- Australia

- /

- Metals and Mining

- /

- ASX:OBM

Ora Banda Mining (ASX:OBM) Valuation Reflects Strong Waihi Drilling Results and Robust Annual Earnings Growth

Reviewed by Simply Wall St

Ora Banda Mining (ASX:OBM) is turning heads after releasing a wave of positive news including exceptional drilling results at the Waihi deposit. For shareholders and prospective investors alike, a resource upgrade can be a game-changer. With both revenue and net income climbing sharply in the latest annual results, there is plenty here to dig into. The combination of operational progress and financial momentum is drawing extra scrutiny to the stock, and questions about just how much upside remains are beginning to surface.

Looking at recent price moves, it is clear that interest has accelerated. Over the past month alone, Ora Banda Mining shares have jumped more than 62%, capping off a transformation that has seen the stock nearly double in the past year. This surge follows not just the drilling update, but also a full-year earnings result that showed significant growth compared to last year, reinforcing an impression of momentum building around the company’s story.

After such a rapid run-up, is Ora Banda Mining now a bargain with more room to grow, or is the market already pricing in all the good news and future resource potential?

Price-to-Earnings of 11.6x: Is it justified?

Based on the price-to-earnings (PE) multiple, Ora Banda Mining appears undervalued compared to both its industry peers and the wider sector averages.

The PE ratio is a widely used metric that compares a company's share price against its annual net earnings, giving investors a simple gauge of how much they are paying for each dollar of profit. For mining companies, this ratio helps assess how favorably the market is treating current and expected profitability in an industry known for cyclical swings.

Ora Banda Mining’s current PE of 11.6x stands well below both the Australian Metals and Mining industry average of 16.2x and the peer average of 50.9x. This suggests that the market is not fully pricing in the company's strong recent earnings surge or its standout growth relative to competitors. The lower multiple might imply market skepticism around sustaining the recent profit jump, but for now, the numbers paint a picture of relative value.

Result: Fair Value of $1.29 (UNDERVALUED)

See our latest analysis for Ora Banda Mining.However, softening net income growth and a recent price target that is below current levels could challenge perceptions of ongoing upside for the stock.

Find out about the key risks to this Ora Banda Mining narrative.Another View: What Does the SWS DCF Model Say?

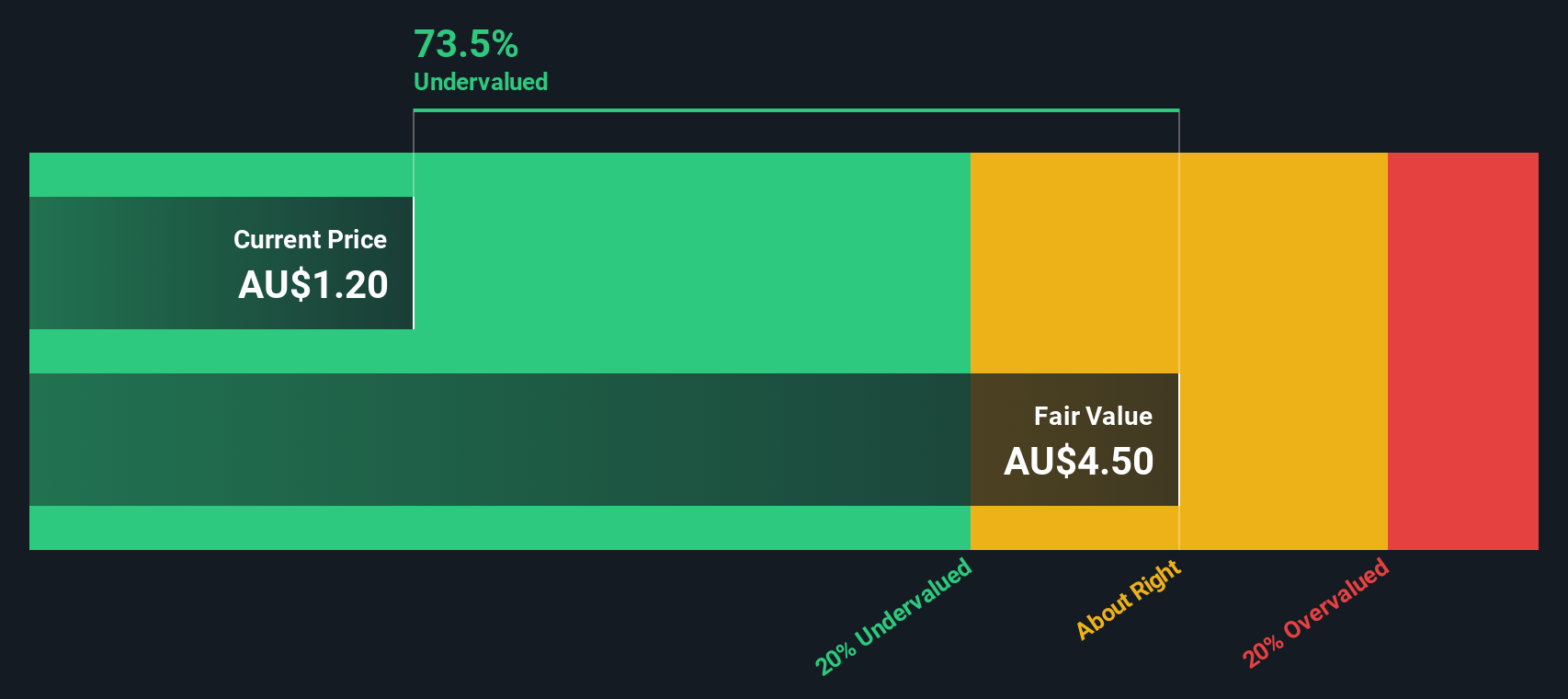

Looking beyond simple ratios, our DCF model takes a long-term perspective and also points to the stock trading below estimated fair value. However, could this generous outlook be missing something about the company’s risks or future trends?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Ora Banda Mining to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Ora Banda Mining Narrative

If you want to dig deeper or see things from your own perspective, you can build your personal analysis in just a few minutes. Do it your way.

A great starting point for your Ora Banda Mining research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Standout Investment Ideas?

Feel confident moving beyond the obvious opportunities. Unlock powerful stock ideas curated by Simply Wall Street’s expert screeners and stay ahead of the market's next big moves.

- Capture rare value plays that have strong cash flow yet remain under the radar with our tool for finding undervalued stocks based on cash flows.

- Spot future industry leaders at the crossroads of healthcare and tech innovation by searching for healthcare AI stocks.

- Push your strategy forward with tomorrow’s technology disruptors when you analyze quantum computing stocks, setting the pace for quantum breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ASX:OBM

Ora Banda Mining

Engages in the exploration, operation, and development of mineral properties and mining in Australia.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives