- Australia

- /

- Metals and Mining

- /

- ASX:NIC

Further Upside For Nickel Mines Limited (ASX:NIC) Shares Could Introduce Price Risks After 29% Bounce

Nickel Mines Limited (ASX:NIC) shares have continued their recent momentum with a 29% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 31% in the last year.

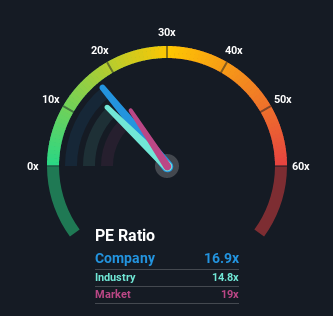

In spite of the firm bounce in price, Nickel Mines may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 16.9x, since almost half of all companies in Australia have P/E ratios greater than 19x and even P/E's higher than 40x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's inferior to most other companies of late, Nickel Mines has been relatively sluggish. It seems that many are expecting the uninspiring earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Nickel Mines

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Nickel Mines' is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 2.8% last year. Still, EPS has barely risen at all in aggregate from three years ago, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 15% each year as estimated by the nine analysts watching the company. That's shaping up to be similar to the 15% per year growth forecast for the broader market.

With this information, we find it odd that Nickel Mines is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Nickel Mines' P/E

Nickel Mines' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Nickel Mines currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Having said that, be aware Nickel Mines is showing 3 warning signs in our investment analysis, you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

Valuation is complex, but we're here to simplify it.

Discover if Nickel Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:NIC

Nickel Industries

Engages in nickel ore mining, nickel pig iron, cobalt, and nickel matte production activities.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives