- Australia

- /

- Metals and Mining

- /

- ASX:NIC

Nickel Industries Limited (ASX:NIC) Stock Rockets 27% But Many Are Still Ignoring The Company

Nickel Industries Limited (ASX:NIC) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 14% over that time.

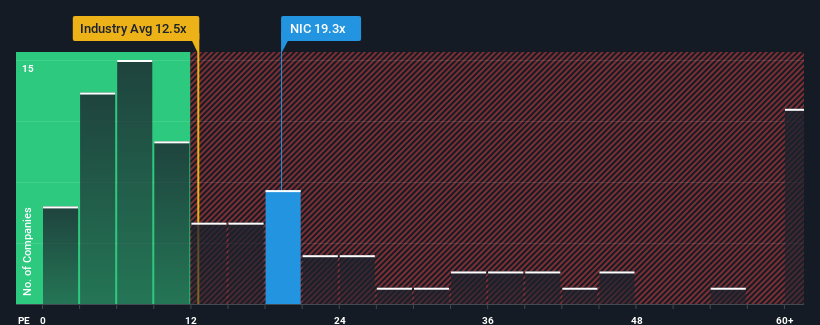

Although its price has surged higher, it's still not a stretch to say that Nickel Industries' price-to-earnings (or "P/E") ratio of 19.3x right now seems quite "middle-of-the-road" compared to the market in Australia, where the median P/E ratio is around 20x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Nickel Industries hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Nickel Industries

How Is Nickel Industries' Growth Trending?

Nickel Industries' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 40% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 50% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 44% each year over the next three years. That's shaping up to be materially higher than the 16% per annum growth forecast for the broader market.

With this information, we find it interesting that Nickel Industries is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Nickel Industries appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Nickel Industries' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Nickel Industries, and understanding these should be part of your investment process.

You might be able to find a better investment than Nickel Industries. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Nickel Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NIC

Nickel Industries

Engages in nickel ore mining, nickel pig iron, cobalt, and nickel matte production activities.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives