- Australia

- /

- Metals and Mining

- /

- ASX:GMD

ASX Penny Stock Highlights For July 2025

Reviewed by Simply Wall St

The Australian market has remained flat over the past week but has shown a 6.9% increase over the last year, with earnings projected to grow by 11% annually in the coming years. Despite their vintage name, penny stocks represent smaller or less-established companies that can offer significant value when chosen wisely. By focusing on those with strong financial foundations and growth potential, investors may uncover opportunities for both stability and upside in this niche area of investment.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.375 | A$107.47M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.21 | A$104.25M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.59 | A$112.49M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.05 | A$470.25M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.31 | A$2.63B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.77 | A$468M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.58 | A$867.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$842.94M | ✅ 5 ⚠️ 3 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.85 | A$149.01M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 458 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Genesis Minerals (ASX:GMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Genesis Minerals Limited focuses on the exploration, production, and development of gold deposits in Western Australia with a market cap of A$4.59 billion.

Operations: The company generates revenue of A$561.40 million from its mineral production, exploration, and development activities.

Market Cap: A$4.59B

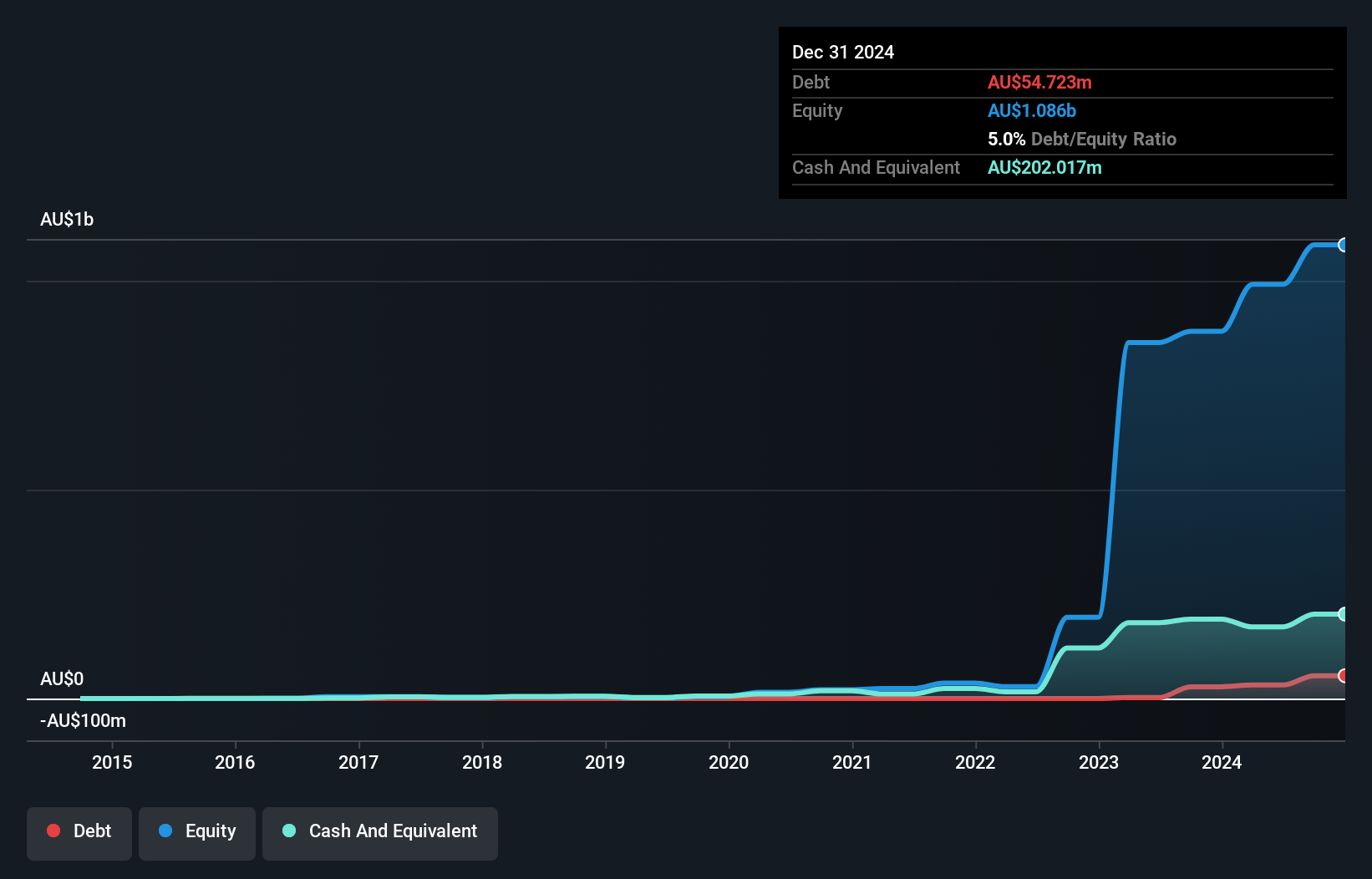

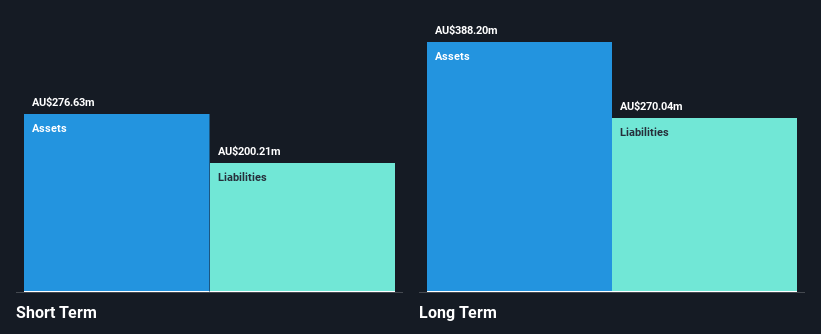

Genesis Minerals Limited has shown promising developments as it transitions into profitability, with earnings forecasted to grow significantly. The company maintains a strong balance sheet, with short-term assets exceeding both short and long-term liabilities. Despite a low return on equity of 11%, Genesis trades below its estimated fair value, indicating potential upside. Recent executive changes include the appointment of Jane Macey as a Non-Executive Director, bringing extensive industry experience which could enhance strategic direction. While the board's average tenure is relatively short at 2.8 years, management stability and high-quality earnings bolster investor confidence in this evolving entity.

- Take a closer look at Genesis Minerals' potential here in our financial health report.

- Explore Genesis Minerals' analyst forecasts in our growth report.

IVE Group (ASX:IGL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IVE Group Limited operates in the marketing industry in Australia, with a market capitalization of A$470.25 million.

Operations: The company generates revenue of A$975.43 million from its advertising segment.

Market Cap: A$470.25M

IVE Group Limited has demonstrated robust earnings growth, with a 179.7% increase over the past year, significantly outpacing the media industry's average. Despite a high net debt to equity ratio of 56%, its debt is well covered by operating cash flow at 76.8%. The company's seasoned management and board contribute to strategic stability, while short-term assets comfortably cover both short and long-term liabilities. Trading at nearly 70% below its estimated fair value suggests potential undervaluation. However, investors should note the unstable dividend track record and low return on equity of 19.9%.

- Dive into the specifics of IVE Group here with our thorough balance sheet health report.

- Understand IVE Group's earnings outlook by examining our growth report.

Pantoro Gold (ASX:PNR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pantoro Gold Limited, with a market cap of A$1.18 billion, is involved in gold mining, processing, and exploration activities in Western Australia.

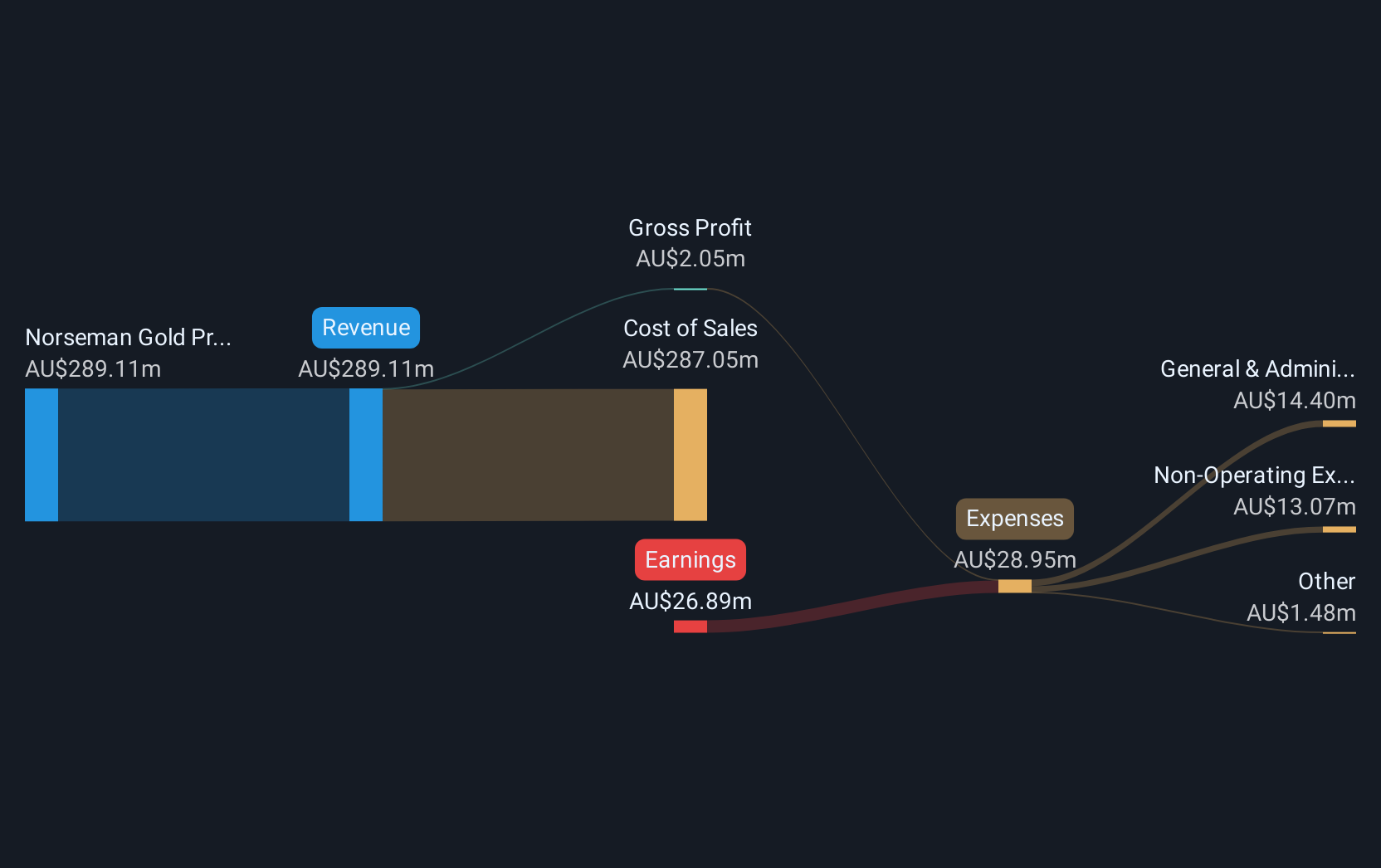

Operations: The company's revenue is primarily derived from the Norseman Gold Project, which generated A$289.11 million.

Market Cap: A$1.18B

Pantoro Gold Limited, with a market cap of A$1.18 billion, is focused on gold mining in Western Australia. The company has not yet reached profitability and its losses have increased by 32% annually over the past five years. Despite this, Pantoro's short-term assets of A$128.9 million exceed both its short and long-term liabilities, ensuring financial stability in the near term. Additionally, it maintains a positive free cash flow with a sufficient cash runway for over three years even if cash flow shrinks by 23.6% annually. The management team is seasoned with an average tenure of 10.8 years.

- Click to explore a detailed breakdown of our findings in Pantoro Gold's financial health report.

- Examine Pantoro Gold's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Embark on your investment journey to our 458 ASX Penny Stocks selection here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GMD

Genesis Minerals

Engages in the gold mining, project development and exploration activities in Western Australia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives