- Australia

- /

- Metals and Mining

- /

- ASX:PRU

Perseus Mining (ASX:PRU) Valuation in Focus After CEO Change and Yaouré Underground Approval

Reviewed by Kshitija Bhandaru

Perseus Mining (ASX:PRU) has just marked a transformative moment for both its leadership and operations. Craig Jones is stepping in as Managing Director and CEO at the same time the company gains approval to start underground mining at Yaouré in Côte d’Ivoire.

See our latest analysis for Perseus Mining.

Looking at the bigger picture, Perseus Mining’s recent leadership shakeup and go-ahead for Yaouré’s underground mine come after a period of modest but steady performance. The stock’s one-year total shareholder return sits just under 1%, and its five-year total return is just below 3%. Momentum has been relatively steady, but the latest operational green lights highlight potential for a new phase of growth.

If gold sector developments and company transitions catch your attention, it’s a great time to see what other resources are thriving. Broaden your perspective with fast growing stocks with high insider ownership

With steady returns and fresh momentum from major developments, is Perseus Mining’s current share price an overlooked opportunity for investors, or is the market already factoring in all the upside from its next chapter?

Most Popular Narrative: 15.9% Overvalued

With Perseus Mining closing at A$4.94 and the most widely followed narrative placing fair value at A$4.26, market enthusiasm outpaces analysts’ consensus. This suggests investors may be pricing in aggressive future growth or assigning a premium for recent operational achievements.

Ongoing development of new projects (Nyanzaga in Tanzania and CMA Underground at Yaouré), as well as planned life extensions of existing mines, positions Perseus for growth in production capacity. This could accelerate topline revenue growth and enhance operating leverage over the medium to long term.

Curious how an ambitious plan to raise production and squeeze more from every ounce mined is shaping expectations? The future narrative focuses on an aggressive ramp-up, higher margins, and assumptions about scale-up that few in the industry attempt. Ready to find out which numbers set this price apart? Click through and discover what makes or breaks the thesis.

Result: Fair Value of $4.26 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including a heavy reliance on high gold prices and rising operational costs. These factors could undermine the upbeat growth assumptions.

Find out about the key risks to this Perseus Mining narrative.

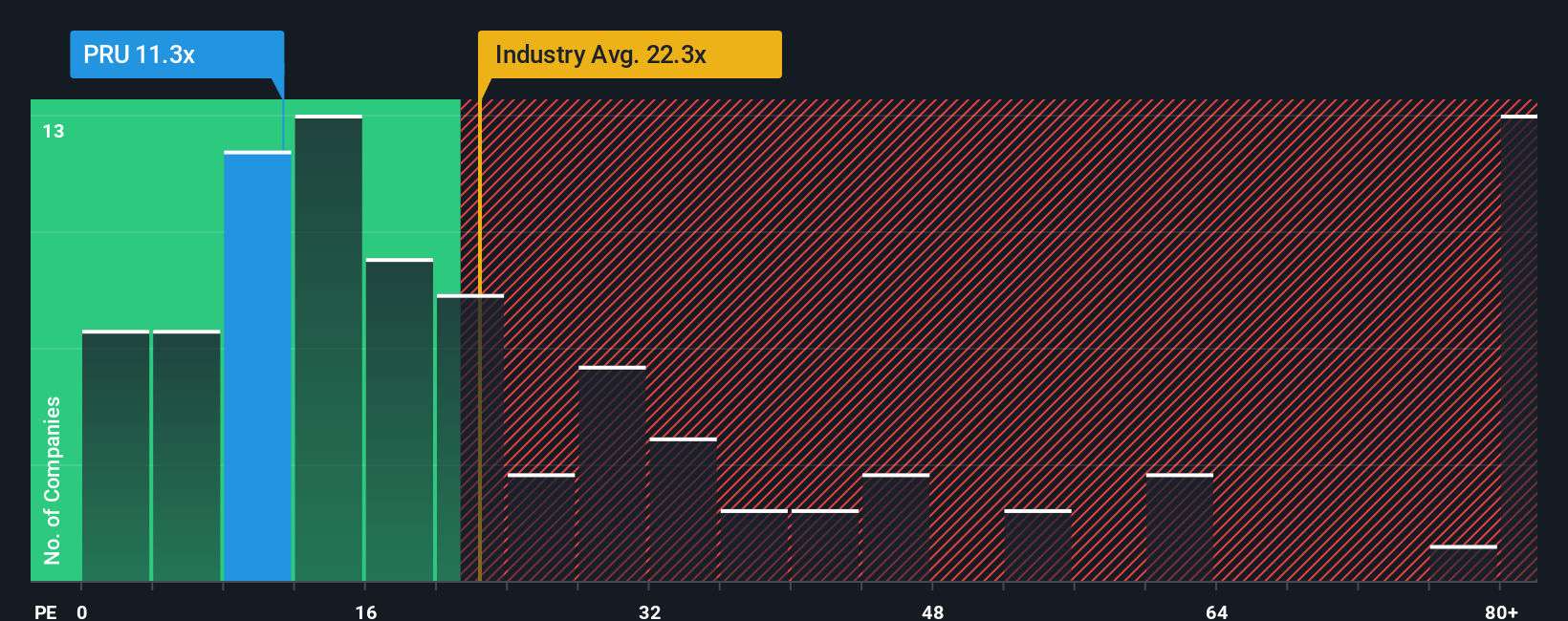

Another View: Pricing Based on Earnings Ratios

While many see Perseus Mining as overvalued versus consensus fair value, a glance through its earnings ratio lens tells another story. The company is trading on a price-to-earnings ratio of 11.9x, which is lower than both its peers (22.7x) and the broader Australian metals and mining industry (21.8x). The fair ratio, which may indicate where the market could move, stands even higher at 18.8x. This suggests a margin of safety. But can this gap persist, or is a market realignment on the horizon?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Perseus Mining Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can build your own story in just a few minutes. Do it your way

A great starting point for your Perseus Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Act now to stay ahead of market trends. The Simply Wall Street Screener helps you spot dynamic, fast-changing sectors and pinpoint untapped opportunities before others notice.

- Explore value opportunities by reviewing these 896 undervalued stocks based on cash flows now trading below their intrinsic worth and gain an edge with stocks that show real pricing upside.

- Discover future medical breakthroughs by checking out these 31 healthcare AI stocks that are innovating with advanced AI and transforming healthcare as we know it.

- Find steady income streams by scouting these 19 dividend stocks with yields > 3% offering consistent yields above 3%, supporting your goals to build a portfolio that pays you back.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PRU

Perseus Mining

Explores, evaluates, develops, and mines for gold properties in Ghana, Côte d’Ivoire, Tanzania, and Sudan.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives