- Australia

- /

- Metals and Mining

- /

- ASX:NCM

Should You Be Adding Newcrest Mining (ASX:NCM) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Newcrest Mining (ASX:NCM), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Newcrest Mining

Newcrest Mining's Improving Profits

In the last three years Newcrest Mining's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, Newcrest Mining's EPS shot from US$0.83 to US$1.43, over the last year. Year on year growth of 71% is certainly a sight to behold.

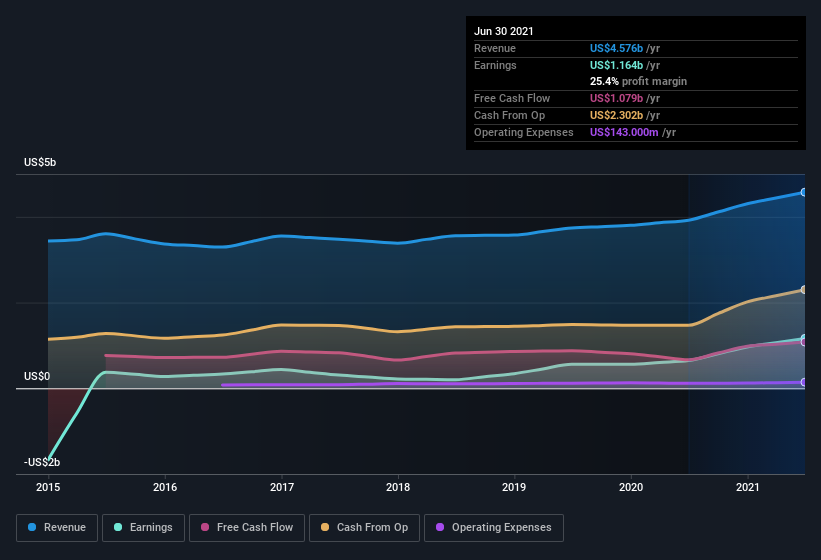

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Newcrest Mining shareholders can take confidence from the fact that EBIT margins are up from 29% to 34%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Newcrest Mining's future profits.

Are Newcrest Mining Insiders Aligned With All Shareholders?

Since Newcrest Mining has a market capitalization of AU$20b, we wouldn't expect insiders to hold a large percentage of shares. But we do take comfort from the fact that they are investors in the company. To be specific, they have US$30m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 0.1% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Newcrest Mining Deserve A Spot On Your Watchlist?

Newcrest Mining's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So yes, on this short analysis I do think it's worth considering Newcrest Mining for a spot on your watchlist. We should say that we've discovered 2 warning signs for Newcrest Mining (1 can't be ignored!) that you should be aware of before investing here.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Newcrest Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:NCM

Newcrest Mining

Newcrest Mining Limited, together with its subsidiaries, engages in the exploration, mine development, mine operation, and sale of gold and gold/copper concentrates.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives