ASX Stocks That May Be Trading Below Their Estimated Value In May 2025

Reviewed by Simply Wall St

As the ASX200 prepares to open over one percent higher, despite mixed signals from Wall Street, investors are closely watching economic data and trade uncertainties that continue to shape market sentiment. In this environment, identifying stocks that may be trading below their estimated value can offer potential opportunities for those looking to navigate the complexities of the current market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Smart Parking (ASX:SPZ) | A$0.95 | A$1.78 | 46.6% |

| Lynas Rare Earths (ASX:LYC) | A$7.66 | A$13.43 | 43% |

| Austal (ASX:ASB) | A$5.06 | A$9.20 | 45% |

| Charter Hall Group (ASX:CHC) | A$18.30 | A$34.25 | 46.6% |

| SciDev (ASX:SDV) | A$0.365 | A$0.68 | 46.4% |

| Polymetals Resources (ASX:POL) | A$0.83 | A$1.52 | 45.4% |

| Genesis Minerals (ASX:GMD) | A$3.84 | A$6.75 | 43.1% |

| Sandfire Resources (ASX:SFR) | A$10.73 | A$21.13 | 49.2% |

| PointsBet Holdings (ASX:PBH) | A$1.095 | A$2.08 | 47.2% |

| Superloop (ASX:SLC) | A$2.48 | A$4.52 | 45.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Judo Capital Holdings (ASX:JDO)

Overview: Judo Capital Holdings Limited, with a market cap of A$1.55 billion, provides banking products and services tailored for small and medium businesses in Australia through its subsidiaries.

Operations: Judo Capital Holdings derives its revenue primarily from its banking segment, which generated A$325.50 million.

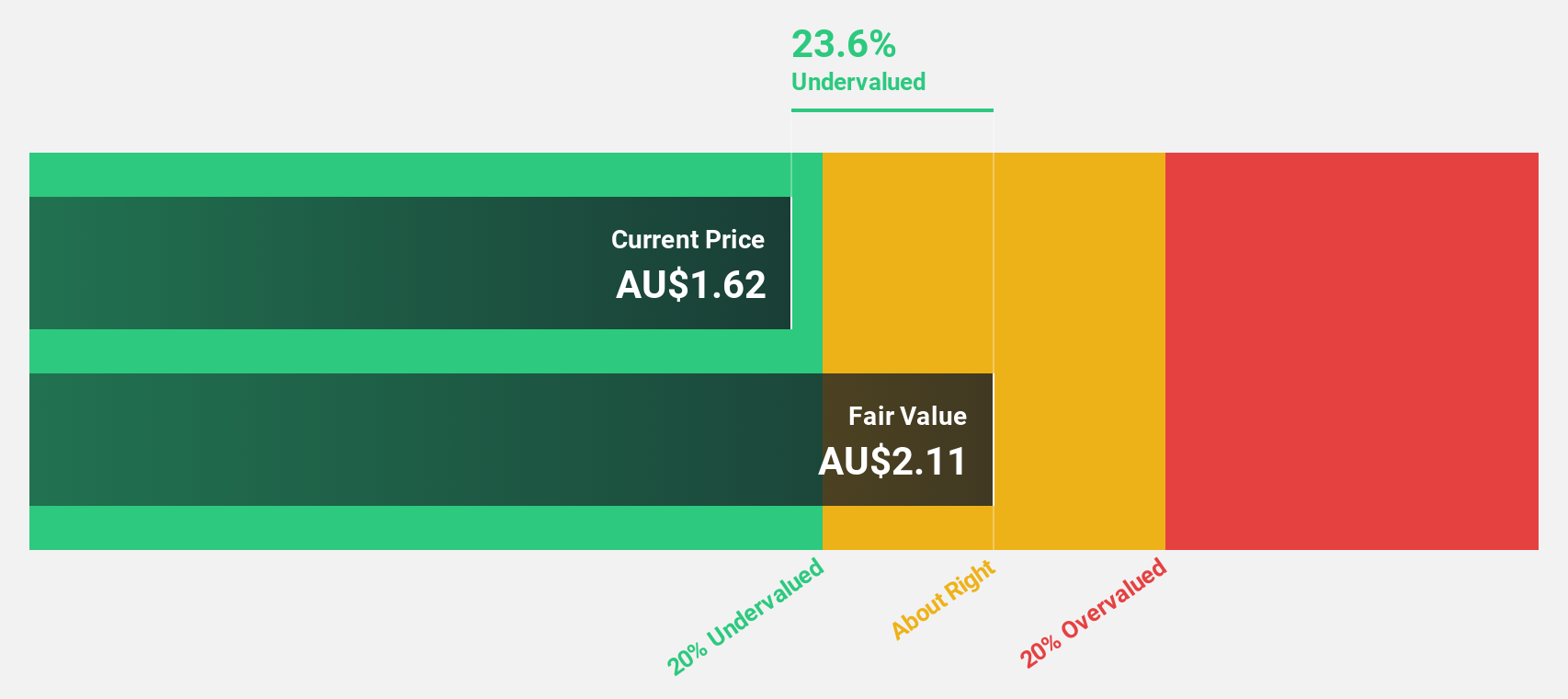

Estimated Discount To Fair Value: 26%

Judo Capital Holdings is trading at A$1.39, significantly below its estimated fair value of A$1.88, highlighting potential undervaluation based on cash flows. Despite significant insider selling recently, the company's earnings are forecast to grow 28.15% annually over the next three years, outpacing the Australian market's average growth rate of 11.7%. However, its Return on Equity is expected to remain low at 10.1% in three years, which may be a concern for some investors.

- Upon reviewing our latest growth report, Judo Capital Holdings' projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Judo Capital Holdings.

Pantoro Gold (ASX:PNR)

Overview: Pantoro Gold Limited, with a market cap of A$1.25 billion, is involved in gold mining, processing, and exploration activities in Western Australia.

Operations: Pantoro Gold Limited's revenue primarily comes from the Norseman Gold Project, generating A$289.11 million.

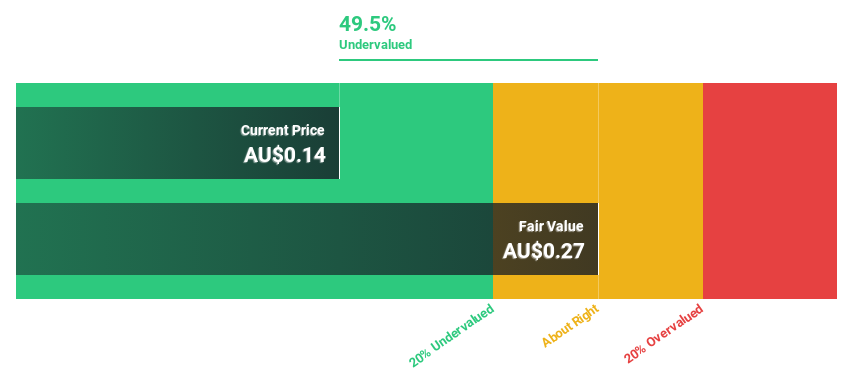

Estimated Discount To Fair Value: 40.8%

Pantoro Gold is trading at A$3.21, considerably below its estimated fair value of A$5.42, suggesting undervaluation based on cash flows. The company reported a significant turnaround with net income of A$6.62 million for the half year ended December 2024, compared to a loss previously. Earnings are projected to grow annually by 57.28%, and it is expected to become profitable in three years with a high forecasted Return on Equity of 21.4%.

- Our comprehensive growth report raises the possibility that Pantoro Gold is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Pantoro Gold stock in this financial health report.

Superloop (ASX:SLC)

Overview: Superloop Limited operates as a telecommunications and internet service provider in Australia with a market cap of A$1.27 billion.

Operations: Superloop's revenue is derived from three main segments: Business (A$103.63 million), Consumer (A$316.02 million), and Wholesale (A$60.05 million).

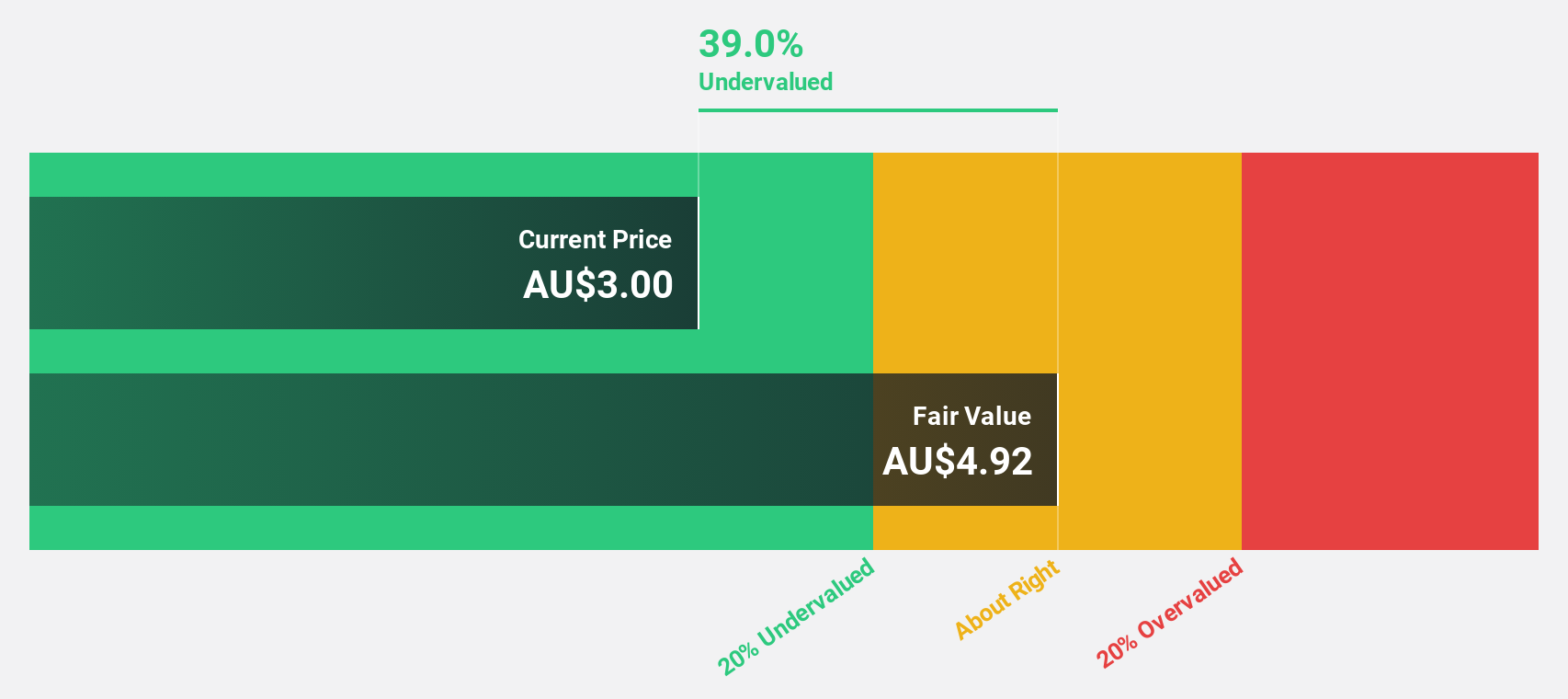

Estimated Discount To Fair Value: 45.1%

Superloop, trading at A$2.48, is significantly undervalued based on cash flows with an estimated fair value of A$4.52. Despite reporting a net loss of A$7.78 million for the half year ended December 2024, this marks an improvement from the previous year's larger loss. Earnings are forecast to grow by 53.1% annually and become profitable within three years, with revenue growth expected to outpace the broader Australian market at 13.4% per year.

- The growth report we've compiled suggests that Superloop's future prospects could be on the up.

- Take a closer look at Superloop's balance sheet health here in our report.

Next Steps

- Click through to start exploring the rest of the 34 Undervalued ASX Stocks Based On Cash Flows now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SLC

Superloop

Operates as a telecommunications and internet service provider in Australia.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives