- Australia

- /

- Construction

- /

- ASX:CVL

American Rare Earths Leads Our ASX Penny Stock Spotlight

Reviewed by Simply Wall St

The Australian market has been trading steadily, with materials leading the charge thanks to strong iron ore prices, while industrials and discretionary sectors have lagged. Amid these conditions, investors often look beyond the major indices for opportunities in smaller companies. Penny stocks, though an older term, still represent a viable investment area by highlighting lesser-known companies that can offer substantial value when backed by solid financial health.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.38 | A$108.9M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.15 | A$101.42M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.605 | A$115.35M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.98 | A$459.46M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.30 | A$2.62B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.73 | A$457.43M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.65 | A$891M | ✅ 4 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.66 | A$813.53M | ✅ 5 ⚠️ 3 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.84 | A$148.2M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 460 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

American Rare Earths (ASX:ARR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: American Rare Earths Limited focuses on the exploration and development of mineral resources in Australia and the United States, with a market cap of A$147.15 million.

Operations: American Rare Earths Limited does not report any specific revenue segments.

Market Cap: A$147.15M

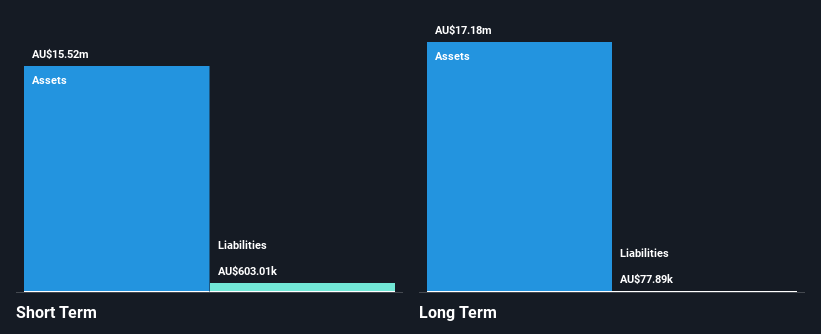

American Rare Earths Limited, with a market cap of A$147.15 million, is pre-revenue and focused on advancing its Halleck Creek Project in Wyoming. Recent milestones include successful leach testing for the Cowboy State Mine, crucial for the project's pre-feasibility study and optimal processing conditions. The company benefits from simplified state permitting processes, enhancing its strategic position in reducing U.S. reliance on rare earth imports. Despite being unprofitable with increasing losses over five years, it remains debt-free with sufficient short-term assets to cover liabilities and a stable cash runway exceeding one year under current conditions.

- Click here and access our complete financial health analysis report to understand the dynamics of American Rare Earths.

- Learn about American Rare Earths' historical performance here.

Civmec (ASX:CVL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Civmec Limited is an investment holding company that offers construction and engineering services across the energy, resources, infrastructure, marine, and defense sectors in Australia, with a market capitalization of A$594.98 million.

Operations: Civmec generates its revenue from three main segments: Resources (A$864.53 million), Infrastructure, Marine & Defence (A$140.68 million), and Energy (A$38.78 million).

Market Cap: A$594.98M

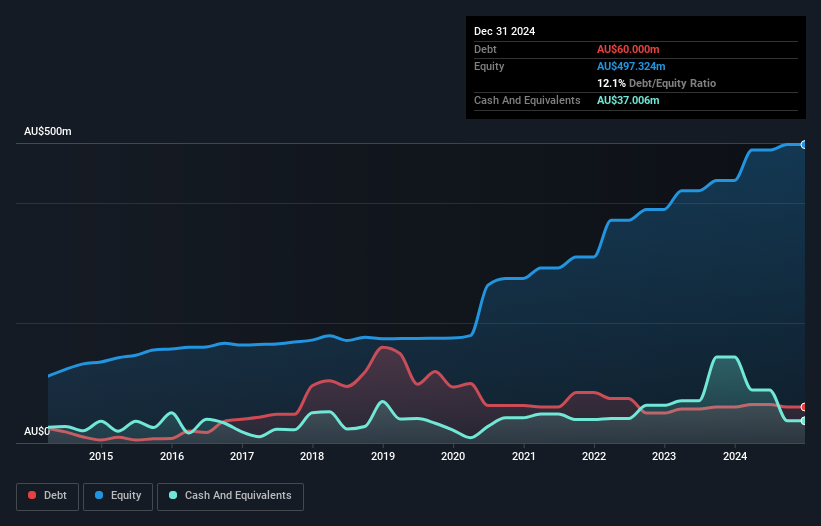

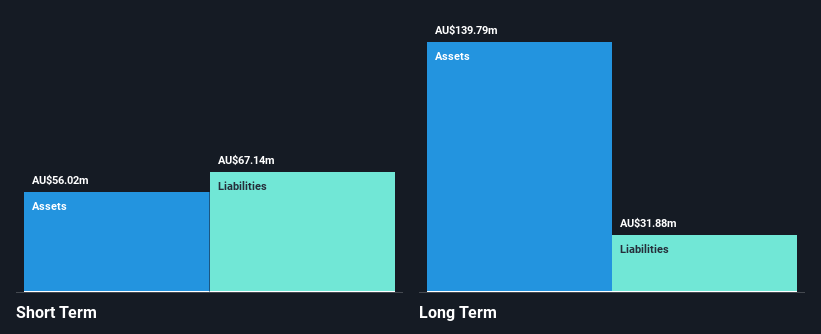

Civmec Limited, with a market cap of A$594.98 million, has recently secured several significant contracts valued at approximately A$285 million, including major projects like the Port Waratah shiploader and Eneabba rare earths refinery. Despite negative earnings growth over the past year and a dividend not well covered by free cash flows, Civmec's financial health is bolstered by its satisfactory net debt to equity ratio of 4.6% and strong short-term asset position exceeding both short-term (A$204.2M) and long-term liabilities (A$186M). The company’s interest payments are well covered by EBIT, indicating manageable debt servicing ability.

- Jump into the full analysis health report here for a deeper understanding of Civmec.

- Understand Civmec's earnings outlook by examining our growth report.

Ora Banda Mining (ASX:OBM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ora Banda Mining Limited focuses on the exploration, operation, and development of mineral properties in Australia with a market cap of A$1.33 billion.

Operations: The company's revenue is derived entirely from its gold mining operations, amounting to A$304.30 million.

Market Cap: A$1.33B

Ora Banda Mining Limited, with a market cap of A$1.33 billion, has recently provided production guidance for fiscal 2026, expecting gold output between 140,000oz and 155,000oz. The company became profitable this year and forecasts earnings growth at 41.2% annually. It maintains strong financial health with more cash than debt and short-term assets exceeding liabilities. Its Return on Equity is outstanding at 44.3%, while interest payments are well covered by EBIT (29.2x). Despite trading significantly below estimated fair value, the management team lacks experience with an average tenure of only 1.8 years.

- Dive into the specifics of Ora Banda Mining here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Ora Banda Mining's future.

Turning Ideas Into Actions

- Embark on your investment journey to our 460 ASX Penny Stocks selection here.

- Contemplating Other Strategies? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CVL

Civmec

An investment holding company, provides construction and engineering services to the energy, resources, infrastructure, marine, and defense sectors in Australia.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives