Those who invested in Orica (ASX:ORI) three years ago are up 38%

One simple way to benefit from the stock market is to buy an index fund. But if you choose individual stocks with prowess, you can make superior returns. For example, Orica Limited (ASX:ORI) shareholders have seen the share price rise 28% over three years, well in excess of the market return (12%, not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 22%, including dividends.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

View our latest analysis for Orica

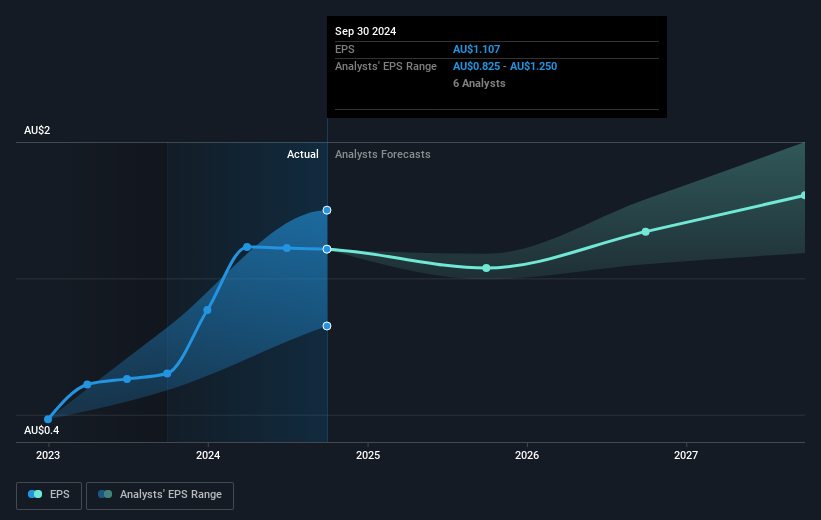

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Orica moved from a loss to profitability. That would generally be considered a positive, so we'd expect the share price to be up.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how Orica has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Orica's financial health with this free report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Orica the TSR over the last 3 years was 38%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Orica shareholders have received returns of 22% over twelve months (even including dividends), which isn't far from the general market return. To take a positive view, the gain is pleasing, and it sure beats annualized TSR loss of 2%, which was endured over half a decade. We're pretty skeptical of turnaround stories, but it's good to see the recent share price recovery. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Orica is showing 2 warning signs in our investment analysis , you should know about...

Of course Orica may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ORI

Orica

Manufactures, distributes, and sells commercial blasting systems, explosives, mining and tunnelling support systems, and various chemical products and services in Australia, Peru, Canada, the United States, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives