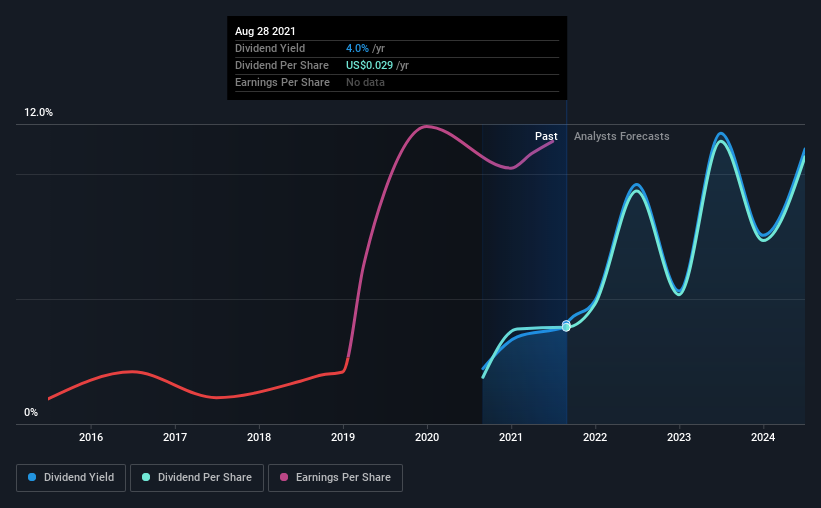

The board of Nickel Mines Limited (ASX:NIC) has announced that the dividend on 10th of September will be increased to AU$0.02, which will be 100% higher than last year. This takes the annual payment to 4.0% of the current stock price, which unfortunately is below what the industry is paying.

Check out our latest analysis for Nickel Mines

Nickel Mines' Earnings Easily Cover the Distributions

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Prior to this announcement, Nickel Mines' dividend was comfortably covered by both cash flow and earnings. This means that a large portion of its earnings are being retained to grow the business.

Earnings per share is forecast to rise by 59.7% over the next year. If recent patterns in the dividend continues, the payout ratio in 12 months could be 77% which is a bit high but can definitely be sustainable.

Nickel Mines Doesn't Have A Long Payment History

Without a track record of dividend payments, we can't make a judgement on how stable it has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. Nickel Mines has impressed us by growing EPS at 56% per year over the past five years. The company doesn't have any problems growing, despite returning a lot of capital to shareholders, which is a very nice combination for a dividend stock to have.

The company has also been raising capital by issuing stock equal to 18% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

We Really Like Nickel Mines' Dividend

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All in all, this checks a lot of the boxes we look for when choosing an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 2 warning signs for Nickel Mines that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you decide to trade Nickel Mines, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nickel Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:NIC

Nickel Industries

Engages in nickel ore mining, nickel pig iron, cobalt, and nickel matte production activities.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives