This article will reflect on the compensation paid to Rob Rutherford who has served as CEO of Red Metal Limited (ASX:RDM) since 2003. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Red Metal

Comparing Red Metal Limited's CEO Compensation With the industry

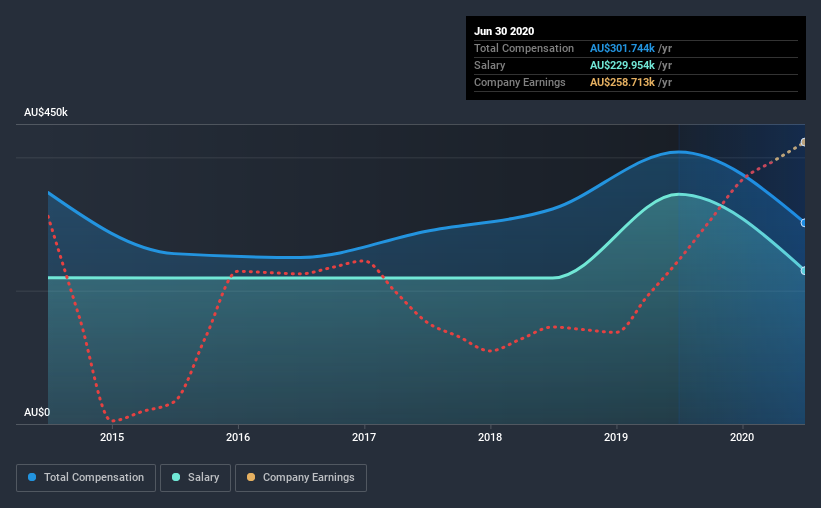

Our data indicates that Red Metal Limited has a market capitalization of AU$27m, and total annual CEO compensation was reported as AU$302k for the year to June 2020. Notably, that's a decrease of 26% over the year before. We note that the salary portion, which stands at AU$230.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below AU$259m, we found that the median total CEO compensation was AU$309k. This suggests that Red Metal remunerates its CEO largely in line with the industry average. What's more, Rob Rutherford holds AU$1.3m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$230k | AU$344k | 76% |

| Other | AU$72k | AU$64k | 24% |

| Total Compensation | AU$302k | AU$408k | 100% |

Talking in terms of the industry, salary represented approximately 69% of total compensation out of all the companies we analyzed, while other remuneration made up 31% of the pie. According to our research, Red Metal has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Red Metal Limited's Growth Numbers

Red Metal Limited's earnings per share (EPS) grew 62% per year over the last three years. In the last year, its revenue is up 297%.

Shareholders would be glad to know that the company has improved itself over the last few years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Red Metal Limited Been A Good Investment?

Given the total shareholder loss of 27% over three years, many shareholders in Red Metal Limited are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As we noted earlier, Red Metal pays its CEO in line with similar-sized companies belonging to the same industry. On the other hand, the company has logged negative shareholder returns over the previous three years. But on the bright side, EPS growth is positive over the same period. Considering positive EPS growth, we'd say compensation is fair, but shareholders may be wary of a bump in pay before the company logs positive returns.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 4 warning signs for Red Metal you should be aware of, and 1 of them is concerning.

Important note: Red Metal is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Red Metal or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:RDM

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026