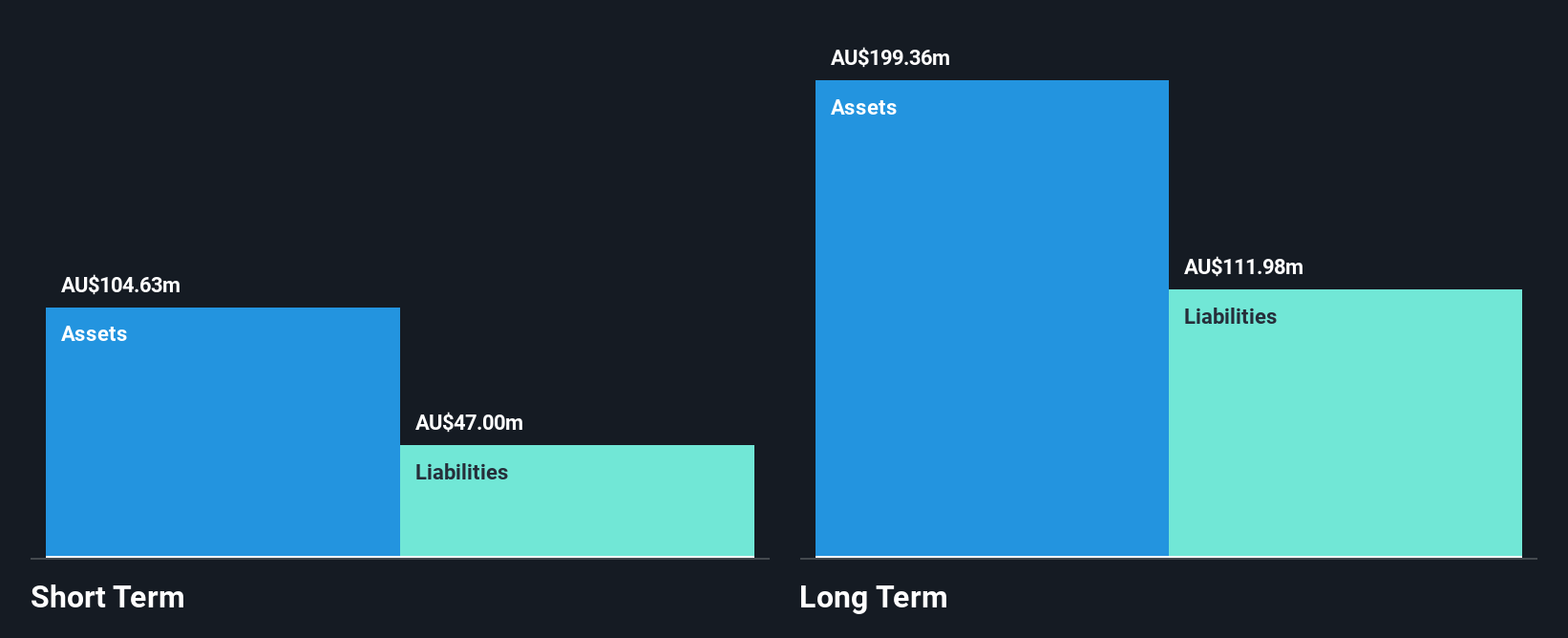

Close the Loop Ltd, with a market cap of A$119.67 million, is navigating a complex landscape as it faces an acquisition proposal from Adamantem Capital Management Pty Ltd at A$0.27 per share. The company's financials reveal mixed signals; while it has become profitable over the last five years and maintains satisfactory debt levels, its recent earnings growth has been negative and profit margins have declined to 5.1% from 8.9%. Despite trading below estimated fair value and having high-quality earnings, challenges include low return on equity and insufficient coverage of long-term liabilities by short-term assets.

- Get an in-depth perspective on Close the Loop's performance by reading our balance sheet health report here.

- Learn about Close the Loop's future growth trajectory here.

Renascor Resources (ASX:RNU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Renascor Resources Limited is involved in the exploration, development, and evaluation of mineral properties in Australia, with a market capitalization of A$149.97 million.

Operations: The company's revenue segment focuses on the exploration for graphite, copper, gold, uranium, and other minerals, generating A$0.00054 million.

Market Cap: A$149.97M

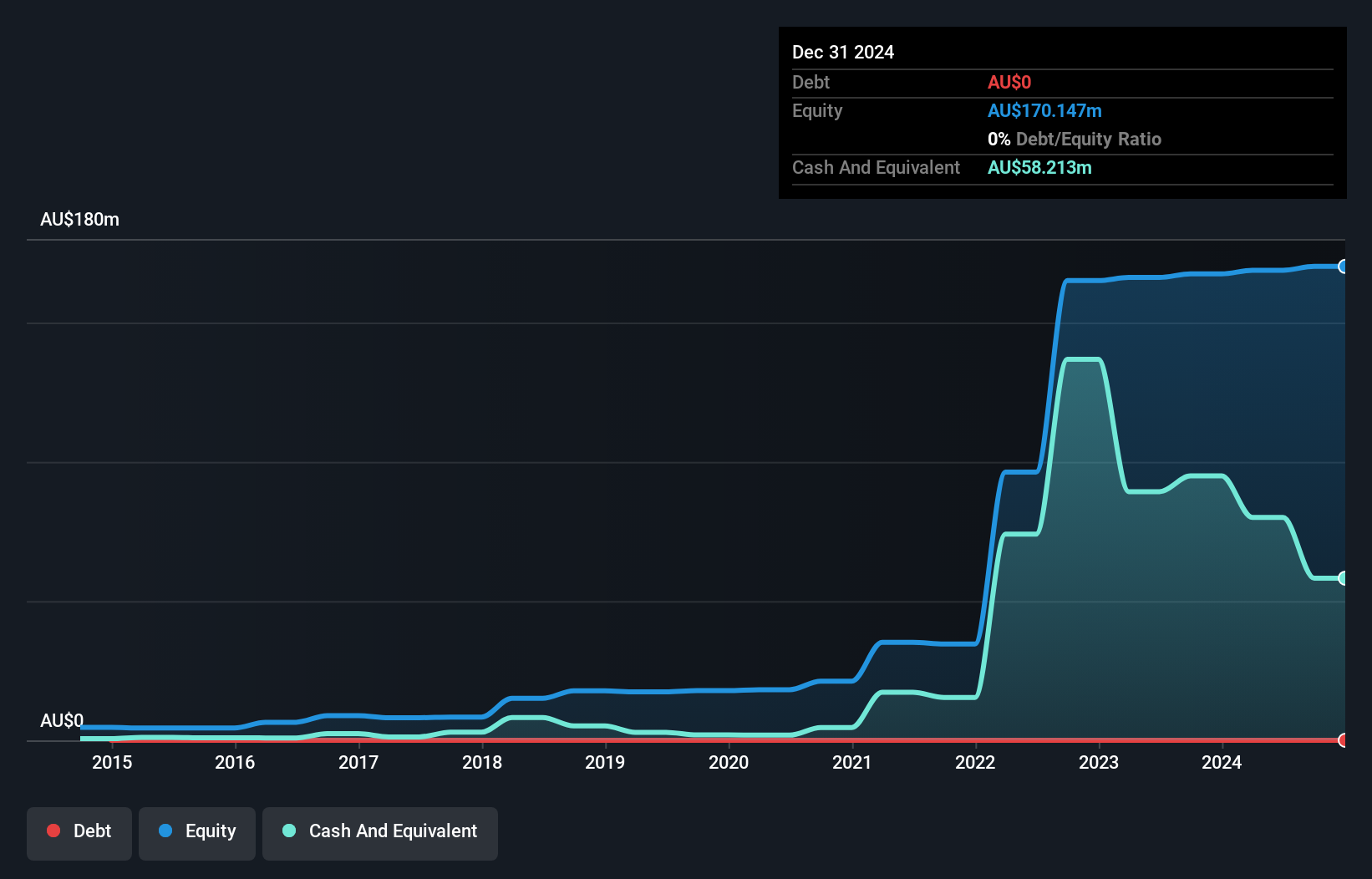

Renascor Resources Limited, with a market capitalization of A$149.97 million, is pre-revenue but has shown promising financial improvements. The company reported earnings growth of 302.1% over the past year, significantly outpacing the industry average. It remains debt-free and has not diluted shareholders recently, reflecting prudent financial management. Short-term assets of A$113.2 million comfortably cover both short-term and long-term liabilities, indicating strong liquidity. Despite low return on equity at 1%, the seasoned board and management team provide experienced oversight as Renascor advances its mineral exploration initiatives amidst recent corporate governance updates.

- Take a closer look at Renascor Resources' potential here in our financial health report.

- Explore historical data to track Renascor Resources' performance over time in our past results report.

Vita Life Sciences (ASX:VLS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vita Life Sciences Limited is a healthcare company that formulates, packages, distributes, and sells vitamins and supplements across Australia, Singapore, Malaysia, Thailand, Vietnam, Indonesia, and China with a market cap of A$107.42 million.

Operations: The company's revenue is primarily derived from Australia (A$46.99 million), Malaysia (A$23.63 million), and Singapore (A$6.83 million).

Market Cap: A$107.42M

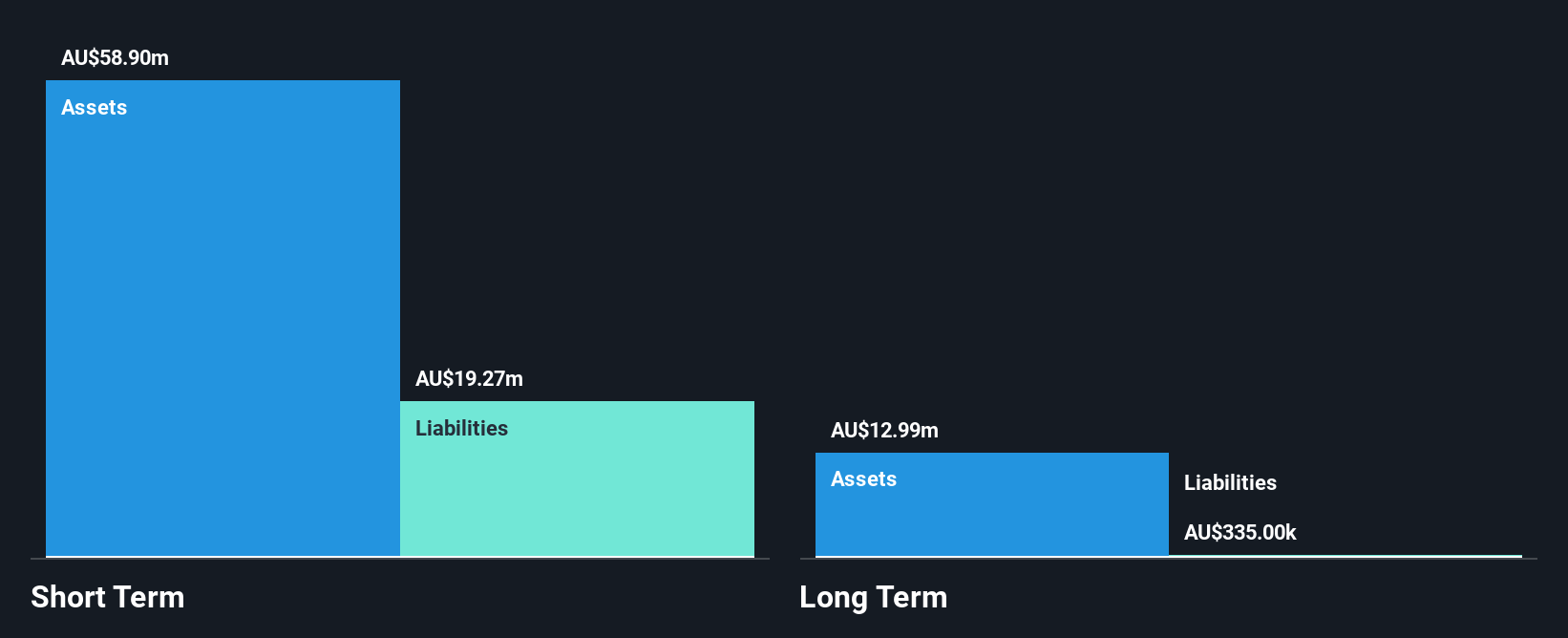

Vita Life Sciences, with a market cap of A$107.42 million, demonstrates strong financial health as it operates debt-free and has stable weekly volatility at 5%. The company anticipates robust sales growth for 2024, driven by its core markets in Australia and Malaysia/Singapore. Despite shareholder dilution over the past year, Vita Life maintains high-quality earnings with improved net profit margins from 10.8% to 11.9%. Short-term assets significantly exceed liabilities, ensuring liquidity. While trading below estimated fair value suggests potential upside, the company's return on equity remains low at 19.3%, reflecting room for improvement in profitability metrics.

- Click here to discover the nuances of Vita Life Sciences with our detailed analytical financial health report.

- Learn about Vita Life Sciences' historical performance here.

Key Takeaways

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,051 more companies for you to explore.Click here to unveil our expertly curated list of 1,054 ASX Penny Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CLG

Close the Loop

Engages in the collection and recycling of electronic equipment, imaging consumables, plastics, paper and cartons, and other related activities in Australia, Europe, South Africa, and the United States.

Undervalued with moderate growth potential.

Market Insights

Community Narratives