Orica (ASX:ORI) shareholders have earned a 15% CAGR over the last three years

One simple way to benefit from the stock market is to buy an index fund. But if you choose individual stocks with prowess, you can make superior returns. For example, Orica Limited (ASX:ORI) shareholders have seen the share price rise 40% over three years, well in excess of the market return (1.6%, not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 23% in the last year, including dividends.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for Orica

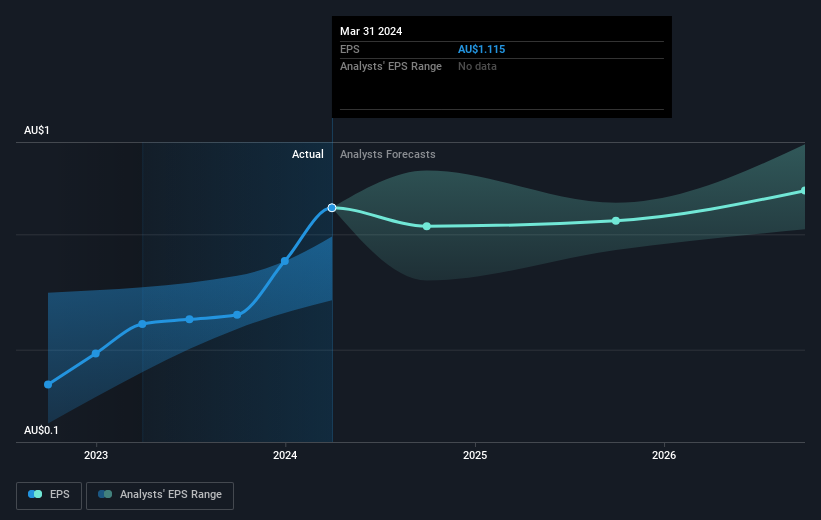

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During three years of share price growth, Orica moved from a loss to profitability. So we would expect a higher share price over the period.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Orica has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Orica's financial health with this free report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Orica the TSR over the last 3 years was 51%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Orica shareholders have received a total shareholder return of 23% over one year. And that does include the dividend. That certainly beats the loss of about 0.7% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Orica better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Orica , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ORI

Orica

Manufactures, distributes, and sells commercial blasting systems, explosives, mining and tunnelling support systems, and various chemical products and services in Australia, Peru, Canada, the United States, and internationally.

Excellent balance sheet and good value.