- Australia

- /

- Metals and Mining

- /

- ASX:PRU

Health Check: How Prudently Does Perseus Mining (ASX:PRU) Use Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Perseus Mining Limited (ASX:PRU) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Perseus Mining

How Much Debt Does Perseus Mining Carry?

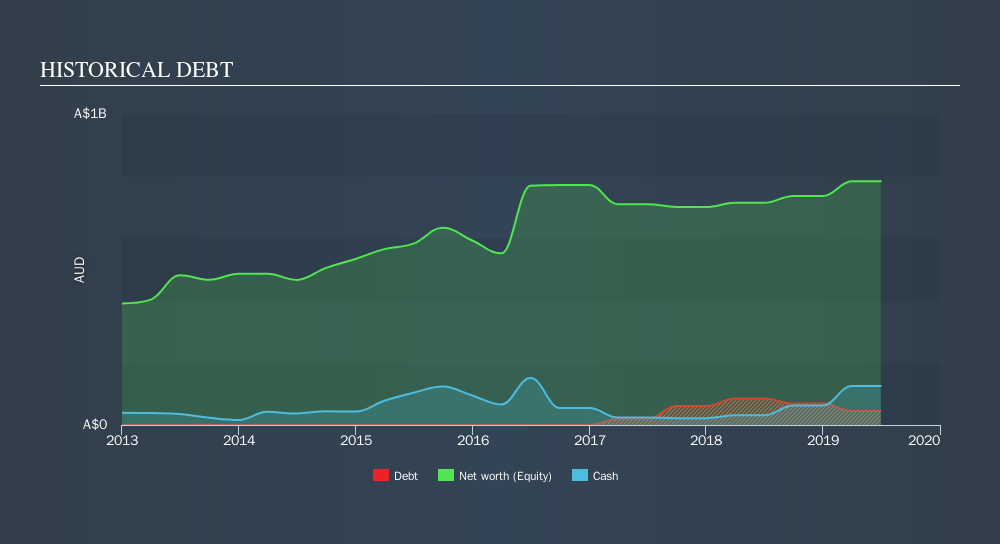

As you can see below, Perseus Mining had AU$44.8m of debt at June 2019, down from AU$85.0m a year prior. But on the other hand it also has AU$125.4m in cash, leading to a AU$80.6m net cash position.

How Strong Is Perseus Mining's Balance Sheet?

According to the last reported balance sheet, Perseus Mining had liabilities of AU$85.8m due within 12 months, and liabilities of AU$99.9m due beyond 12 months. Offsetting this, it had AU$125.4m in cash and AU$8.67m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by AU$51.7m.

Of course, Perseus Mining has a market capitalization of AU$1.06b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. While it does have liabilities worth noting, Perseus Mining also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Perseus Mining's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Perseus Mining reported revenue of AU$509m, which is a gain of 35%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is Perseus Mining?

Although Perseus Mining had negative earnings before interest and tax (EBIT) over the last twelve months, it made a statutory profit of AU$7.0m. So when you consider it has net cash, along with the statutory profit, the stock probably isn't as risky as it might seem, at least in the short term. One positive is that Perseus Mining is growing revenue apace, which makes it easier to sell a growth story and raise capital if need be. But we still think it's somewhat risky. For riskier companies like Perseus Mining I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:PRU

Perseus Mining

Explores, evaluates, develops, and mines for gold properties in Ghana, Côte d’Ivoire, Tanzania, and Sudan.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026