- Australia

- /

- Hospitality

- /

- ASX:CTD

ASX Insights Corporate Travel Management And 2 More Stocks Assessed Below Intrinsic Value

Reviewed by Simply Wall St

The Australian stock market has recently experienced a downturn, with the ASX200 closing down 1.3% at 7,786 points amid concerns over US tariffs on Aussie steel and aluminium. In such volatile conditions, identifying undervalued stocks can provide opportunities for investors seeking potential value plays. A good stock in this environment is often one that demonstrates strong fundamentals and resilience against broader market pressures, making it potentially attractive despite current challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Acrow (ASX:ACF) | A$1.035 | A$2.00 | 48.3% |

| Domino's Pizza Enterprises (ASX:DMP) | A$26.08 | A$52.05 | 49.9% |

| Champion Iron (ASX:CIA) | A$4.98 | A$9.16 | 45.7% |

| Nido Education (ASX:NDO) | A$0.885 | A$1.62 | 45.5% |

| Charter Hall Group (ASX:CHC) | A$16.20 | A$31.92 | 49.3% |

| SciDev (ASX:SDV) | A$0.43 | A$0.81 | 47.2% |

| Pantoro (ASX:PNR) | A$0.145 | A$0.28 | 48.2% |

| ReadyTech Holdings (ASX:RDY) | A$2.76 | A$5.19 | 46.8% |

| Superloop (ASX:SLC) | A$2.05 | A$3.74 | 45.2% |

| Adriatic Metals (ASX:ADT) | A$4.42 | A$8.23 | 46.3% |

Here's a peek at a few of the choices from the screener.

Corporate Travel Management (ASX:CTD)

Overview: Corporate Travel Management Limited is a travel management solutions company that oversees the procurement and delivery of travel services across Australia and New Zealand, North America, Asia, and Europe, with a market cap of A$2.02 billion.

Operations: The company's revenue segments include Travel Services in Asia (A$60.96 million), Europe (A$126.20 million), North America (A$319.90 million), and Australia and New Zealand (A$181.43 million).

Estimated Discount To Fair Value: 10.3%

Corporate Travel Management is trading at A$14.21, slightly below its fair value estimate of A$15.83, suggesting some undervaluation based on cash flows. Despite a decrease in profit margins from 15.3% to 9.2%, earnings are forecasted to grow significantly at over 20% annually, outpacing the broader Australian market's growth rate. The company completed a share buyback worth A$59.2 million and anticipates revenue growth of approximately 10% for fiscal year 2026, reflecting strategic financial management amidst fluctuating earnings performance.

- The growth report we've compiled suggests that Corporate Travel Management's future prospects could be on the up.

- Navigate through the intricacies of Corporate Travel Management with our comprehensive financial health report here.

Judo Capital Holdings (ASX:JDO)

Overview: Judo Capital Holdings Limited operates through its subsidiaries to provide a range of banking products and services tailored for small and medium businesses in Australia, with a market capitalization of A$2.05 billion.

Operations: Judo Capital Holdings Limited generates revenue of A$325.50 million from its banking segment, focusing on services for small and medium enterprises in Australia.

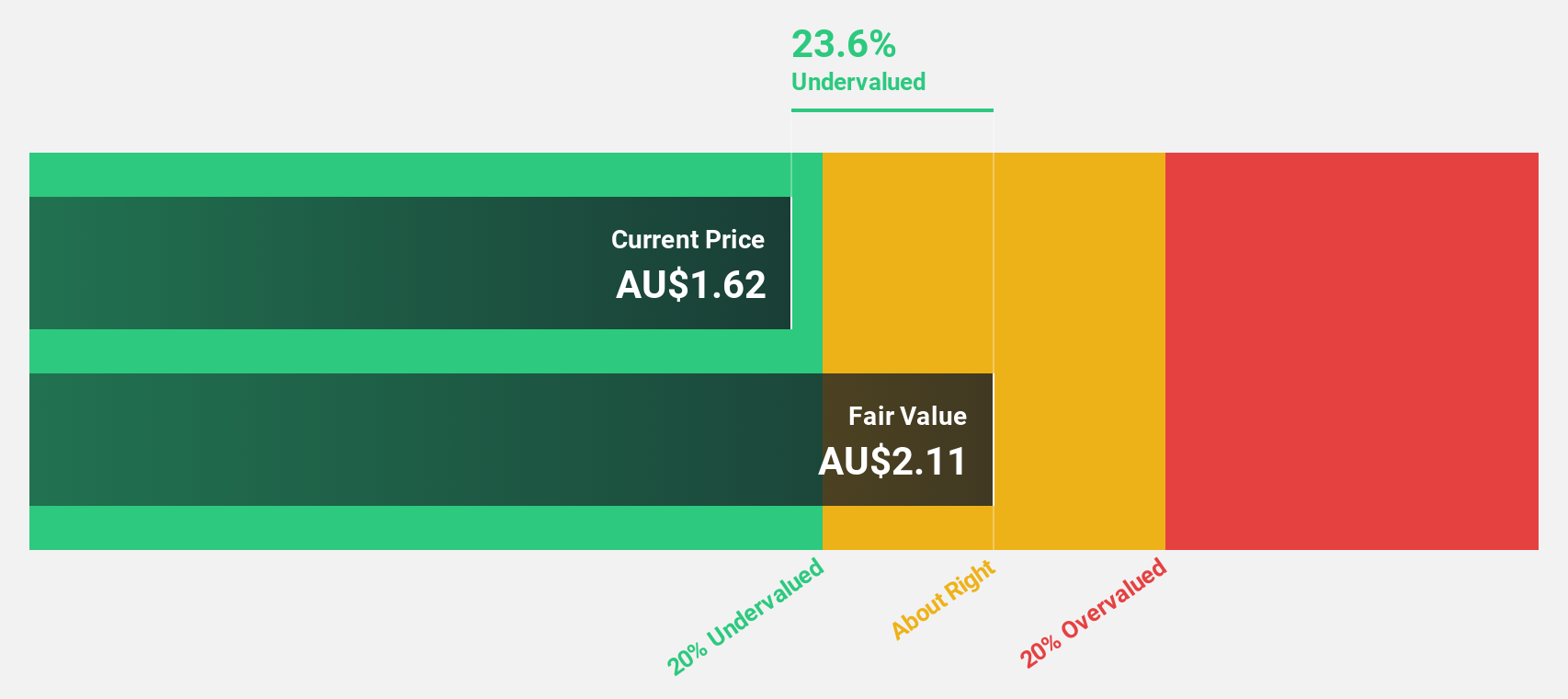

Estimated Discount To Fair Value: 10.5%

Judo Capital Holdings is trading at A$1.84, below its fair value estimate of A$2.05, indicating some undervaluation based on cash flows. Despite a slight decline in net income to A$40.9 million for H1 2025, earnings are projected to grow significantly at 29.6% annually, surpassing the Australian market's growth rate of 12.1%. However, recent insider selling and a forecasted low return on equity of 10.8% could be concerns for investors seeking strong financial metrics.

- According our earnings growth report, there's an indication that Judo Capital Holdings might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Judo Capital Holdings.

Pantoro (ASX:PNR)

Overview: Pantoro Limited, with a market cap of A$949.96 million, is involved in gold mining, processing, and exploration activities in Western Australia.

Operations: Pantoro Limited's revenue is primarily derived from its activities in gold mining, processing, and exploration within Western Australia.

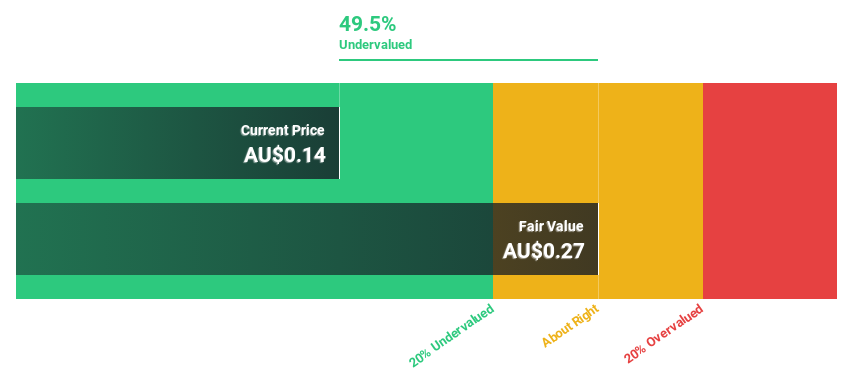

Estimated Discount To Fair Value: 48.2%

Pantoro Limited, trading at A$0.15, is significantly undervalued compared to its fair value estimate of A$0.28, with a promising earnings growth forecast of 50.32% annually as it moves toward profitability in three years. Recent earnings for H1 2024 showed a positive shift with sales rising to A$153.43 million and net income reaching A$6.62 million from a previous loss, despite past shareholder dilution concerns and low future return on equity projections (17.2%).

- Our comprehensive growth report raises the possibility that Pantoro is poised for substantial financial growth.

- Dive into the specifics of Pantoro here with our thorough financial health report.

Summing It All Up

- Take a closer look at our Undervalued ASX Stocks Based On Cash Flows list of 44 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CTD

Corporate Travel Management

A travel management solutions company, manages the procurement and delivery of travel services in Australia and New Zealand, North America, Asia, and Europe.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives