- Australia

- /

- Real Estate

- /

- ASX:UOS

ASX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The Australian market has been experiencing a notable upswing, with the ASX200 closing up 0.28% at 8417 points and reaching an all-time high in intra-day trading. In this context of market growth, investors might find opportunities beyond well-known companies by exploring penny stocks—traditionally smaller or newer firms that can offer unique investment potential. While the term 'penny stocks' may seem dated, these investments continue to be relevant for those seeking affordability and growth potential, especially when they show strong financial fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.80 | A$148.62M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.585 | A$69.16M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.83 | A$239.61M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.965 | A$327.26M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.525 | A$328.68M | ★★★★★☆ |

| IPD Group (ASX:IPG) | A$3.69 | A$433.44M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.66 | A$808.63M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$2.10 | A$117.1M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.1525 | A$67.53M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.445 | A$86.23M | ★★★★★★ |

Click here to see the full list of 1,046 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Piedmont Lithium (ASX:PLL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Piedmont Lithium Inc. is a development stage company focused on the exploration and development of resource projects in the United States, with a market cap of A$359.60 million.

Operations: The company generates revenue of $46.98 million from its mineral exploration and development activities.

Market Cap: A$359.6M

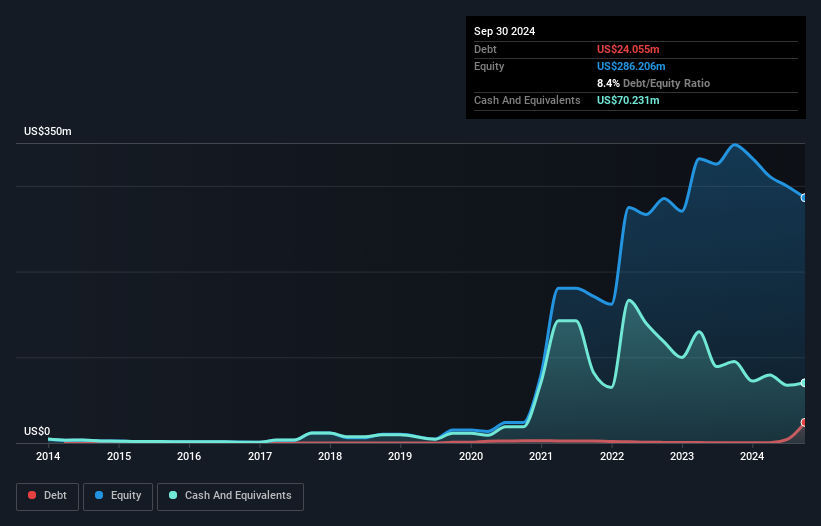

Piedmont Lithium has recently completed a follow-on equity offering of A$40 million, which may bolster its cash position amidst ongoing financial challenges. Despite being unprofitable with increasing losses over the past five years, the company maintains more cash than debt and has sufficient short-term assets to cover liabilities. The recent merger agreement with Sayona Mining Limited valued at approximately $260 million could provide strategic advantages if approved. However, Piedmont's share price remains highly volatile and trading significantly below estimated fair value, reflecting market uncertainty about its future prospects.

- Get an in-depth perspective on Piedmont Lithium's performance by reading our balance sheet health report here.

- Learn about Piedmont Lithium's future growth trajectory here.

PolyNovo (ASX:PNV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices in the United States, Australia, New Zealand, and internationally with a market cap of A$1.37 billion.

Operations: The company's revenue of A$103.23 million is generated from the development, manufacturing, and commercialisation of its NovoSorb Technology.

Market Cap: A$1.37B

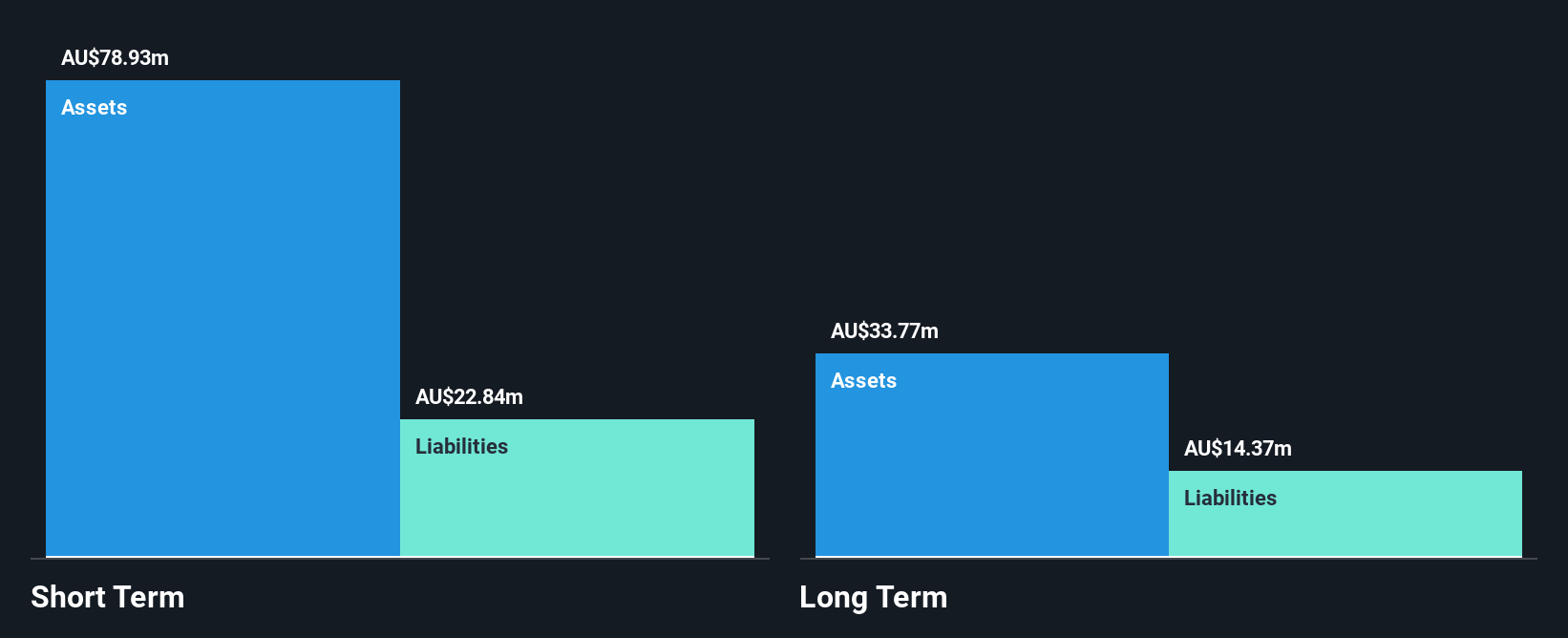

PolyNovo Limited has seen significant developments, becoming profitable this year with high-quality earnings and operating cash flow that comfortably covers its debt. The company holds more cash than its total debt, and short-term assets exceed both short and long-term liabilities. Despite a low return on equity of 7.3%, the stock is trading below estimated fair value, suggesting potential undervaluation. Recent changes include adopting a new constitution and board adjustments following the retirement of a long-serving director. These shifts may influence future governance dynamics as PolyNovo continues leveraging its NovoSorb Technology for revenue growth across international markets.

- Dive into the specifics of PolyNovo here with our thorough balance sheet health report.

- Explore PolyNovo's analyst forecasts in our growth report.

United Overseas Australia (ASX:UOS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: United Overseas Australia Ltd, along with its subsidiaries, is involved in the development and resale of land and buildings across Malaysia, Singapore, Vietnam, and Australia, with a market cap of A$917.59 million.

Operations: The company's revenue primarily comes from its investment activities, which generated A$604.42 million, and land development and resale operations, contributing A$250.14 million.

Market Cap: A$917.59M

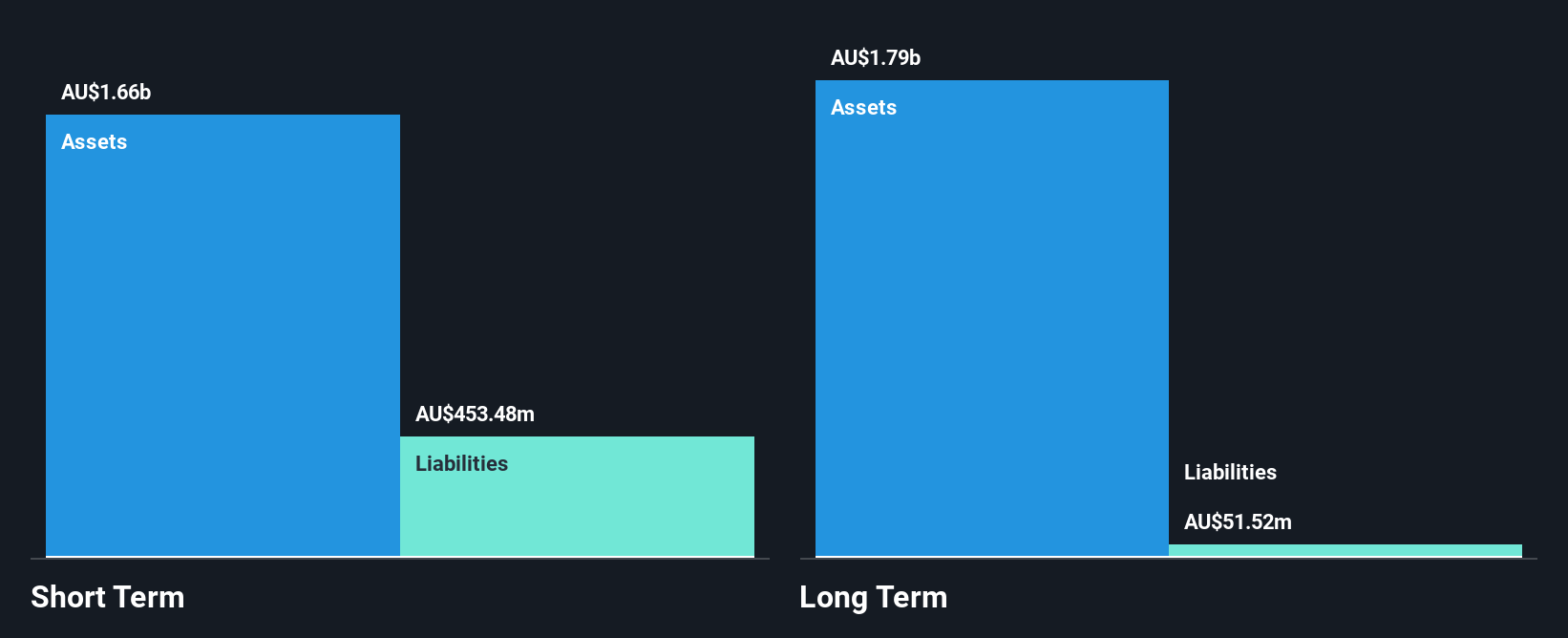

United Overseas Australia's financial position is marked by stable earnings growth, with a net income of A$33.92 million for the half year ending June 2024, slightly up from the previous year. The company maintains strong liquidity, evidenced by short-term assets of A$1.4 billion surpassing its liabilities and more cash than debt. However, shareholders faced dilution with a 3% increase in total shares outstanding over the past year. Despite a low return on equity at 4.8%, UOS trades below its estimated fair value and continues to distribute dividends, reflecting steady operational performance amidst industry challenges.

- Unlock comprehensive insights into our analysis of United Overseas Australia stock in this financial health report.

- Evaluate United Overseas Australia's historical performance by accessing our past performance report.

Key Takeaways

- Gain an insight into the universe of 1,046 ASX Penny Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:UOS

United Overseas Australia

Engages in the development and resale of land and buildings in Malaysia, Singapore, Vietnam, and Australia.

Excellent balance sheet and fair value.