- Australia

- /

- Metals and Mining

- /

- ASX:CYL

Catalyst Metals And 2 Other Undiscovered Gems with Strong Fundamentals

Reviewed by Simply Wall St

As the Australian market navigates through a period of cautious optimism, with the ASX200 inching up by 0.5% amidst ongoing speculation about the Reserve Bank of Australia's impending rate decision, investors are keenly observing sectors like IT and Staples that have shown robust performance. In this context, identifying stocks with strong fundamentals becomes crucial for those looking to capitalize on potential opportunities; Catalyst Metals and two other lesser-known companies stand out as promising contenders in today's dynamic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Schaffer | 24.98% | 2.97% | -6.23% | ★★★★★★ |

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Bailador Technology Investments | NA | 11.17% | 10.16% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| K&S | 16.07% | 0.09% | 33.40% | ★★★★☆☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Catalyst Metals (ASX:CYL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Catalyst Metals Limited engages in the exploration and evaluation of mineral properties in Australia, with a market capitalization of approximately A$942.35 million.

Operations: Catalyst Metals generates revenue primarily from its operations in Western Australia (A$243.77 million) and Tasmania (A$75.08 million).

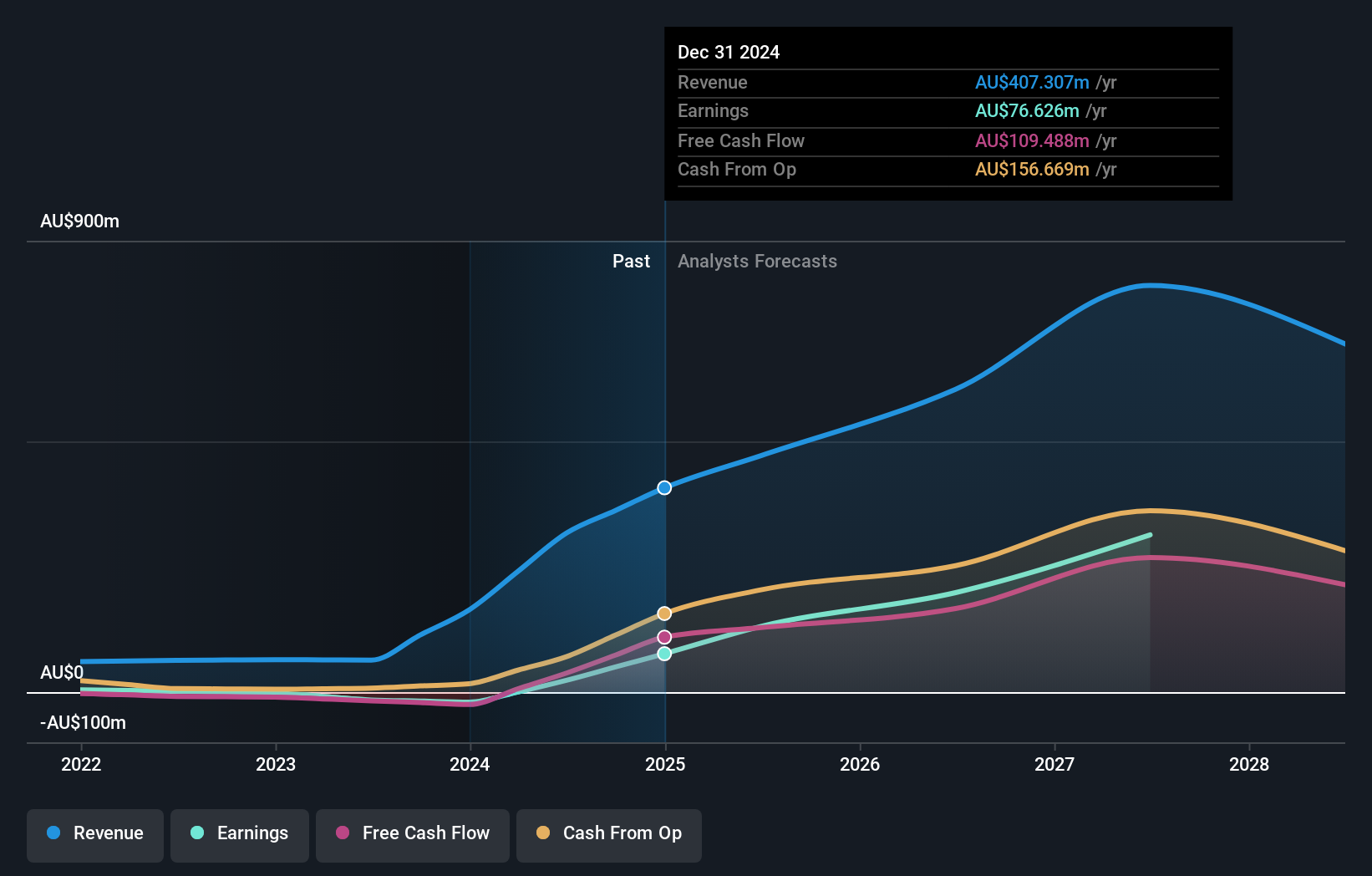

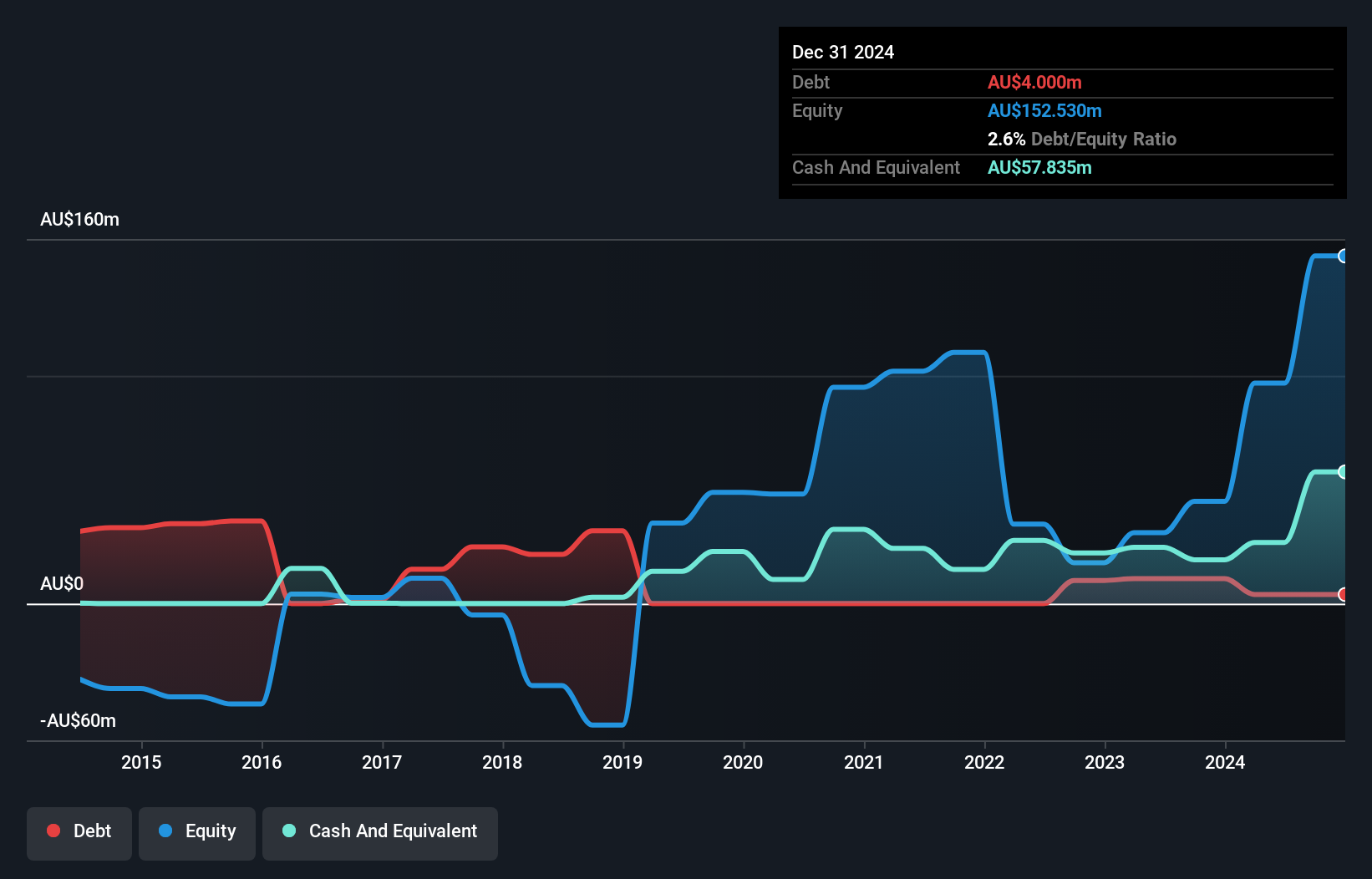

Catalyst Metals, a promising player in the Australian mining sector, has shown noteworthy progress recently. The company reported gold production of 28.4koz for the December 2024 quarter, with Henty contributing 6.6koz and Plutonic delivering 21.8koz. Trading at a significant discount of 55% below its estimated fair value, Catalyst seems undervalued in the market. Its debt is well-covered by EBIT at a ratio of 6x, and it holds more cash than total debt, indicating strong financial health despite an increase in its debt to equity ratio from 0% to 1.8% over five years.

Generation Development Group (ASX:GDG)

Simply Wall St Value Rating: ★★★★★★

Overview: Generation Development Group Limited is an Australian company that focuses on the marketing and management of life insurance and life investment products and services, with a market capitalization of A$1.46 billion.

Operations: Generation Development Group's revenue primarily comes from Benefit Funds, contributing A$316.26 million, and Benefit Funds Management & Funds Administration, adding A$37.26 million. The company's net profit margin shows a significant trend worth noting at 20%.

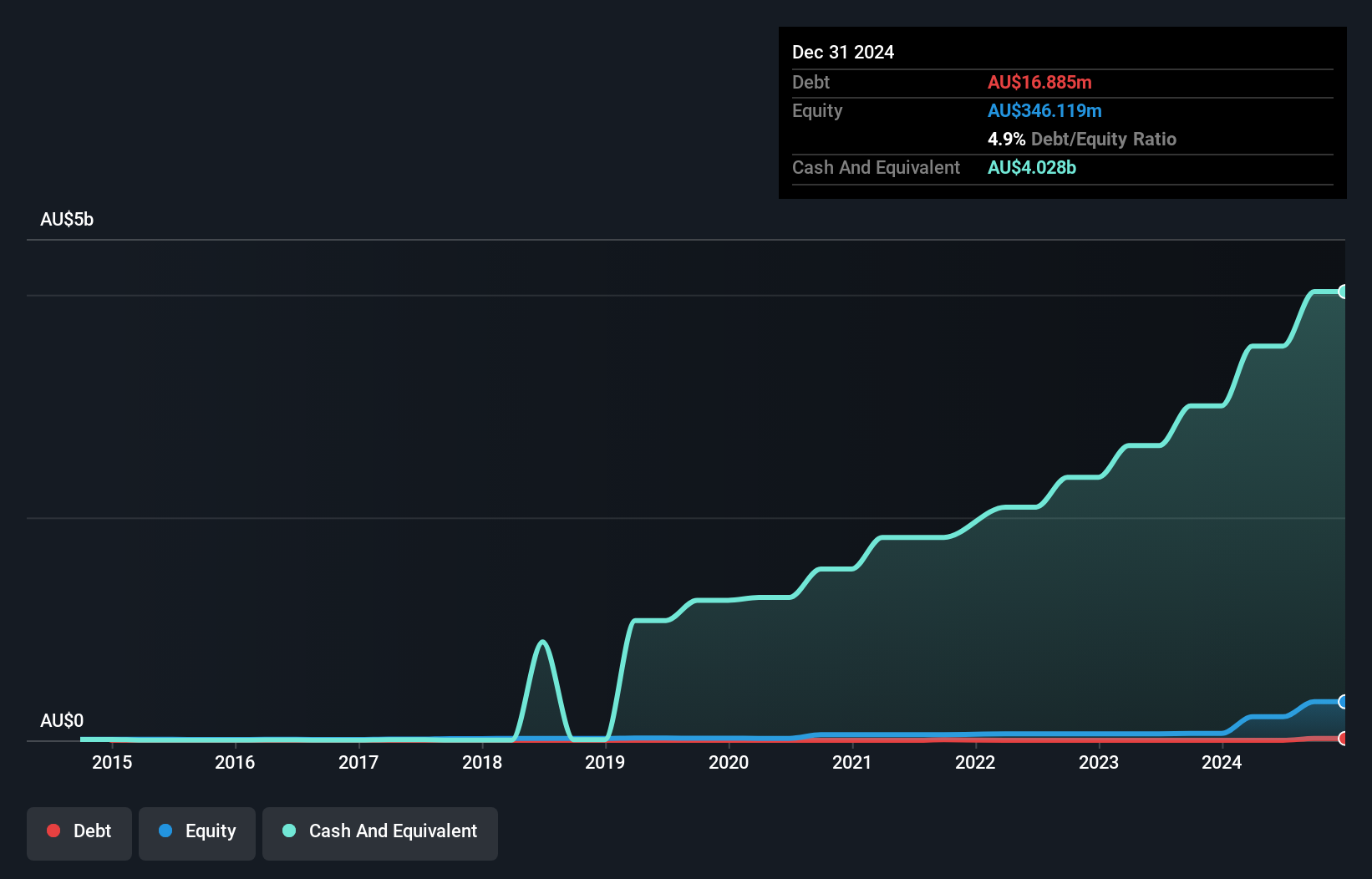

Generation Development Group, an intriguing player in the Australian market, operates debt-free and showcases robust financial health. With earnings growth of 30.3% last year, it outpaced the insurance industry average of 25.4%. Despite substantial shareholder dilution recently due to a follow-on equity offering worth A$287.93 million, its forecasted annual earnings growth is a promising 42.47%. The recent acquisition of Evidentia Group Holdings Pty Ltd and leadership changes with Grant Hackett as CEO reflect strategic maneuvers aimed at future expansion. These moves suggest GDG's intent to strengthen its position while leveraging high-quality earnings for sustained success.

Ora Banda Mining (ASX:OBM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ora Banda Mining Limited focuses on the exploration, operation, and development of mineral properties in Australia with a market capitalization of A$1.79 billion.

Operations: Ora Banda Mining generates revenue primarily from gold mining, amounting to A$214.24 million.

Ora Banda Mining, a small player in the Australian mining sector, has recently turned profitable, contrasting with the industry’s modest 0.7% growth. Trading at a significant discount of 56.6% below its estimated fair value, OBM presents an intriguing opportunity for investors seeking undervalued assets. The company's interest payments are well covered by EBIT at 7.8 times over, reflecting strong financial management despite its debt to equity ratio rising to 4.1% over five years. With earnings projected to grow annually by nearly 45%, OBM seems positioned for promising future performance within the metals and mining landscape.

- Unlock comprehensive insights into our analysis of Ora Banda Mining stock in this health report.

Understand Ora Banda Mining's track record by examining our Past report.

Next Steps

- Delve into our full catalog of 49 ASX Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CYL

Catalyst Metals

Engages in the mineral exploration and evaluation in Australia.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion