- Australia

- /

- Metals and Mining

- /

- ASX:AKE

Here's Why Orocobre Limited's (ASX:ORE) CEO Compensation Is The Least Of Shareholders' Concerns

Orocobre Limited (ASX:ORE) has exhibited strong share price growth in the past few years. However, its earnings growth has not kept up, suggesting that there may be something amiss. The upcoming AGM on 30 November 2021 may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

See our latest analysis for Orocobre

Comparing Orocobre Limited's CEO Compensation With the industry

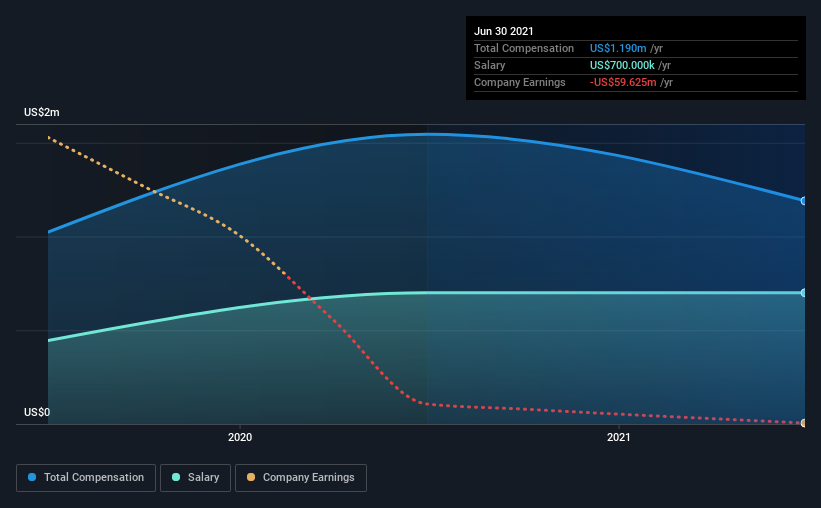

Our data indicates that Orocobre Limited has a market capitalization of AU$6.2b, and total annual CEO compensation was reported as US$1.2m for the year to June 2021. We note that's a decrease of 23% compared to last year. In particular, the salary of US$700.0k, makes up a fairly large portion of the total compensation being paid to the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between AU$2.8b and AU$8.8b had a median total CEO compensation of US$1.6m. From this we gather that Martin de Solay is paid around the median for CEOs in the industry. Moreover, Martin de Solay also holds AU$3.3m worth of Orocobre stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | US$700k | US$700k | 59% |

| Other | US$490k | US$845k | 41% |

| Total Compensation | US$1.2m | US$1.5m | 100% |

Talking in terms of the industry, salary represented approximately 59% of total compensation out of all the companies we analyzed, while other remuneration made up 41% of the pie. Although there is a difference in how total compensation is set, Orocobre more or less reflects the market in terms of setting the salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Orocobre Limited's Growth

Orocobre Limited has reduced its earnings per share by 91% a year over the last three years. It achieved revenue growth of 10.0% over the last year.

Few shareholders would be pleased to read that EPS have declined. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Orocobre Limited Been A Good Investment?

Most shareholders would probably be pleased with Orocobre Limited for providing a total return of 137% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 2 warning signs for Orocobre (of which 1 is concerning!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:AKE

Allkem

Allkem Limited engages in the production and sale of lithium and boron in Argentina.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives