Pro-Pac Packaging's (ASX:PPG) earnings have declined over five years, contributing to shareholders 60% loss

Pro-Pac Packaging Limited (ASX:PPG) shareholders should be happy to see the share price up 12% in the last week. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. In fact, the share price has declined rather badly, down some 69% in that time. So we're not so sure if the recent bounce should be celebrated. But it could be that the fall was overdone.

While the last five years has been tough for Pro-Pac Packaging shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

See our latest analysis for Pro-Pac Packaging

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Pro-Pac Packaging became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

In contrast to the share price, revenue has actually increased by 13% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

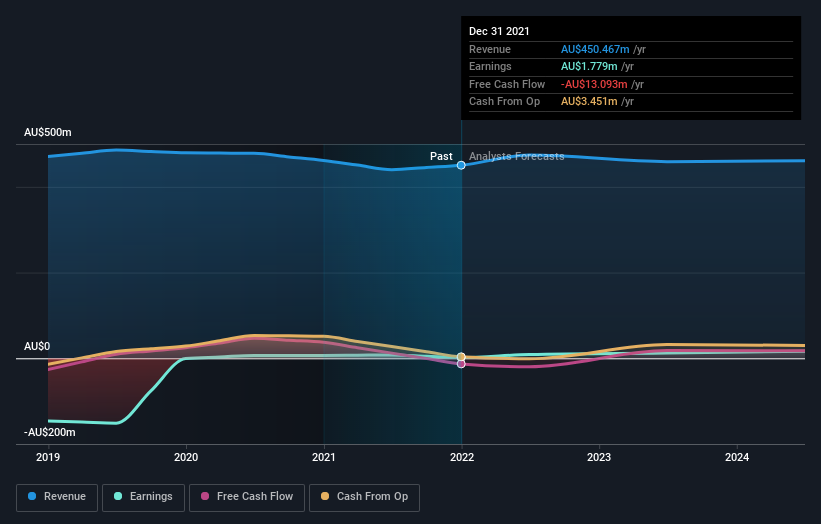

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how Pro-Pac Packaging has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Pro-Pac Packaging's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Pro-Pac Packaging shareholders, and that cash payout explains why its total shareholder loss of 60%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Investors in Pro-Pac Packaging had a tough year, with a total loss of 43%, against a market gain of about 13%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Pro-Pac Packaging better, we need to consider many other factors. To that end, you should learn about the 5 warning signs we've spotted with Pro-Pac Packaging (including 1 which is significant) .

We will like Pro-Pac Packaging better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:PPG

Pro-Pac Packaging

Manufactures and distributes flexible and industrial packaging products in Australia and New Zealand.

Slight risk and slightly overvalued.

Market Insights

Community Narratives