- Australia

- /

- Metals and Mining

- /

- ASX:RDN

We Think Raiden Resources (ASX:RDN) Can Afford To Drive Business Growth

We can readily understand why investors are attracted to unprofitable companies. For example, Raiden Resources (ASX:RDN) shareholders have done very well over the last year, with the share price soaring by 400%. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

Given its strong share price performance, we think it's worthwhile for Raiden Resources shareholders to consider whether its cash burn is concerning. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Raiden Resources

When Might Raiden Resources Run Out Of Money?

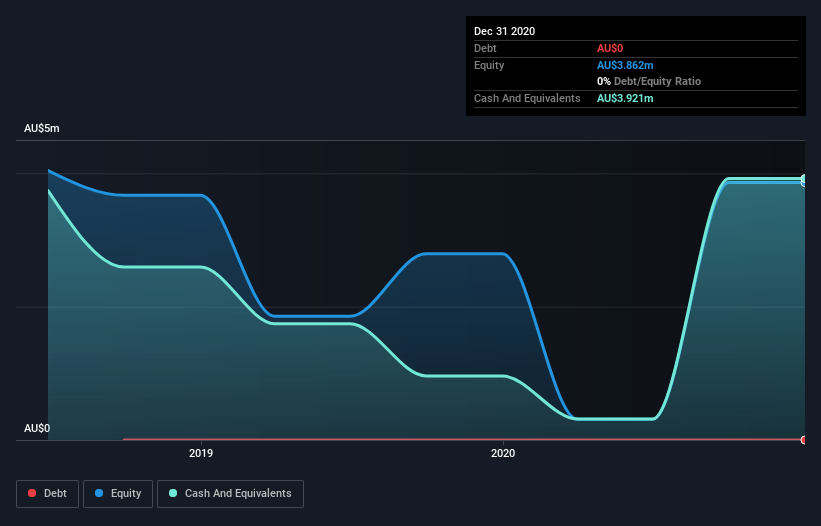

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When Raiden Resources last reported its balance sheet in December 2020, it had zero debt and cash worth AU$3.9m. In the last year, its cash burn was AU$1.5m. That means it had a cash runway of about 2.6 years as of December 2020. Arguably, that's a prudent and sensible length of runway to have. The image below shows how its cash balance has been changing over the last few years.

How Is Raiden Resources' Cash Burn Changing Over Time?

Raiden Resources didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. With cash burn dropping by 6.0% it seems management feel the company is spending enough to advance its business plans at an appropriate pace. Raiden Resources makes us a little nervous due to its lack of substantial operating revenue. We prefer most of the stocks on this list of stocks that analysts expect to grow.

Can Raiden Resources Raise More Cash Easily?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Raiden Resources to raise more cash in the future. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of AU$26m, Raiden Resources' AU$1.5m in cash burn equates to about 5.8% of its market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

Is Raiden Resources' Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way Raiden Resources is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Its weak point is its cash burn reduction, but even that wasn't too bad! After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. On another note, Raiden Resources has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

If you’re looking to trade Raiden Resources, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:RDN

Raiden Resources

Engages in the mineral exploration business in the Republic of Serbia, the Republic of Bulgaria, and Australia.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion